El Salvador Splits Bitcoin Reserve to Guard Against Quantum Hacking Risks

El Salvador has overhauled the structure of its Bitcoin treasury, moving away from a single wallet system to a diversified model.

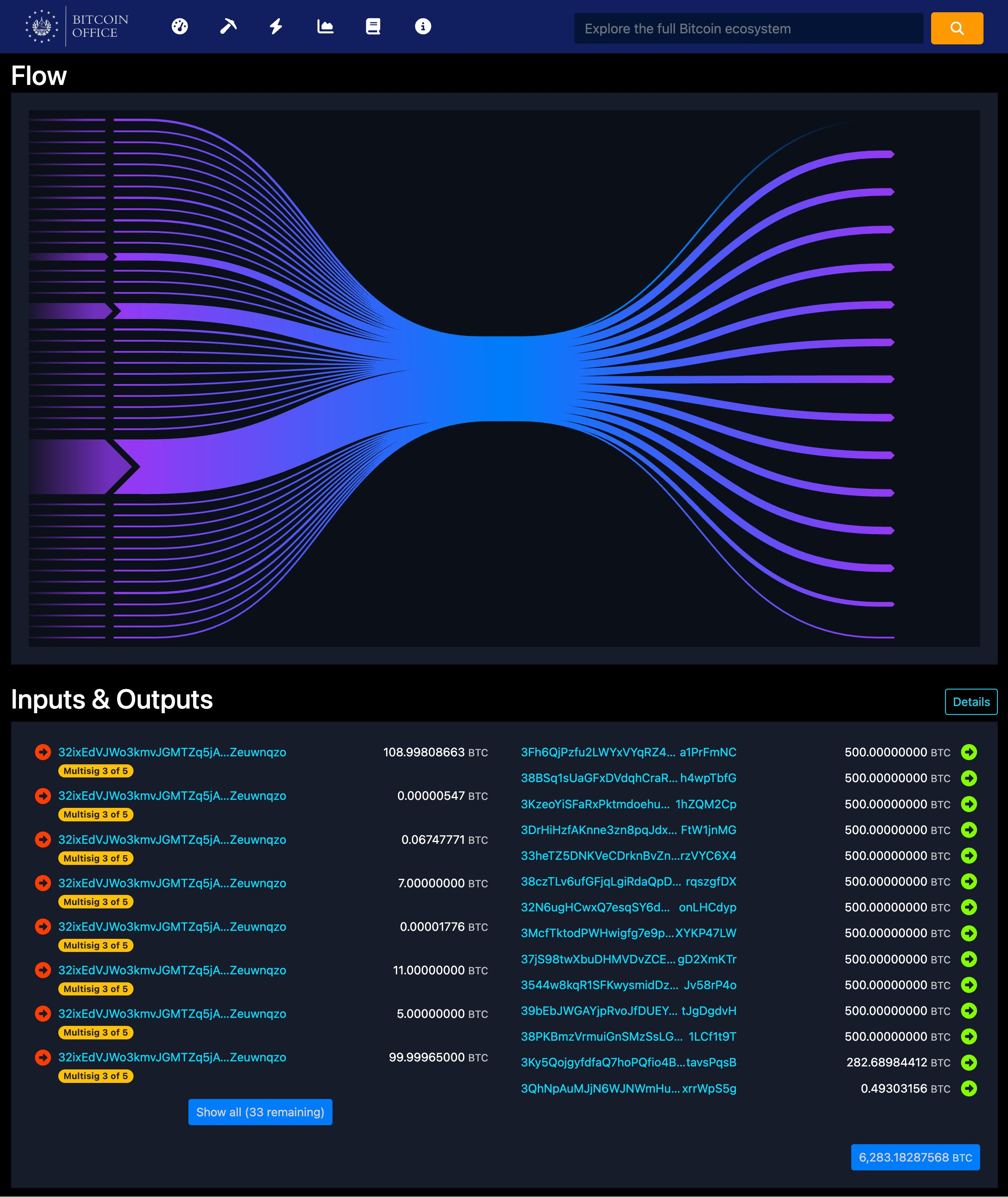

On August 30, the National Bitcoin Office confirmed that it will store the reserves across several addresses, each holding no more than 500 BTC.

Why El Salvador is Shifting its Bitcoin Treasury Reserve Model

The Salvadoran government said the redistribution aligns with global best practices in digital asset management. It also explained that the move addresses long-term concerns about quantum computing.

According to the government, quantum machines could theoretically crack the cryptography that protects Bitcoin keys. This possibility raises long-term questions about the security of digital wallets.

Previously, El Salvador relied on a single, continuously reused address. That practice made its public key permanently visible, effectively giving attackers unlimited time to attempt a breach.

The new system avoids this risk by spreading holdings across multiple unused addresses while publishing the list publicly to ensure accountability.

Considering this, the Bitcoin Office said distributing funds reduces exposure by limiting the amount stored in each wallet. It also prevents unused public keys from appearing on the blockchain until transactions occur.

“Limiting funds in each address reduces exposure to quantum threats because an unused Bitcoin address with hashed public keys remains protected. Once funds are spent from an address, its public keys are revealed and vulnerable. By splitting funds into smaller amounts, the impact of a potential quantum attack is minimized,” the government argued.

Stacy Herbert, who leads the National Bitcoin Office, framed the move as both precautionary and strategic.

“El Salvador was the first to establish a Strategic Bitcoin Reserve and we continue to lead the way on establishing best practices for this era of true sovereignty and freedom money,” she stated.

Meanwhile, the decision has drawn positive reactions from industry figures.

Nick Neuman, co-founder of Bitcoin custody firm CasaHODL, described it as an encouraging example of how large-scale holders can anticipate future threats.

“Great to see large/public BTC holders taking proactive steps to protect against future quantum threats. El Salvador continues to be a good model for how nations should manage bitcoin treasuries,” Neuman wrote.

This development comes around a month after the International Monetary Fund (IMF) claimed that El Salvador has not meaningfully increased its Bitcoin stash. Instead, it was argued that most activity involved internal transfers rather than new purchases.

Despite this, the Central American country has continued to announce new Bitcoin purchases, pushing its total holdings to 6,284 BTC (worth over $681 million). As of press time, Mononaut, the pseudonymous founder of Mempool, reported that these funds have been spread across 14 new addresses.

El Salvador’s New Bitcoin Reserve Management. Source: Mononaut.

El Salvador’s New Bitcoin Reserve Management. Source: Mononaut.

Notably, President Nayib Bukele recently hinted that the figure could approach $1 billion by year-end.