Bitcoin Price Forecast: BTC stabilizes around $112,600 as Fed caution, geopolitical risks weigh on sentiment

- Bitcoin stabilizes around $112,600 on Wednesday after correcting nearly 3% so far this week.

- The Fed’s cautious stance and rising geopolitical conflicts could trigger a risk-off sentiment in the market.

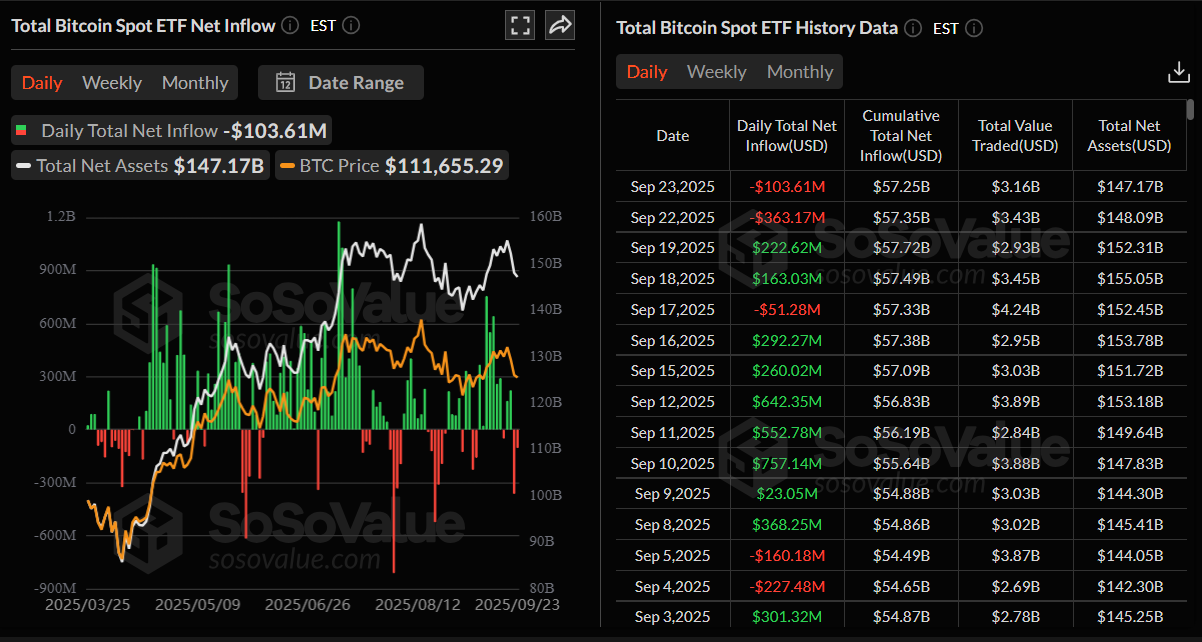

- US-listed spot Bitcoin ETFs recorded a second consecutive day of outflows on Tuesday.

Bitcoin (BTC) price stabilizes around $112,600 at the time of writing on Wednesday, after correcting by nearly 3% so far this week. However, the broader outlook remains fragile as the Federal Reserve’s (Fed) cautious stance on rate cuts and escalating geopolitical conflicts dampen risk appetite. Adding to the pressure, US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded their second consecutive day of outflows, highlighting weakness in institutional demand.

Fed’s cautious stance on rate cuts triggers risk-off sentiment

Bitcoin price extended its correction on Tuesday, following a wave of massive liquidations earlier in the week. By Wednesday’s European session, BTC stabilizes around $112,600 after briefly dipping toward $111,000 during the Asian trading hours.

Cryptomarkets turn cautious as Fed Chair Jerome Powell tried to push back expectations of more rate cuts in the coming months and said, on Tuesday, that the central bank needed to continue balancing the competing risks of high inflation and a weakening job market in coming rate decisions.

Powell added that easing too aggressively could leave the inflation task unfinished and would necessitate a reversal of course. This helps revive demand for the US dollar (USD), while risk assets such as BTC continue to slide.

Meanwhile, market participants await this week's US economic docket, which includes the final Q2 Gross Domestic Product (GDP) reading and August's Durable Goods Orders on Thursday, followed by the US Personal Consumption Expenditures (PCE) Price Index on Friday, which could bring in fresh volatility for Bitcoin.

Rising geopolitical conflicts weigh on Bitcoin

Apart from the cautious Fed stance, the ongoing geopolitical conflicts add bearish sentiment to the cryptomarkets.

