Top Crypto Gainers: ASTER, ZEC, PUMP extend gains in a volatile market

- Aster extends gains on record high perpetual trading volume, alongside the highest protocol revenue in 24 hours.

- Zcash surged over 13% on Tuesday with a near 40% rise in open interest.

- Pump.fun stabilizes above the 200-period EMA of the 4-hour chart, with bulls anticipating a bounce back.

Aster (ASTER), Zcash (ZEC), and Pump.fun (PUMP) survived the volatility in the cryptocurrency market over the last 24 hours to rise as top performers. Aster drives the rally on the back of increased trading volume, while a surge in interest in Zcash and the Pump.fun derivatives market fuels the uptrend.

Aster targets a new record high as bullish momentum holds

Aster trades above $2.00 at the time of writing on Wednesday, targeting the all-time high of $2.15 from Tuesday. The Decentralized Exchange (DEX) token appreciates over 4% on the day, extending the 19% surge from the previous day.

The DEX recently topped $11 billion in perpetual trading volume in a 24-hour period, as previously reported by FXStreet. Furthermore, the DeFiLlama data shows that among DeFi protocols except for Stablecoins, Aster ranks the highest based on 24-hour revenue, with $7.12 million, outpacing its competitor Hyperliquid, which holds $2.79 million.

DeFi protocols by revenue. Source: DeFiLlama

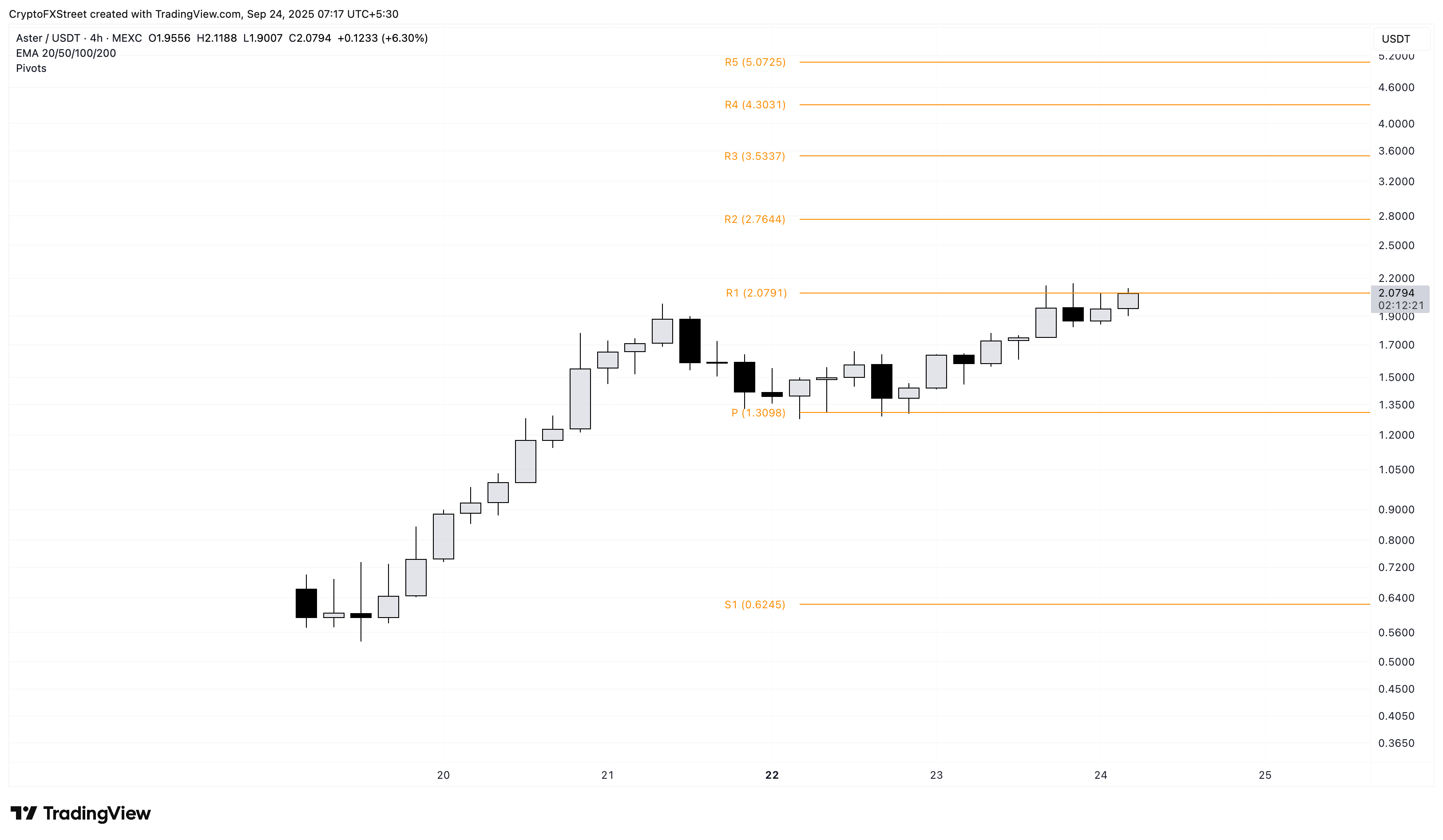

ASTER’s rally is facing opposition from the R1 pivot level at $2.07 on the 4-hour chart. A decisive close above this level could extend the rally to the R2 pivot level at $2.76.

ASTER/USDT 4-hour price chart.

However, a reversal from $2.07 could result in a retest of the centre pivot level at $1.30.

Zcash eyes further gains as open interest records double-digit rise

Zcash edges lower by 1% at press time on Wednesday, following a 13% jump on the previous day. The privacy token marked its highest daily close since January 16 on Tuesday alongside the R1 pivot level breakout at $54.13.

CoinGlass data shows that the Open Interest of Zcash increased by 39% over the last 24 hours, reaching $19.04 million. This significant influx of capital signals a boost in traders' confidence.

Adding to the confidence, the OI-weighted funding rate at 0.0145% suggests that bullish sentiment is high as long position holders are paying a premium to balance the swap and spot prices, offsetting the leverage imbalance.

