Lucid’s Repricing Moment: Is a Turnaround Coming or Already Priced In?

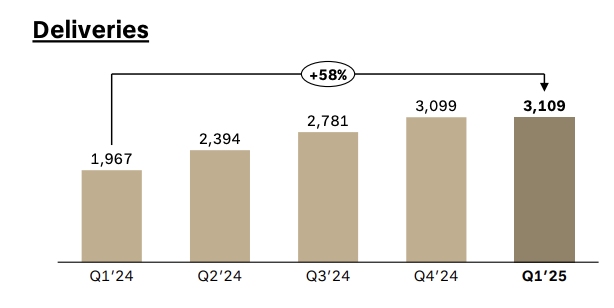

- Lucid delivered 3,109 vehicles in Q1 2025, marking its fifth consecutive quarter of record deliveries, +58% YoY.

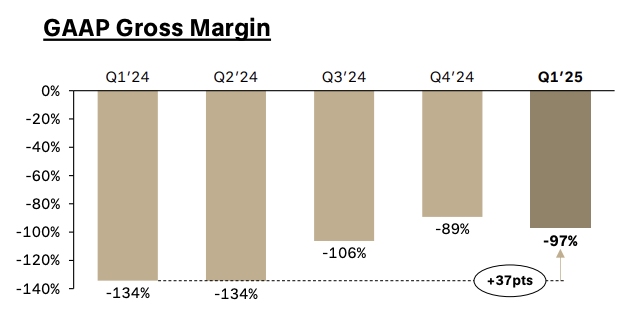

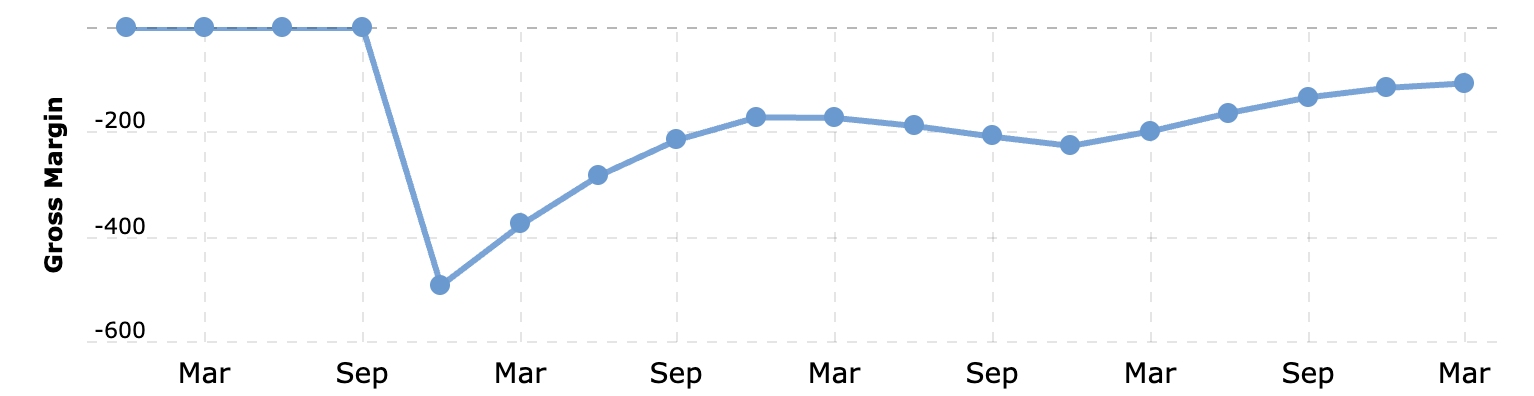

- Gross margin improved by 37 percentage points YoY, reflecting stronger manufacturing efficiency and cost discipline.

- Liquidity stands at $5.76 billion, but free cash flow remains negative at -$429 million with growing inventory levels.

- Valuation sits at ~4.2x forward sales and P/B under 3, dependent on scaling the Gravity SUV and midsize platform.

