Ripple Price Forecast: XRP poised for 23% move, eyeing record high as traders reposition

- XRP is poised for a 23% breakout to its record high of $3.66, reflecting positive sentiment in the market.

- XRP futures Open Interest and funding rate rise, indicating growing interest from traders leveraging positions.

- A rejection at $3.00 could delay the potential breakout.

Ripple (XRP) displays bullish potential, trading above $2.98 on Monday as cryptocurrency prices generally recover. A break above the immediate $3.00 hurdle could bolster XRP’s technical structure, increasing the chances of a 23% breakout to its all-time high of $3.66 reached on July 18.

XRP gains bullish momentum as Open Interest and funding rate rebound

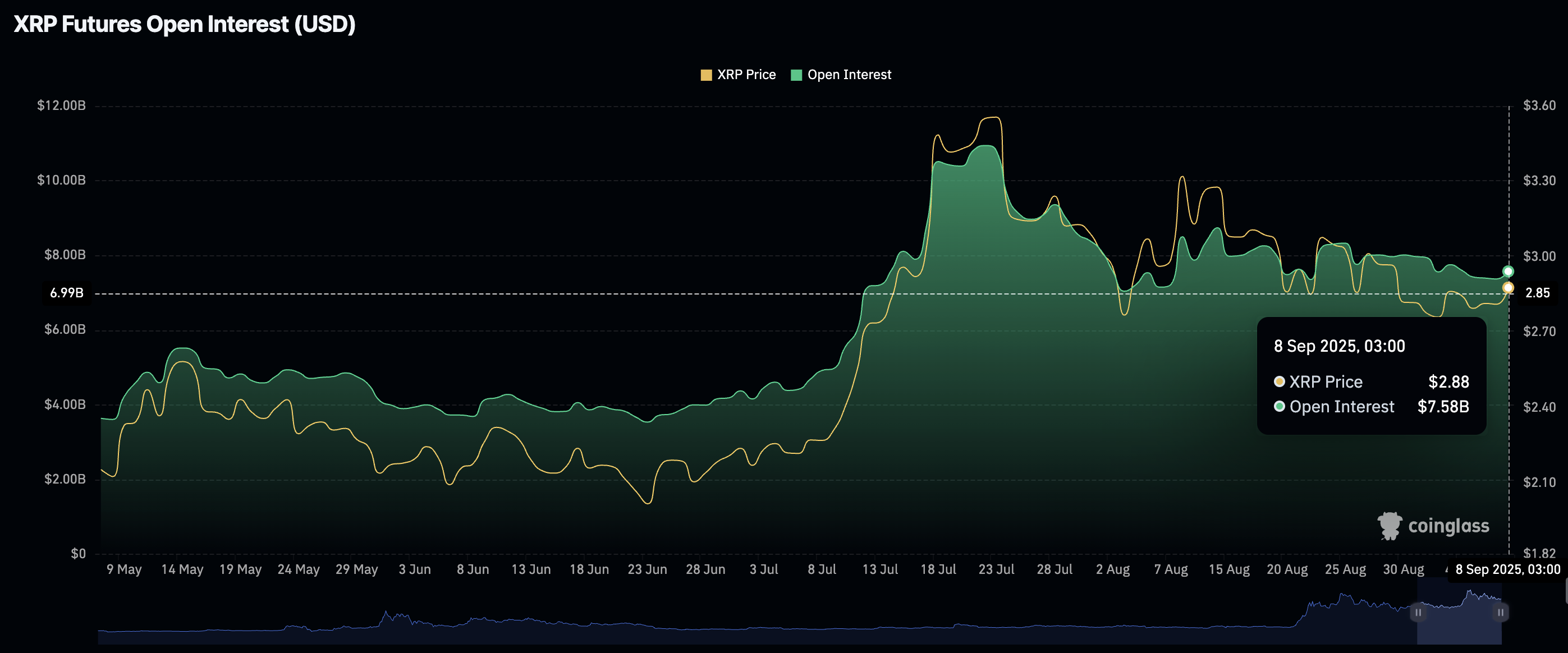

The XRP futures market shows signs of life after several weeks of volatility. This bullish outlook is reflected by the total Open Interest (OI), which averages at $7.58 billion, up from $7.37 billion recorded on Sunday.

OI refers to the notional value of outstanding futures contracts. A steady increase implies that traders are repositioning themselves, following the correction from the all-time high, which has found support at $2.72 as of September 1.

Arab Chain, an analyst highlighted via CryptoQuant, stated that “the stabilization of OI after the peak, along with the price’s decline from its highs, indicates a repositioning phase. Leveraged positions remain in the market, but at a lower level than during the July or August peak.”