ZEC Derivatives. Source: CoinGlass

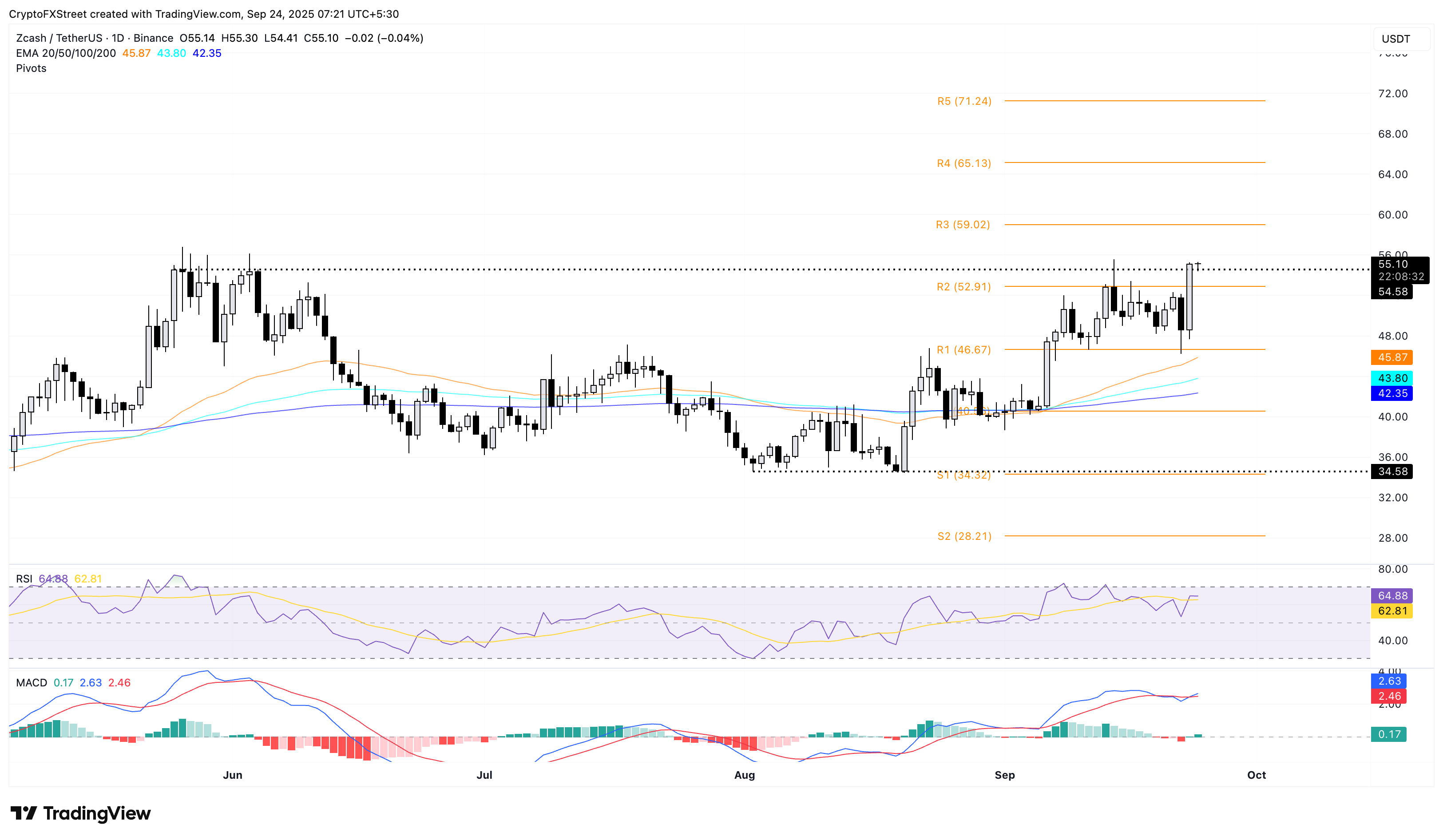

As ZEC takes a breather, a potential bounce back could target the R2 pivot level at $56.41 as the immediate resistance.

The intraday surge creates a positive shift in momentum indicators on the daily chart, as the Relative Strength Index (RSI) at 63 extends upward movement above the halfway line, suggesting increased buying pressure. Additionally, the Moving Average Convergence Divergence (MACD) crosses above its signal line, signaling an end to the short-term bearish phase. If the MACD holds an uptrend, Zcash could further extend its gains.

ZEC/USDT daily price chart.

On the downside, if ZEC marks a daily close below $54.13, it would invalidate the breakout rally. This could extend the decline to the 200-day Exponential Moving Average (EMA) at $42.35.

