Bitcoin Price Forecast: BTC edges down as FTX prepares for $1.6 billion creditor payout

- Bitcoin price edges slightly down on Tuesday, trimming the nearly 2% recovery seen in the previous day.

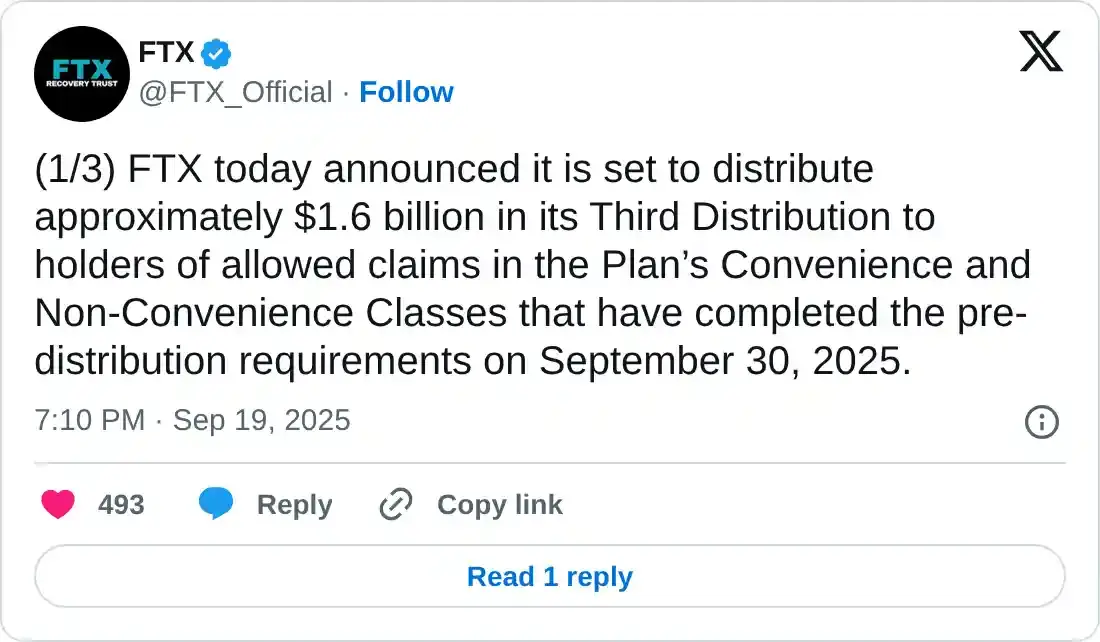

- Defunct FTX exchange is set to receive the third phase of payouts on Wednesday, which is worth over $1.6 billion in stablecoins.