XRP Futures Open Interest | Source: CoinGlass

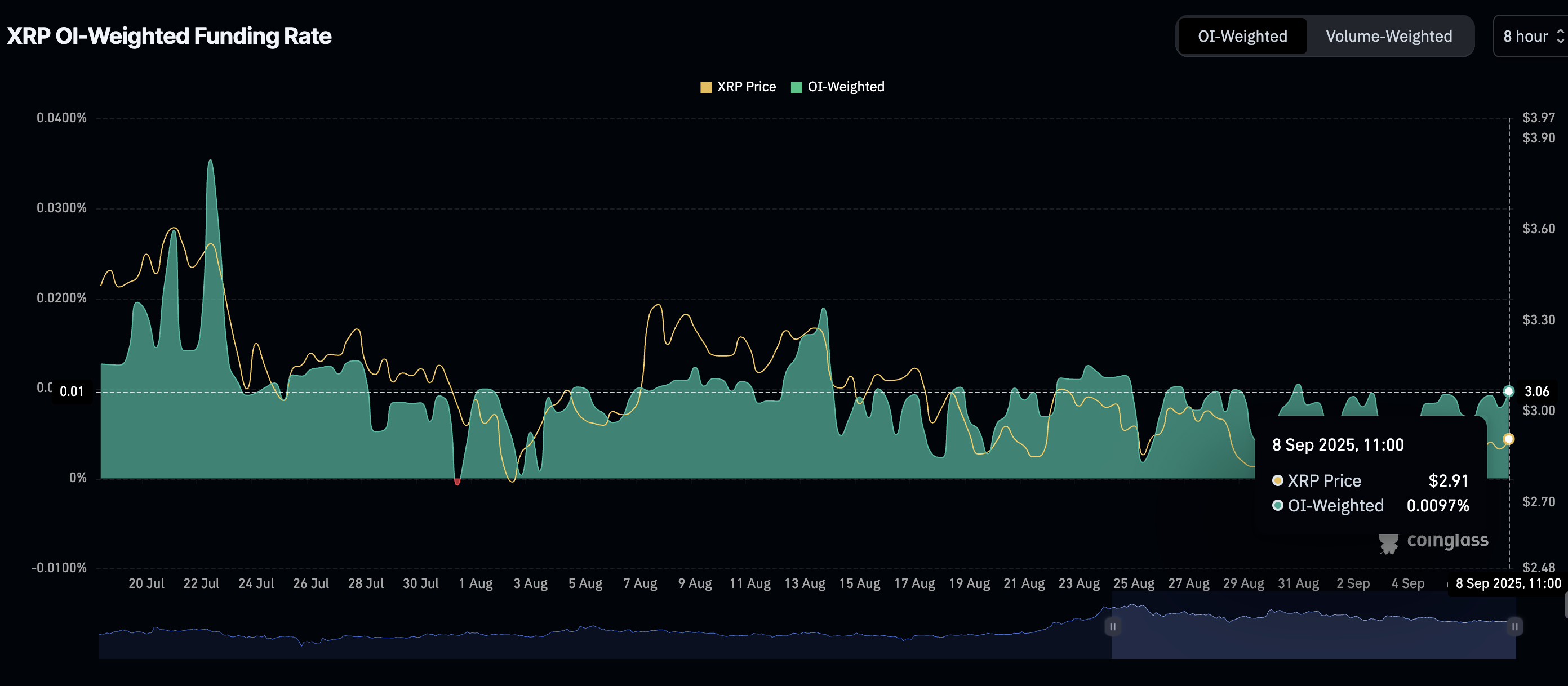

The steady increase in the futures funding rate to 0.0083% at the time of writing from 0.0047% on September 2 supports the bullish outlook for XRP derivatives. A steady increase in this metric suggests that more traders are leveraging long positions in XRP, thereby bolstering bullish market sentiment.

XRP Futures Funding Rate| Source: CoinGlass

Technical Outlook: Assessing XRP’s bullish structure

XRP holds above key moving averages on the 4-hour chart, including the 200-period EMA at $2.92, the 100-period EMA at $2.88 and the 50-period EMA at $2.85, signaling positive market sentiment.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, which has been in place since Sunday, supports a potential bullish outcome. This could propel XRP to a 23% breakout above its current level and reach its record high of $3.66.

XRP/USDT 4-hour chart

Traders will look for a short-term break above the $3.00 pivotal level to validate XRP’s bullish potential. However, with the Relative Strength (RSI) showing signs of retreating from overbought territory, a rejection is on the cards, which may delay the move to $3.66.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.