The Russia-Ukraine conflict took a new turn on Tuesday as the North Atlantic Treaty Organization (NATO) warned Russia that it would use all necessary military and non-military tools to defend itself. This follows Russia's recent large-scale provocation and the violation of the airspace of NATO alliance members – Estonia, Poland, and Romania.

Meanwhile, tensions in the Middle East remain heightened as Israel continues its military operations across Gaza, adding to broader geopolitical uncertainty. A newly released United Nations (UN) report found that the Israeli government has shown a clear intent to establish permanent control over Gaza and ensure a Jewish majority in the occupied West Bank.

These ongoing global conflicts and uncertainties could trigger a risk-off sentiment in the market, which does not bode well for riskier asset prices, such as Bitcoin.

Bitcoin’s institutional flow continues to weaken

SoSoValue data shows that US-listed Bitcoin spot ETFs recorded an outflow of $103.61 million, continuing their second consecutive day of outflows this week. If these outflows continue and intensify, Bitcoin price could face a further pullback.

Total Bitcoin Spot ETF Net Inflow chart. Source: SoSoValue

Bitcoin traders remain cautious

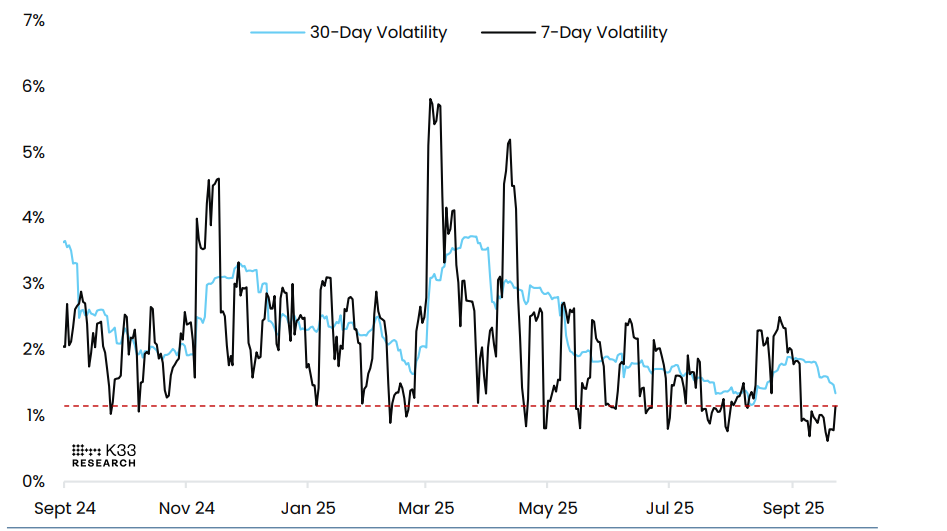

A K33 report on Tuesday highlighted that the CME markets remain cautious, while perpetuals remain highly leveraged.

The report explained that the CME’s BTC futures activity remains subdued, with Open Interest (OI) still near yearly lows, reflecting a defensive tone.

Moreover, on the perpetual side, the markets remained highly leveraged despite the massive liquidations on Monday.

“Despite a brief drop in OI and negative funding rates ahead of the sell-off, yields have rebounded, but elevated OI and historical underperformance post-liquidation keep our outlook cautious,” reported K33 analyst.

Additionally, volatility remains muted, as shown below, with a 7-day volatility of 1.1%, after reaching its lowest level since August 2023, at 0.616% last Thursday.

The analyst added, “This prolonged calm, alongside high open interest, raises the risk of sudden, sharp moves as leverage quietly builds.”

BTC volatility chart. Source: K33 Research

Bitcoin Price Forecast: Momentum continues to weaken

Bitcoin price failed to find support around the daily level of $116,000 on Friday and declined 3.19% over the next four days, closing below the 50-day Exponential Moving Average at $113,814 on Monday. At the time of writing on Wednesday, BTC hovers at around $112,600.

If BTC continues its ongoing correction, it could extend its decline to retest the next daily support at $107,245.

The Relative Strength Index (RSI) on the daily chart reads 45, below its neutral level of 50, indicating bearish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on Monday, giving a sell signal. Moreover, the rising red histogram bars below the neutral level also suggest a bearish momentum and continuation of the downward trend.

BTC/USDT daily chart

However, if BTC recovers and closes above the 50-day EMA at $113,814, it could extend the recovery toward the daily resistance at $116,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.