De-Dollarization Accelerates at Record Pace – WGC Survey: Central Banks Buy Gold, Reduce Dollar Reserves

TradingKey - Despite gold prices nearly doubling since the outbreak of the Russia-Ukraine conflict in 2022 — and amid JPMorgan’s forecast of a pause in Chinese central bank purchases and Citi’s bearish outlook on gold — the World Gold Council (WGC) has released new survey results showing that global central banks are more eager than ever to increase gold reserves, while reducing their holdings of the U.S. dollar.

According to the WGC’s 2025 Central Bank Gold Reserves (CBGR) survey, published on June 17, central banks remain bullish on gold during a period of heightened geopolitical and economic uncertainty, reinforcing gold’s enduring appeal and relevance.

Key Findings:

- 43% of respondents expect their central bank to increase gold reserves within the next 12 months, up from 29% in 2024, marking the highest level in the survey’s history.

- 95% expect global central bank gold reserves to rise over the next year, up from 81% in last year’s survey — another record high.

- Notably, no respondent anticipated a decrease in gold reserves over the coming year.

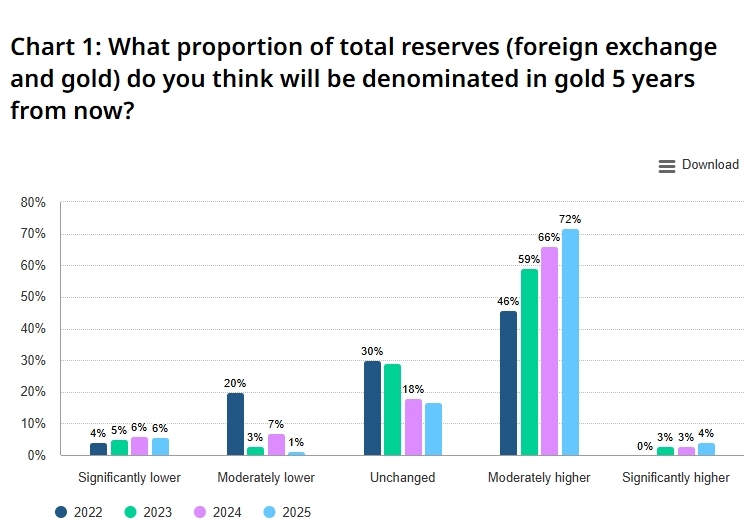

Looking further ahead, 76% of central banks expect the share of gold in total reserves to rise moderately or significantly over the next five years, up from 69% in 2024.

2025 Central Bank Gold Reserves (CBGR) survey, Source: WGC

In contrast, 73% of respondents expect the share of U.S. dollar reserves to decline moderately or significantly over the next five years, while shares of other currencies such as the euro and renminbi are expected to rise.

The WGC noted that gold’s historical performance during crises, portfolio diversification needs, and its role as an inflation hedge are key drivers behind central banks’ plans to add more gold in the coming year.

What’s Next for Gold?

At the time of writing, gold prices stood at $3,375.56 per ounce.

Goldman Sachs recently projected that strong structural demand from central banks could push gold to $3,700 per ounce by the end of 2025, and even reach $4,000 per ounce by mid-2026.

Goldman highlighted that if Section 899 of Trump’s bill is passed — which would impose tariffs on capital gains from sovereign investments in U.S. Treasuries — it could further accelerate de-dollarization and drive more central banks to shift into gold.