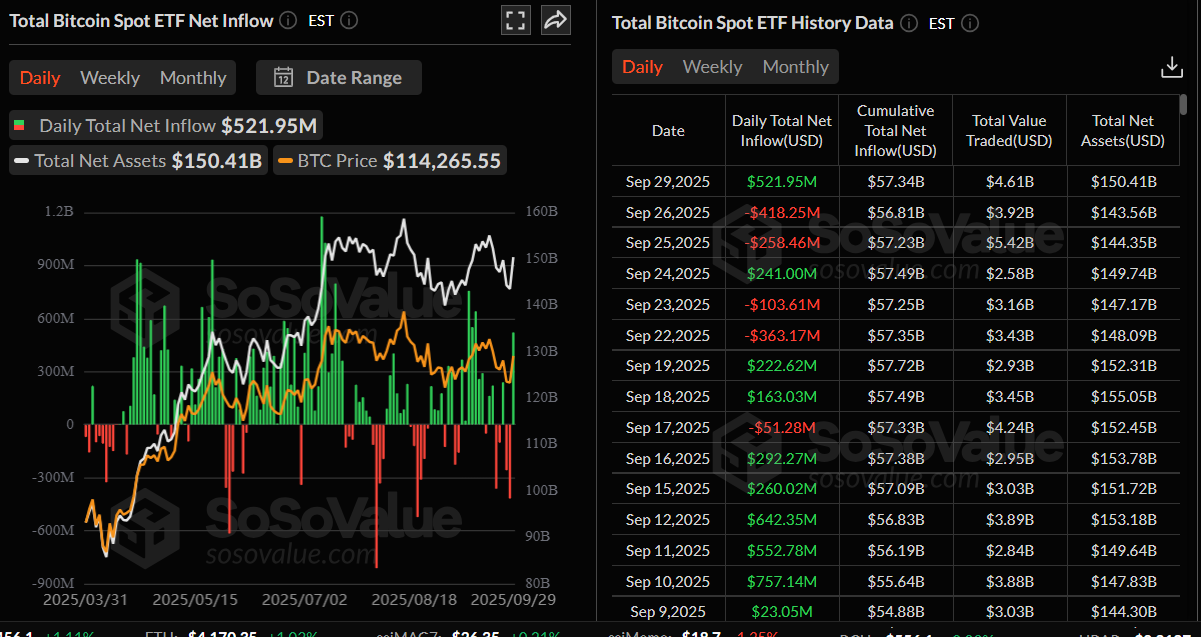

- US-listed spot Bitcoin ETFs recorded an inflow of over $520 million on Monday, the highest single-day inflow since mid-September.

Bitcoin (BTC) is edging slightly down at around $113,000 on Tuesday after recovering nearly 2% the previous day. Market attention shifts to the $1.6 billion payout from the defunct FTX exchange, which could support crypto prices by injectingliquidity into the market. Meanwhile, spot Bitcoin Exchange Traded Funds (ETFs) recorded the strongest single-day inflows in two weeks, signaling resilient institutional demand.

FTX set to distribute $5 billion in stablecoins to creditors

Creditors of the defunct FTX exchange, which collapsed in late 2022, are set to receive the third phase of payouts. The payouts are scheduled to begin on Tuesday, with over $1.6 billion in stablecoins. This influx of fresh liquidity in the form of stablecoins is expected to boost Bitcoin and other cryptos as stablecoins are considered the key to a crypto gateway, potentially triggering significant market rallies.

Market uncertainty rises on US government shutdown concerns

A White House meeting between US President Trump and congressional leaders from both sides of the political spectrum to avoid a government shutdown ended without a deal on Monday. Vice President JD Vance stated that a government shutdown is likely to occur as an impasse persists over the flow of funding.

“The possibility of a US government shutdown – deep political polarisation, rising fiscal deficits, and a fragile global economy leave markets more sensitive to shocks," Bitfinex analyst told FXStreet.

The analyst continued that another concern is the disruption of federal data collection, including key inflation reports such as the CPI or Nonfarm Payrolls. Delays in this data could complicate Federal Reserve policy decisions and ripple through the TIPS market (Treasury Inflation-Protected Securities). At the same time, global investors have already been trimming US allocations; a drawn-out shutdown could accelerate diversification into non-US equities, bonds, and alternative assets.

The analyst concluded that the shutdowns are not the same as debt-ceiling crises, which directly threaten US sovereign creditworthiness. But they remain highly disruptive, with significant implications for federal employees and public services.

"For markets, the immediate risk is confidence erosion and data blind spots, rather than systemic financial instability," the analyst said.

Return of institutional investors

Bitcoin recovery was further supported by institutional demand at the start of this week. SoSoValue data shows that Bitcoin spot ETFs recorded an inflow of $521.95 million on Monday, breaking the two-day streak of outflows and the highest inflows since mid-September. If these inflows continue and intensify, the BTC price could recover.

Total Bitcoin spot ETF net inflow chart. Source: SoSoValue

On the corporate front, Strategy announced that it acquired 196 BTC on Monday, bringing the total holdings to 640,031 BTC.

On the same day, Kazakhstan launched its first crypto reserve, the Alem Crypto Fund, established by the Ministry of Artificial Intelligence and Digital Development and managed by Qazaqstan Venture Group within the AIFC framework. The primary objective of the fund is to make long-term investments in digital assets and to build strategic reserves.

