Crypto market steadies ahead of Litecoin, Solana, XRP, Dogecoin, and Cardano spot ETFs deadlines

- The crypto market stabilizes after a turbulent week, ahead of multiple spot ETF deadlines.

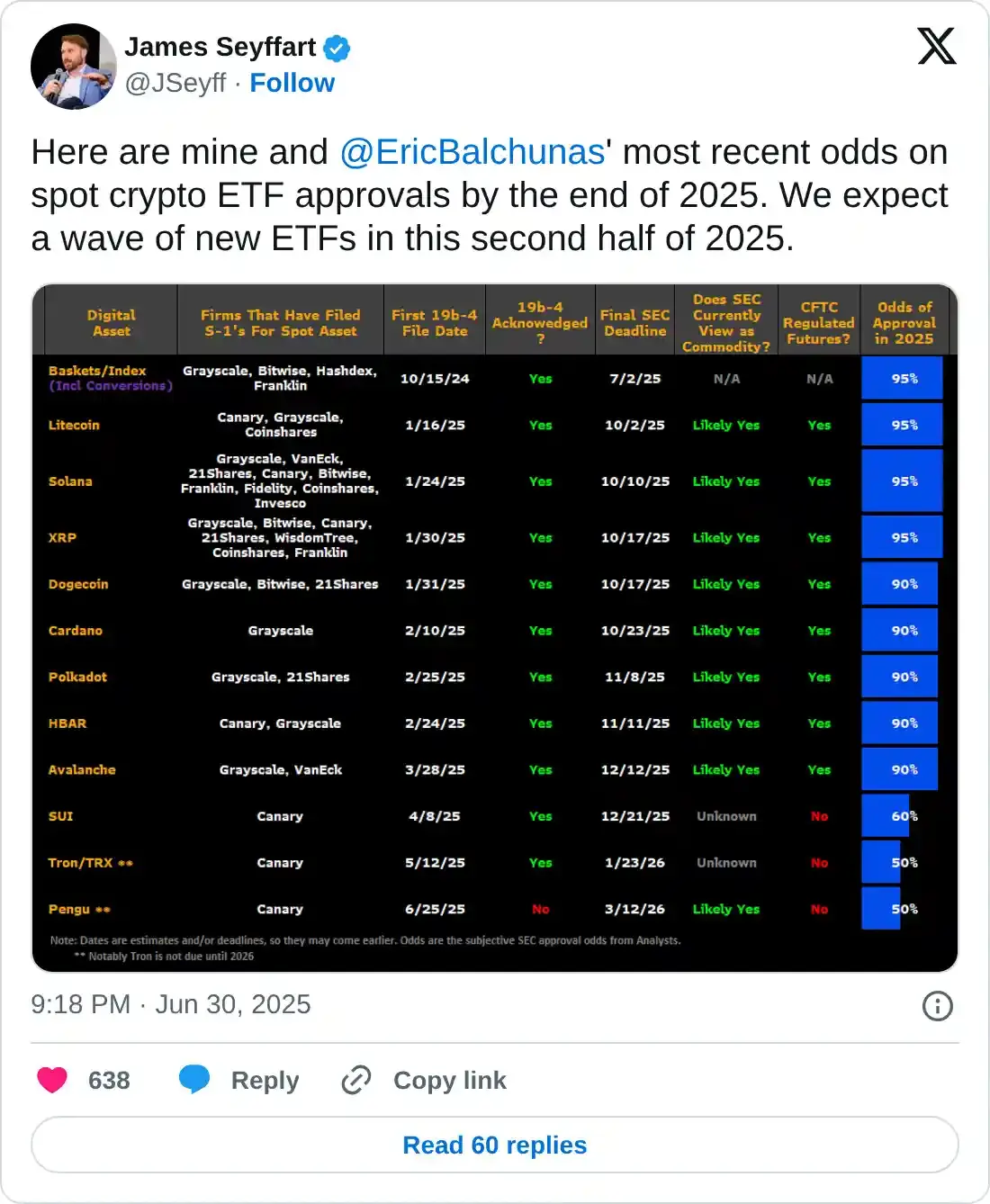

- The final SEC deadline for Litecoin, Solana, XRP, Dogecoin, and Cardano Spot ETFs is scheduled for October.

- Historically, the month of October has remained bullish for six consecutive years.

The total cryptocurrency market capitalization remains steady at $3.8 trillion as of Monday's press time, following a 2.29% rise on Sunday. This stability, following the massive liquidation spikes of over $3 billion on September 22 and $1 billion on Thursday, prepares the market for the US Securities and Exchange Commission (SEC) approval deadlines of multiple Exchange Traded Funds (ETFs).

Crypto market could recover amid multiple ETF deadlines

The final SEC deadline for the Litecoin ETFs is on Thursday (October 2), filed by various investment firms like Canary Capital, Grayscale Investments, and CoinShares International. This will mark the beginning of multiple ETF deadlines, including Solana, XRP, Dogecoin, and Cardano, later in the month.

These ETFs are filed under the 1933 Securities Act, which can take up to 240 days for approval, unlike the recently launched ETFs of Solana, XRP, and Dogecoin by Rex Shares and Osprey Funds, which are filed under the 1940 Investment Act. This difference helped them secure quick approvals within 75 days.

According to Bloomberg ETF specialist James Seyffart, these ETFs have a 90% or higher approval chance. If approved, the news could boost investors' sentiment, as seen previously.

