Can Aster Hit a New All-Time High Amid BSC Altcoin Rally?

Aster (ASTER) is showing renewed bullish momentum after reclaiming the $2 mark, moving closer to its all-time high of $2.43.

The recent surge in demand has strengthened the altcoin’s position in the market, with traders anticipating another leg up if favorable conditions persist in the coming days.

Aster Has Some Strength In It

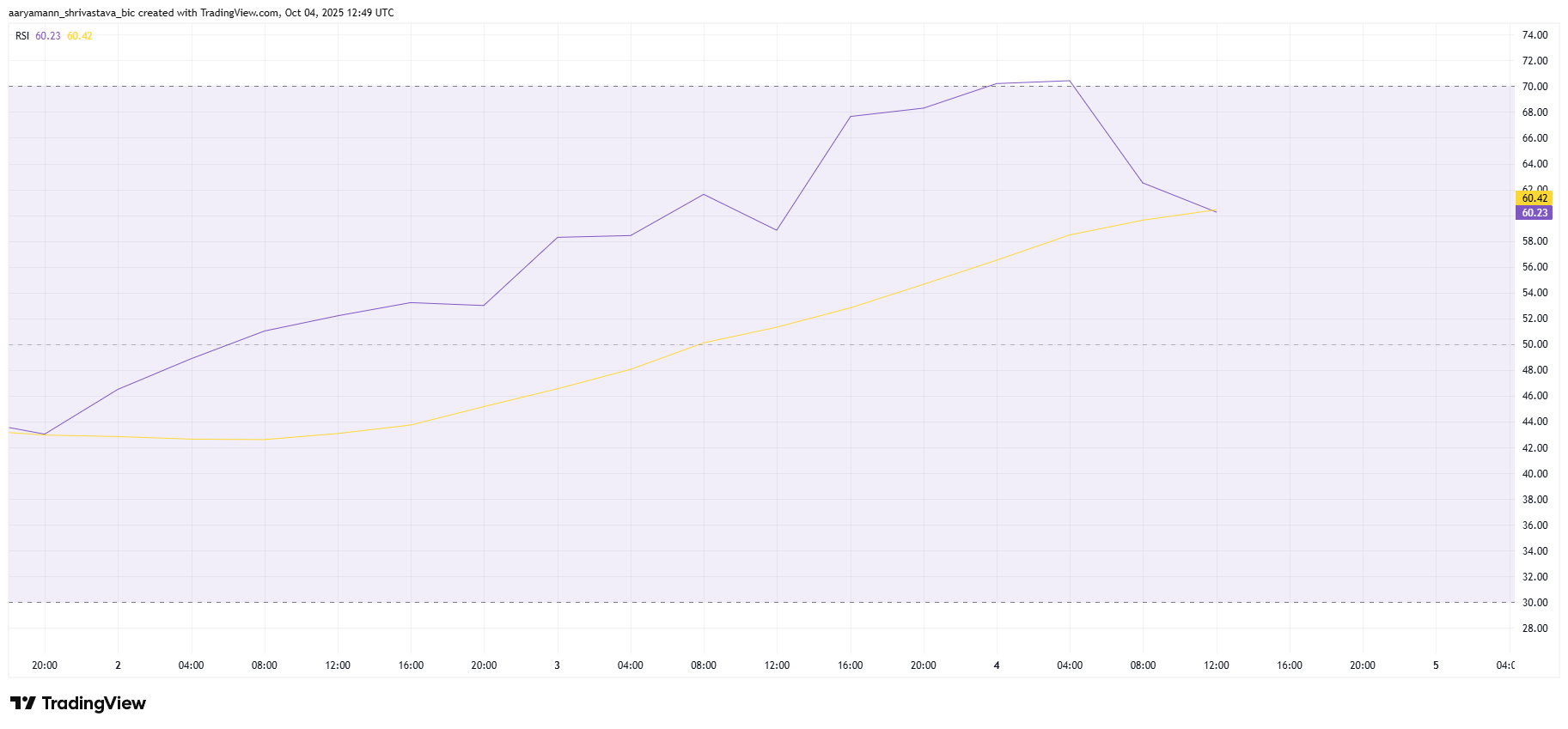

The Relative Strength Index (RSI) is retracing from the overbought zone, moving back into positive territory. Typically, an overbought RSI signals a potential pullback as bullish sentiment begins to cool.

However, in this case, the indicator remains in the bullish range, suggesting that Aster’s uptrend still has room to extend further.

