Hectic data docket culminates in critical US NFP reading

- Holiday-dampened start to the week gives way to hefty data docket.

- This week will wrap up with a bumper print of US NFP jobs data.

- Risk appetite is riding high as markets bet on a September Fed rate cut.

September opens up on a quiet note, with US markets shuttered on Monday for a long weekend. The Labor Day holiday has market flows crimped by the US long weekend, but a wide swath of high-impact events will keep this week on the entertaining side before the latest round of US Nonfarm Payrolls (NFP) crash into markets.

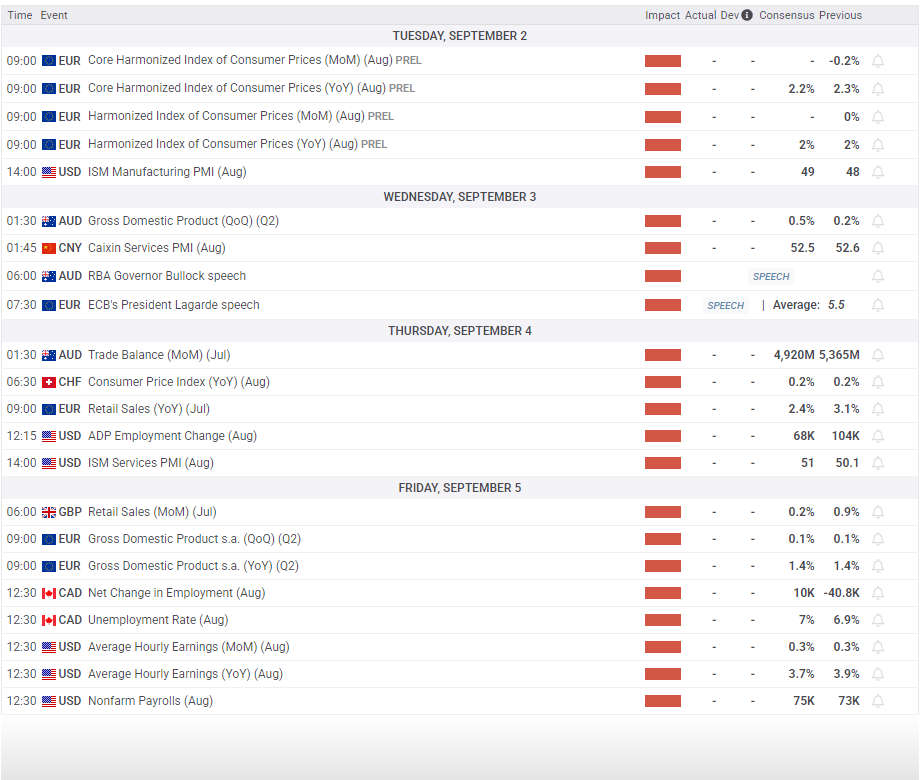

Tuesday will officially kick the trading week off in earnest with the latest European Harmonized Index of Consumer Prices (HICP), the EU’s own off-brand riff on Consumer Price Index (CPI) inflation. Pan-EU HICP inflation is expected to hold steady at 2.0% in August. US markets will come back to life on Tuesday just in time for the latest ISM Manufacturing Purchasing Managers Index (PMI) survey results. The response rate for PMI surveys is generally too low to stretch the final figure into an accurate sample size, thus rendering any conclusions drawn from the survey a moot point. However, the final figure will nonetheless be watched by investors.

Rounding the corner into the midweek, quarterly Australian Gross Domestic Product (GDP) growth for Q2 as well as China’s Caixin Services PMI for August will both land on the Antipodeans on Wednesday. European Central Bank (ECB) President Christine Lagarde will also make her second appearance in three days on Wednesday, but any meaningful shifts in ECB policy statements are not expected for the time being.

Australian Trade Balance figures will wrap up this week’s Asiatic data docket on Thursday, followed by European Retail Sales data for the year ended in July. European Retail Sales figures are expected to slow sharply to 2.4% YoY, but the figure is so far back-dated that immediate market immediate will be muted.

Friday will open things up with Q2 European GDP growth, which is expected to remain entrenched at a disappointing but stable 1.4%, and Canada makes its only meaningful appearance on this week’s data schedule with its latest employment figures, but the CAD-demoninated labor figures will be wholly eclipsed by US Nonfarm Payrolls (NFP). The Federal Reserve (Fed) is barreling toward an interest rate cut on September 17 thanks to its sometimes-conflicting dual mandate of influencing interest rates to both bolster job creation and control inflation. A recent bout of softening US labor figures has investor hopes riding high that the Fed will brush off a recent uptick in inflation pressures and deliver a rate in a few weeks to prop up US employment numbers that took a sharp downward turn heading into the middle of the year.

Key events coming up this week