“The creation of the Alem Crypto Fund is a step toward advancing digital finance in Kazakhstan. Our goal is to make it a reliable instrument for major investors and a key foundation for digital state reserves,” noted Zhaslan Madiyev, Deputy Prime Minister – Minister of Artificial Intelligence and Digital Development of the Republic of Kazakhstan, in a press release.

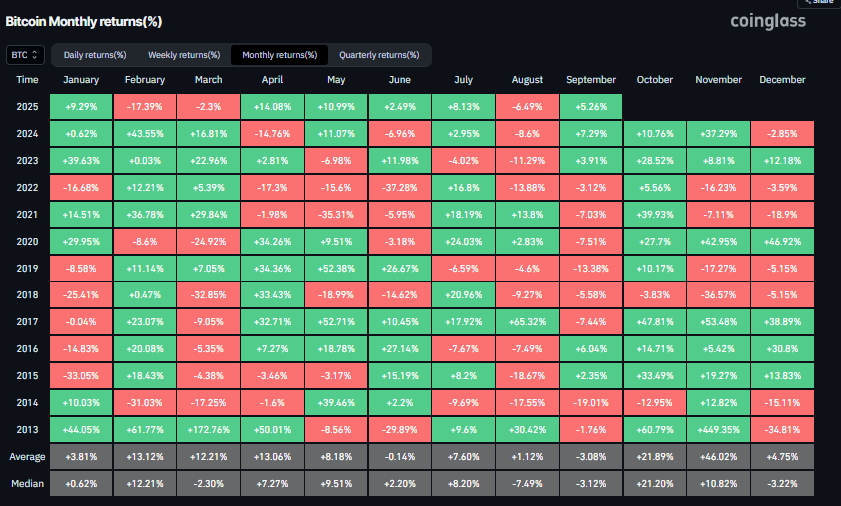

Is Uptober here?

CoinGlass’s historical monthly return data shows that October has generally delivered a positive return for Bitcoin, averaging 21.89%, with the market terming it as a ‘Uptober’ rally.

Bitcoin Monthly returns chart. Source: Coinglass

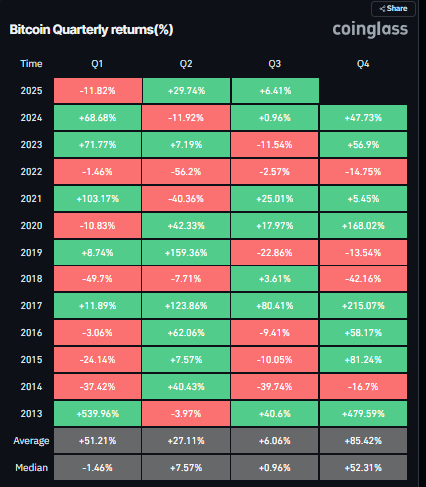

Moreover, Q4 has traditionally also been the best quarter of BTC with an average return of 85.42%, with Eric Trump saying, “Q4 will be unbelievable for crypto."

Bitcoin Quarterly returns chart. Source: Coinglass

Bitcoin Price Forecast: BTC could head towards $116,000 if support remains strong

BTC rose by nearly 2% on Monday, closing above the 50-day Exponential Moving Average (EMA) at $113,313. At the time of writing on Tuesday, BTC is slipping below its 50-day EMA at around $112,800.

If BTC finds support around the 50-day EMA at $113,313, it could extend the recovery toward the daily resistance at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 49, after moving above the neutral level of 50 on Monday, indicating indecision among traders. For the bullish recovery to be sustained, the RSI must be maintained above the neutral level. Moreover, the Moving Average Convergence Divergence (MACD) lines are also about to flip to a bullish crossover, while the falling red histogram bars also indicate the fading of bearish momentum.

BTC/USDT daily chart

However, if BTC fails to find support around the 50-day EMA at $113,313, it could extend the decline toward the daily support at $107,245.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.