This moderate correction in RSI could benefit ASTER by allowing buyers to re-enter the market. As long as the RSI maintains its current position above the neutral 50 mark, the token is likely to sustain upward momentum, reinforcing investor confidence in the ongoing rally.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER RSI. Source: TradingView

ASTER RSI. Source: TradingView

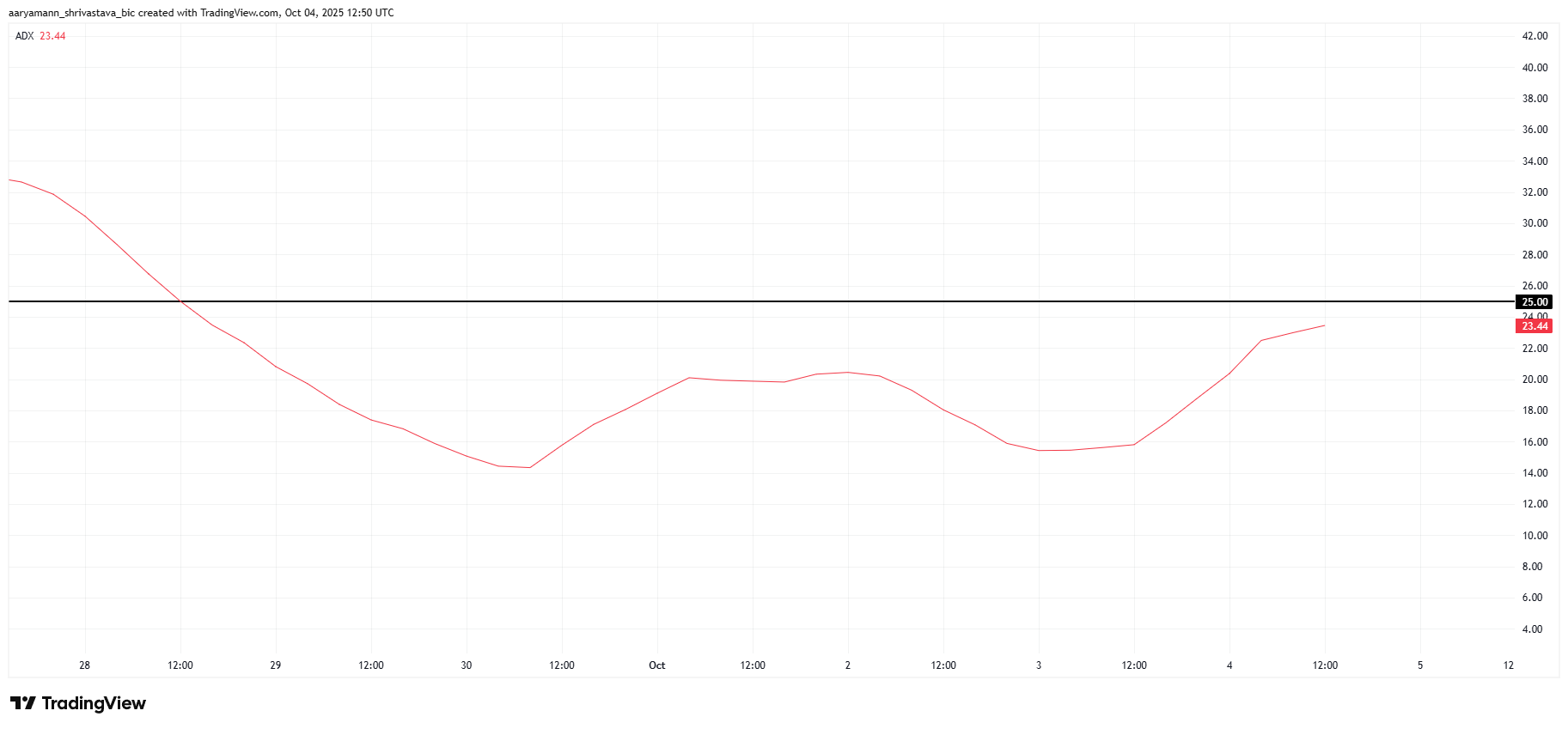

Aster’s broader market momentum is strengthening, with the Average Directional Index (ADX) nearing the key 25.0 threshold. The ADX measures trend strength, and a rise beyond 25.0 confirms the presence of a strong trend. Given that ASTER is currently in an uptrend, crossing this threshold could amplify its bullish potential.

Once the ADX breaks above 25.0, Aster’s market structure would gain greater stability, signaling that traders are committed to maintaining the rally. This confirmation would provide further validation of the altcoin’s growing momentum.