Pump.fun prepares to lift off from the 200-period EMA

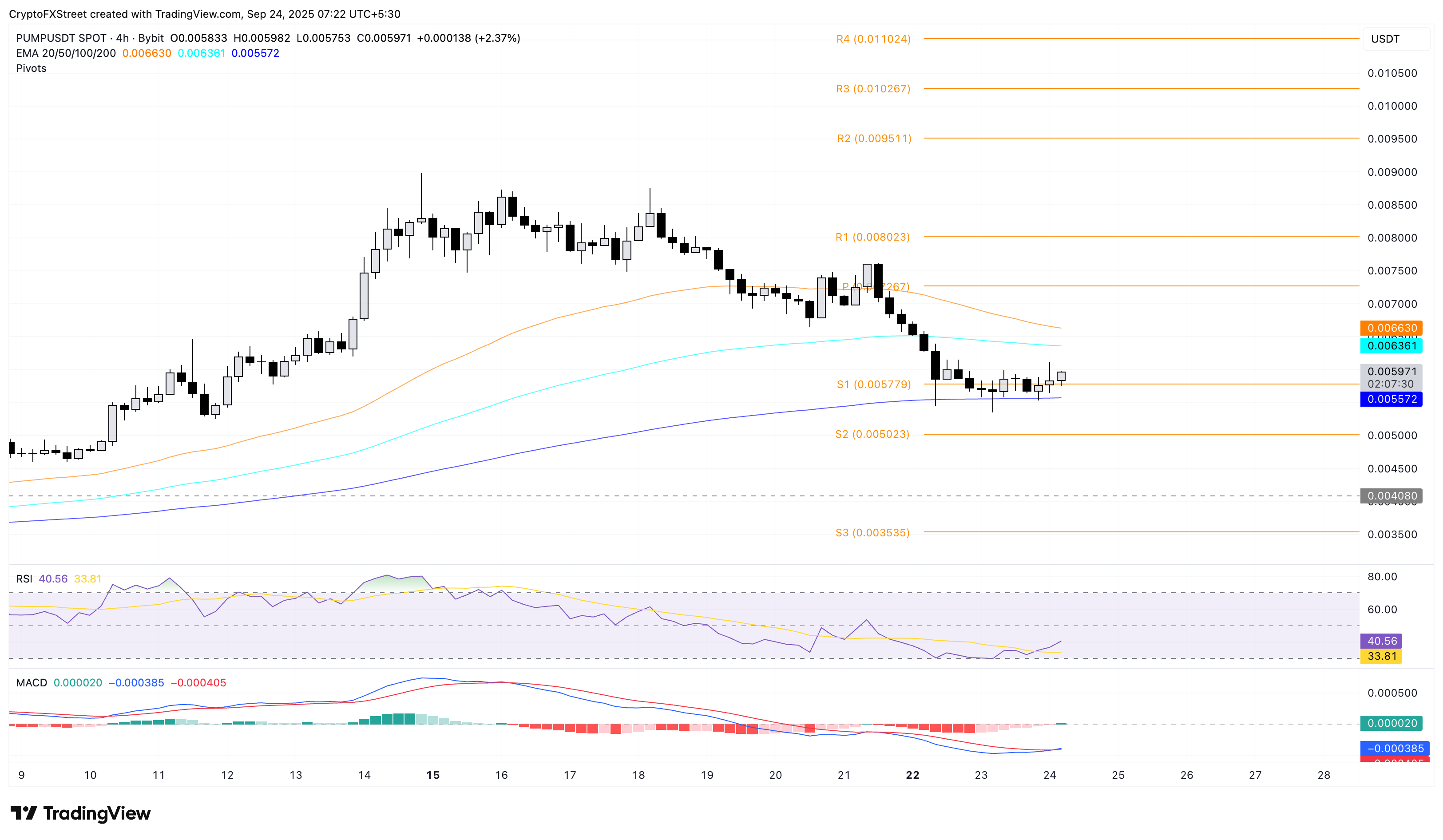

Pump.fun trades above $0.005900 at the time of writing on Wednesday as it bounces off the 200-period EMA on the 4-hour chart. The launchpad token stabilizes above the $0.005000 psychological level and the S1 pivot level at $0.005779.

A potential reversal in PUMP could face resistance at the declining 50-period EMA at $0.006629, followed by the centre pivot level at $0.007267.

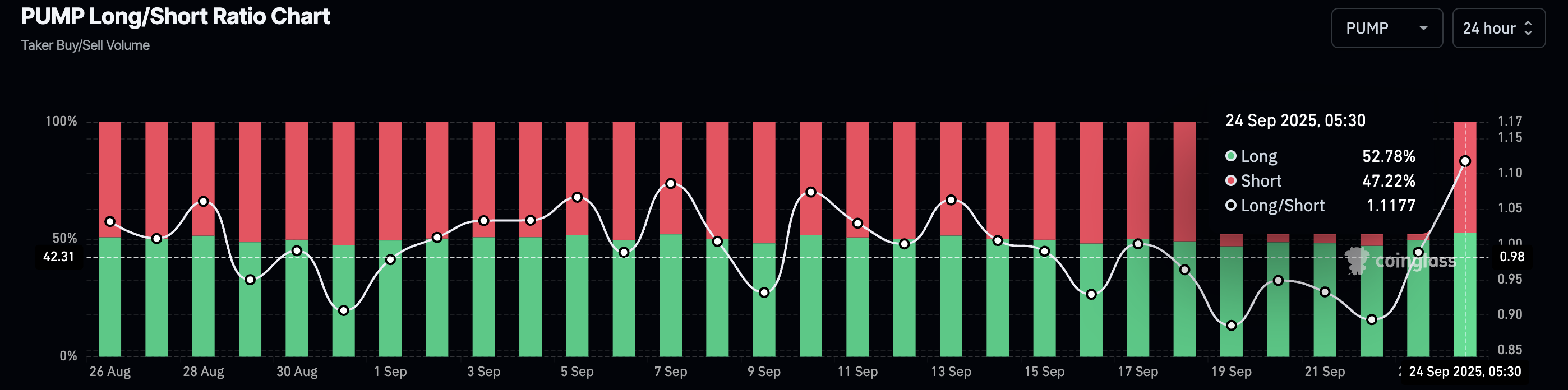

Betting on a bullish reversal, CoinGlass data shows that the long positions have surged to 52.78%, from 49.71% in the last 24 hours. This indicates a significant positive shift in traders’ sentiment.

PUMP long/short ratio chart. Source: CoinGlass

The RSI at 40 on the 4-hour chart rebounds from the oversold boundary line, suggesting a decline in selling pressure. Adding to the lowered supply pressure, the MACD crossing above its signal line indicates that the bullish momentum is resurfacing.

PUMP/USDT 4-hour price chart.

Looking down, if PUMP drops below the 200-period EMA at $0.005571, it could retest the S2 pivot level at $0.005023.