APT price breaks out as Donald Trump Jr., Zach Witkoff confirm USD1 launch on Aptos

- Aptos renews its uptrend in tandem with the wider cryptocurrency market on Wednesday.

- Donald Trump Jr. and World Liberty Financial CEO Zach Witkoff announced the launch of USD1 stablecoin on Aptos.

- USD1 is a dollar-pegged World Liberty Financial-backed stablecoin with a market capitalisation of $2.6 billion.

Aptos (APT) extends its recovery, trading above $4.60 as cryptocurrencies regain bullish momentum on Wednesday, following extreme price volatility in September. Based on APT's short-term technical picture, bulls could tighten their grip to sustain the uptrend above $5.00 in the coming days.

World Liberty Financial USD1 poised to launch on Aptos

Donald Trump Jr. and World Liberty Financial CEO Zach Witkoff announced on Wednesday that the stablecoin USD1 will expand its reach to the Aptos Network on October 6.

Aptos, which has been pushing for more adoption, also confirmed the impending rollout via an X post. Donald Trump Jr. and Witkoff were speaking during the Token 2049 conference in Singapore.

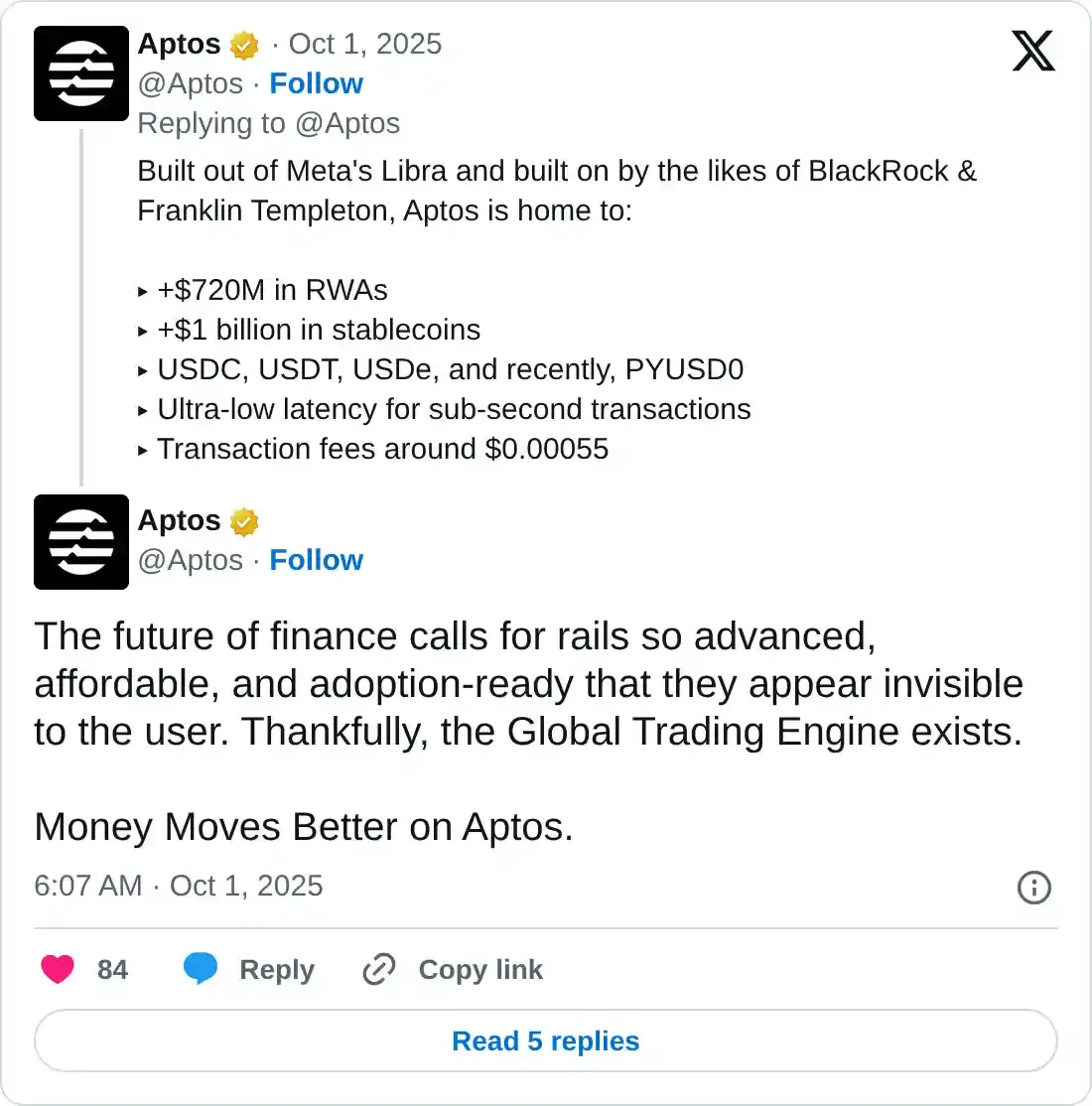

"Aptos is USD1's first Move-based integration. The list grows of those choosing the fastest, cheapest, & most efficient rails in the world," Aptos wrote on X.

Aptos emphasized that USD1 will receive the full support of the protocol from the outset, including the APT Decentralized Finance (DeFi) ecosystem's applications, such as Echelon Market, Hyperion, Thala, Panora Exchange, and Tapp Exchange.

Aptos highlighted that its network boasts over $720 million in real-world assets (RWAs) and $1 billion in stablecoins, including USDC, USDT and USDe.

USD1 is a stablecoin issued by World Liberty Financial, a crypto entity backed by United States (US) President Donald Trump's family.

USD1 is an institutional-grade stablecoin backed by the US Dollar one-to-one. World Liberty Financial has been pushing for multiple-chain expansion and interoperability, with USD1 currently available on BNB Chain, Solana, Tron, Ethereum, and the Plume Network.

In addition to the rollout on Aptos, World Liberty Financial plans to debut other services, including a debit card and tokenized commodity assets. The debit card will bridge the gap between digital assets and everyday spending.

Investors reacted to the adoption news, increasing risk exposure as the price of Aptos extended its recovery. APT declined below $4.00 level in the previous week as volatility surged across the cryptocurrency market. The next few days could offer insight into the direction the APT price may take in October.

Technical outlook: Aptos rally gains momentum

Aptos upholds bullish momentum supported by key technical indicators. The Moving Average Convergence Divergence (MACD) supports the bullish outlook, as a buy signal was triggered last Friday. The green histogram bars show that bullish momentum is building, increasing the odds of the uptrend extending above the $5.00 level.

APT/USDT 4-hour chart

Still, traders should be cautiously optimistic, considering the Relative Strength Index (RSI) is positioned at 78, in overbought territory. Extremely overbought conditions often precede sudden price pullbacks. Hence, there's a need to prepare for possible drawdowns if profit-taking drives the APT price downward toward the 200-period Exponential Moving Average (EMA) at $4.38 and the 50-period EMA at $4.33.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.