Arthur Hayes Suggests Hyperliquid’s HYPE Token Could Reach $5,000

Arthur Hayes, co-founder of BitMEX, has made one of his most aggressive predictions yet, placing Hyperliquid’s HYPE token on a path to potentially reach $5,000.

In a podcast interview with Kyle Chasse, he tied the projection to an explosive expansion in the stablecoin market. He argued that aggregate supply could climb beyond $10 trillion, sparking a surge of speculative trading.

How HYPE’s Price Can Reach The $5,000 Mark

According to Hayes, such conditions would encourage retail investors to chase outsized returns through leverage, fueling demand for platforms that cater to high-risk trading.

“I don’t have enough money to do these things that I want to do. But there’s this leverage trading venue where if I pick the right, you know, piece of coin or I pick the right meme stock in the American, you know, casino stock market, you know, I can get the car, I can pay off my student loan for the worthless degree that I got,” he quipped.

In his view, this risk-on environment—when capital flows into high-yielding assets—will fuel demand for platforms like Hyperliquid. As a result, this would benefit Hyperliquid’s HYPE token as market liquidity expands and the platform’s adoption surges.

“This is the system that those in charge have chosen to create—and the population is going along with it. I’m going to own the casino where the plebs are going to gamble,” Hayes stated.

Hayes’ remarks build on earlier comments in Tokyo, where he suggested HYPE could see a 126x gain in three years.

That prediction now resonates more strongly as Hyperliquid cements itself as one of the most influential decentralized exchanges in crypto.

Unlike competitors, the platform operates entirely on its own blockchain and focuses on perpetual futures contracts, which let traders speculate without expiration dates.

That design choice has translated into remarkable traction. Hyperliquid now accounts for more than 60% of the perpetual futures market. Its trading volumes have already surpassed Robinhood’s and chipped away at Binance’s dominance.

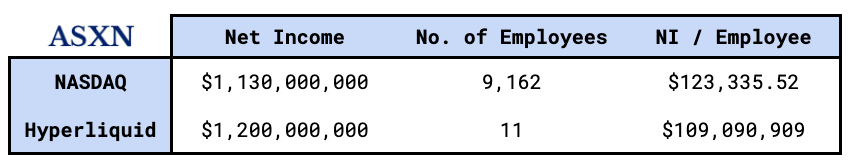

Moreover, the platform’s financial performance has been equally striking. Research firm ASXN reported that Hyperliquid generated $1.2 billion in net income in 2024, narrowly edging out NASDAQ’s $1.13 billion.

Hyperliquid vs. NASDAQ’s Net Income. Source: ASXN

Hyperliquid vs. NASDAQ’s Net Income. Source: ASXN

The comparison highlights the scale of its growth, particularly given that Hyperliquid operates with a workforce more than 800 times smaller.

Crucially for token holders, 98% of the exchange’s revenue is directed toward HYPE buybacks. This constant purchasing pressure has underpinned the token’s performance, which has seen it climb to a recent all-time high above $57.