Ethereum’s $5,000 Dream Delayed by Long-Term Holder Exit and Bearish Futures Bets

Ethereum’s climb toward the long-awaited $5,000 mark may face further stalls as on-chain signals suggest headwinds.

Data shows that long-term holders (LTHs) of ETH are actively distributing their coins, creating potential sell pressure that could weigh on the market. At the same time, persistent bearish sentiment among futures traders adds another layer of caution, putting its near-term upside at risk.

Profit-Taking by Long-Term Holders Puts ETH’s Breakout on Hold

ETH’s month-long price consolidation has created an opportunity for long-term holders (LTHs) to lock in profits following the altcoin’s late-August rally to an all-time high.

This trend is evident in the coin’s Liveliness metric, which, according to Glassnode, has climbed to a year-to-date peak of 0.704.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETH Liveliness. Source: Glassnode

ETH Liveliness. Source: Glassnode

An asset’s Liveliness tracks the movement of its previously dormant tokens by measuring the ratio of an asset’s coin days destroyed to the total coin days accumulated. When it falls, LTHs are moving their assets off exchanges, a sign that accumulation is underway.

On the other hand, when an asset’s liveliness climbs, more dormant coins are sold, signaling increased profit-taking by LTHs.

Therefore, the uptick in ETH’s Liveliness suggests that its LTHs are actively realizing gains instead of holding out for further upside. This selling pressure could limit ETH’s ability to stage a decisive breakout toward the $5,000 level in the near term.

Futures Traders Maintain Heavy Sell-Side Pressure

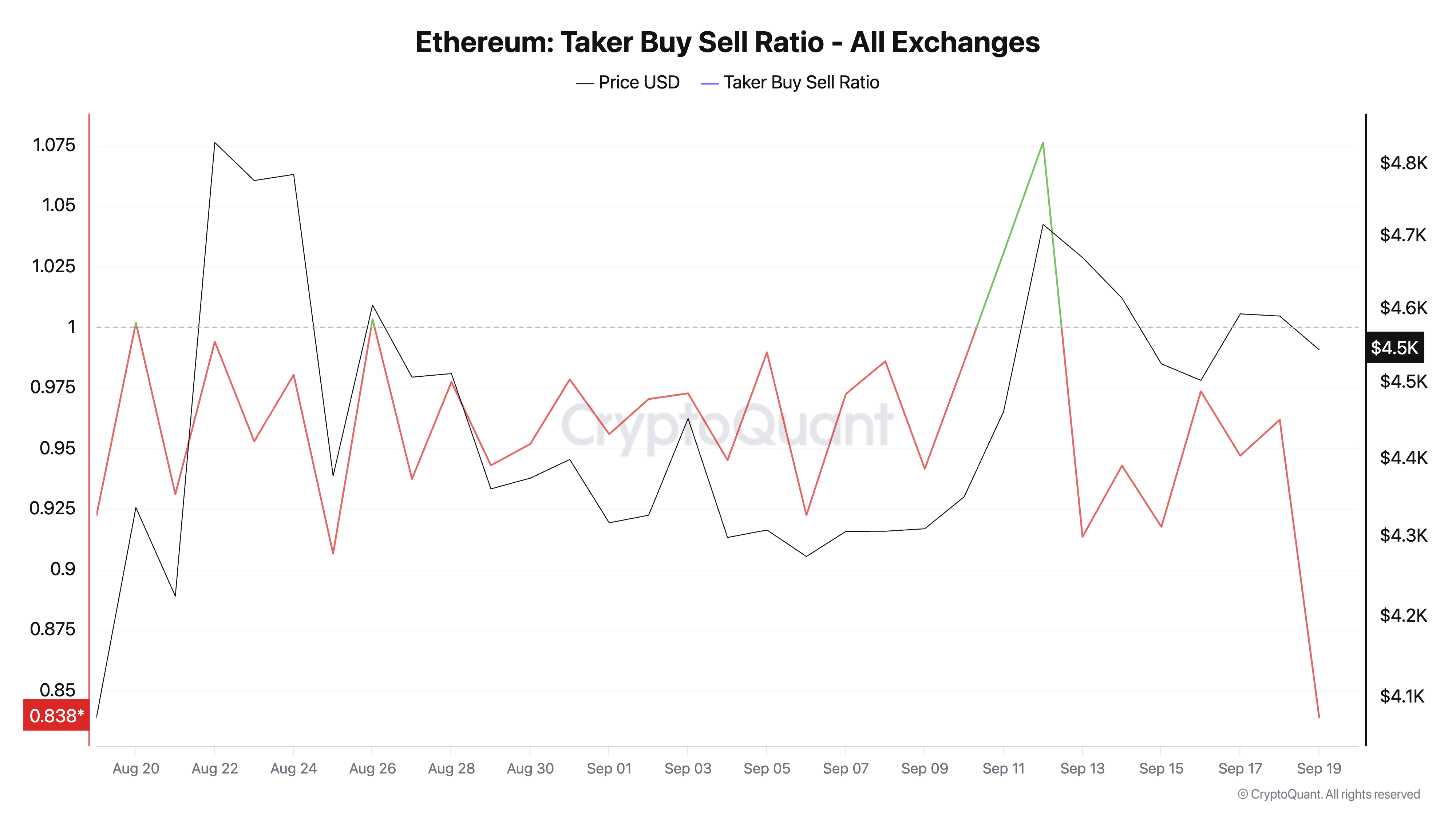

The persistent bearish sentiment in the derivatives market adds to this pressure. Readings from CryptoQuant show that ETH’s taker buy-sell ratio has remained mostly in the red for much of the past month, highlighting persistent exits among futures traders.

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

An asset’s taker buy-sell ratio measures the balance between buy and sell volumes in the futures market. A value greater than one indicates stronger buy volume, while a value below one signals heavier sell-side activity.

As seen with ETH, there has been a persistent return of values under one for over a month. This points to sustained bearish positioning among traders, which could further delay ETH’s rally to $5000.

$5,000 Breakout Hinges on Demand Revival

As of this writing, the leading altcoin trades at $4,542, holding above the support floor at $4,211. If bearish sentiment strengthens and selloffs continue, the coin could retest this support line.

It could give way to a deeper decline to $3,626 if it fails to hold.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingView

However, a resurgence in demand for ETH could invalidate this bearish outlook. In that instance, the coin’s price could attempt to breach the resistance at $4,957. If successful, it could propel it to new price peaks above $5,000.