ASTER ADX. Source: TradingView

ASTER ADX. Source: TradingView

ASTER Price Nears ATH

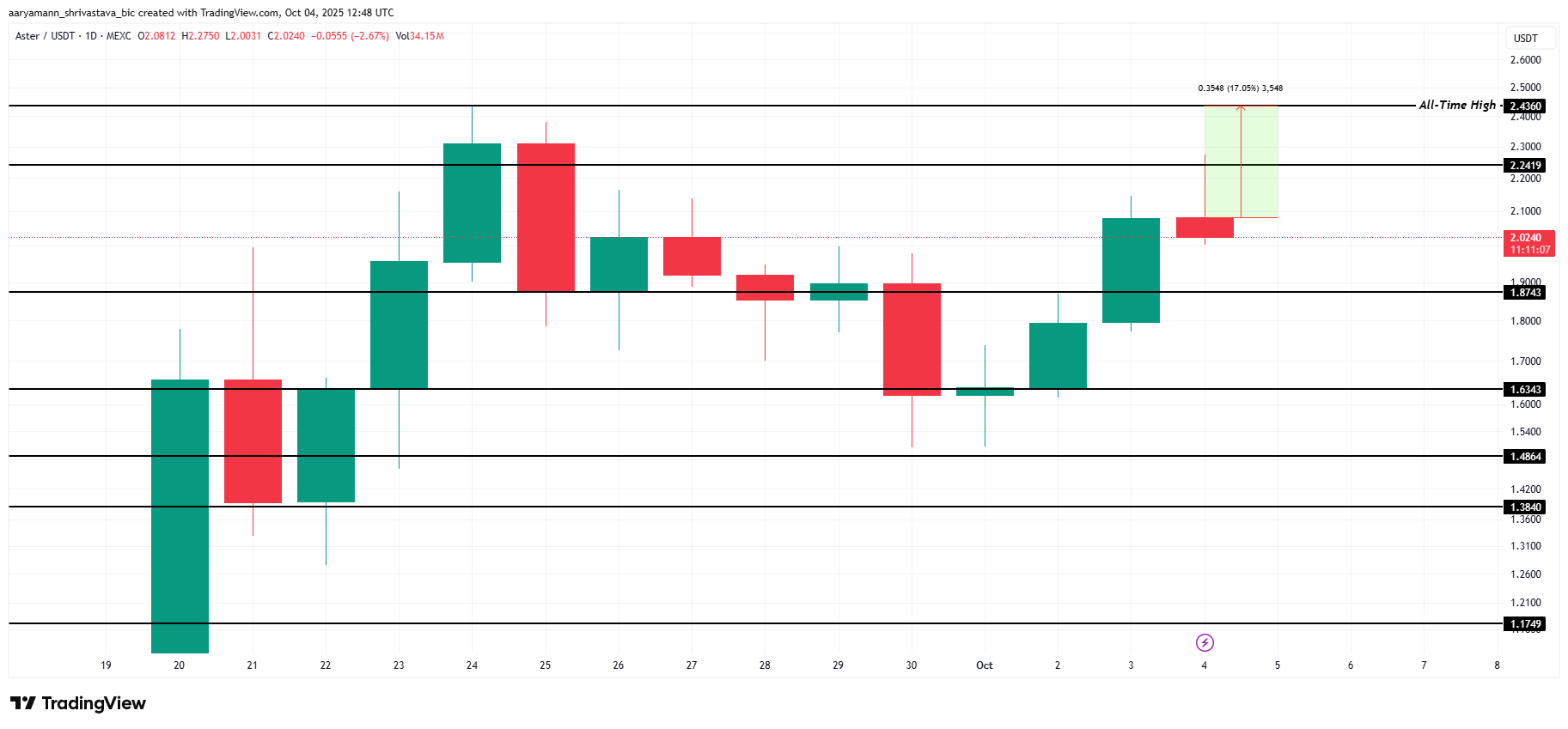

At the time of writing, Aster is trading at $2.02 after successfully breaching the $1.87 resistance. The altcoin now sits only 17% below its all-time high of $2.43, suggesting that further gains could be within reach if market sentiment continues to improve.

The technical setup supports a potential climb, as rising momentum and positive indicators could push ASTER above the $2.24 resistance. A breakout from this level would likely propel the token beyond $2.43, marking a new all-time high and solidifying its bullish trajectory.

ASTER Price Analysis. Source: TradingView

ASTER Price Analysis. Source: TradingView

However, downside risks persist if investors start taking profits. Should selling pressure increase, Aster could drop below the $1.87 support, falling toward $1.63 or lower. Such a decline would invalidate the bullish outlook and pause the ongoing uptrend.