Adding to the recovery chances, CoinGlass data shows that Bitcoin has remained positive in October for the last six consecutive years. Considering the high likelihood of ETF approval amid the pro-crypto stance of the US President Donald Trump administration, the broader cryptocurrency market could spark a risk-on sentiment with the involvement of corporate investors.

Bitcoin Monthly returns. Source: CoinGlass

Litecoin eyes a bullish rebound ahead of ETF deadline

Litecoin holds above the 200-day Exponential Moving Average (EMA) at $103 at press time on Monday, following the 2.22% bounce back on Friday and the 2.32% on Sunday. The recovery faces headwinds at the 61.8% Fibonacci retracement level at $106, which is drawn from the $147 high of December 6 to the $63 low of April 7.

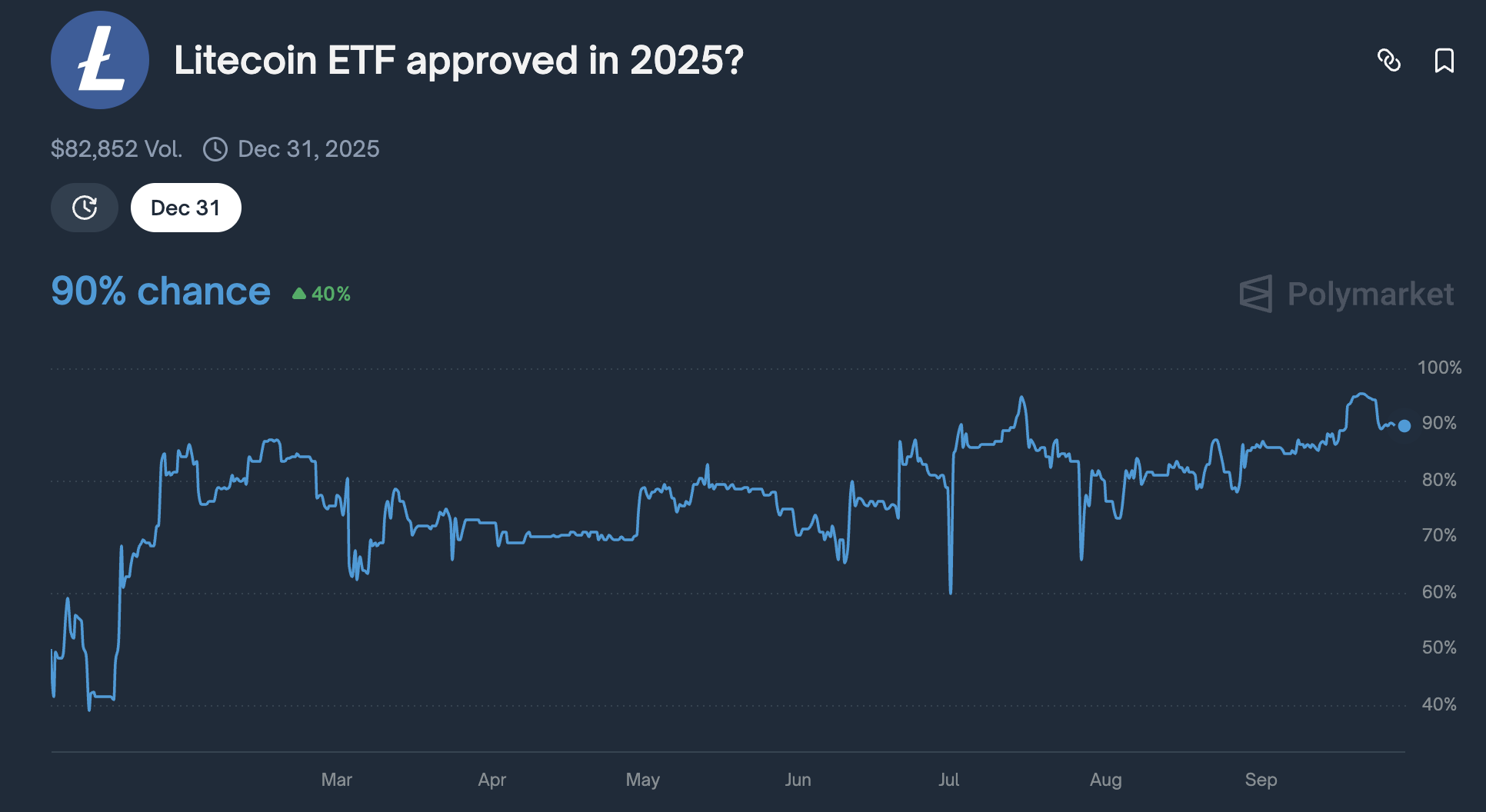

The Polymarket data indicates a 90% chance of Litecoin ETF approval, with a market volume of $82,852, which means a positive market sentiment. If the Litecoin ETF is approved on Thursday, a potential demand boost could cause the LTC rally to the 78.6% Fibonacci retracement level at $122.

Litecoin ETF approval market. Source: Polymarket

The technical indicators on the daily chart indicate a decline in selling pressure as the Relative Strength Index (RSI) rebounds above the oversold zone to 41. If RSI resurfaces above the midpoint at 50, it could be an early signal of a renewed rally.

Additionally, the Moving Average Convergence Divergence (MACD) approaches its signal line as red histogram bars decline, indicating a loss in bearish momentum. A potential crossover resulting in a green histogram bar above the zero line would indicate a trend reversal.

LTC/USDT daily price chart.

However, if LTC fails to hold above the 200-day EMA at $103, it could result in a drop to the 50% Fibonacci retracement level at $96.