TradingKey - Lucid Group (LCID) has been positioning itself for years as the pinnacle luxury EV disruptor, with the Lucid Air garnering praise for range, engineering, and design. But in Q1 2025, the market is unmistakably telling us that innovation is not enough. While delivering a record volume of deliveries and enhancing critical financial metrics, the valuation of stock collapsed.

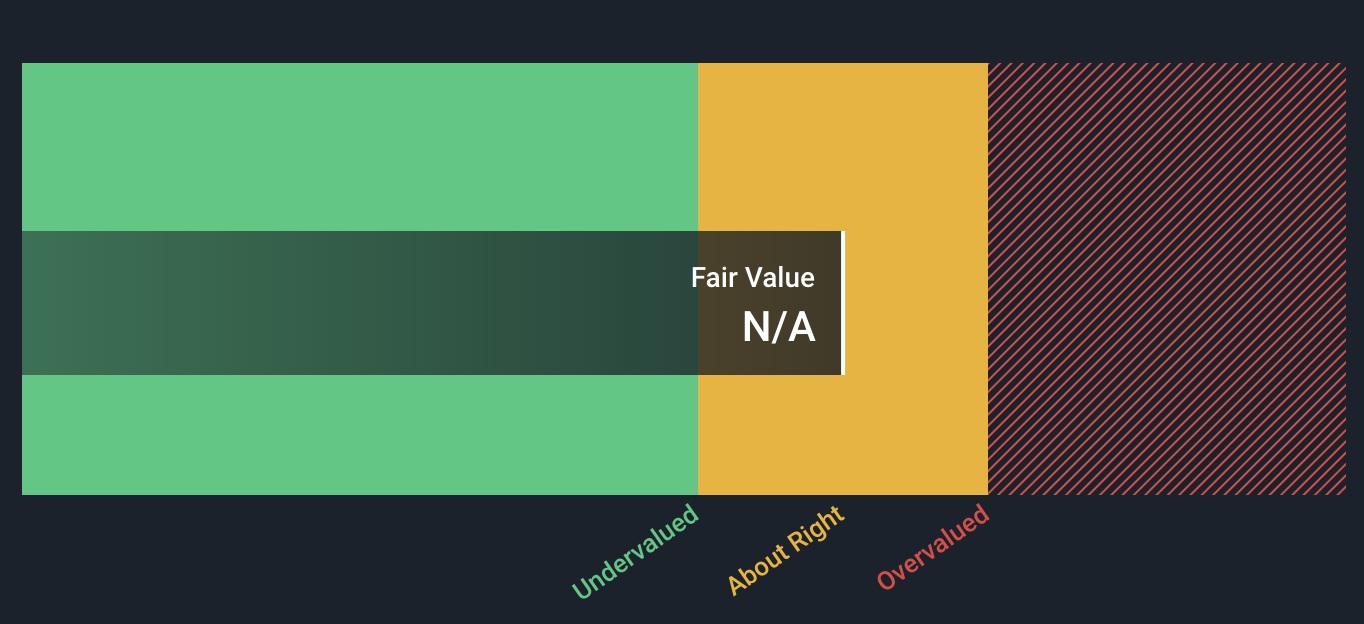

Source: Simply Wall Street, Lucid Share Price vs Fair Value

With a forward P/S less than 7x and a P/B around 2x, Lucid still has significant backing, decent liquidity runway, and some revenue growth, which is not enough to be a cutting-edge tech company. Investors are discounting the long-term runway in favor of near-term losses and cash burn fears. However, a closer examination sees a company turning, vigorously, toward operating maturity. Q1 was Lucid's fifth quarter in a row of record deliveries (3,109 units), +58% YoY, and notably enhanced gross margin (+37 pts YoY).

Source: Lucid, First Quarter 2025 Earnings Release

Source: Lucid, First Quarter 2025 Earnings Release

The introduction of the Lucid Gravity SUV and breakthroughs in battery tech are signs of a company no longer only innovating but commercializing at scale. The question is not if Lucid is a growth story. It's whether or not it can be a profitable one before the runway shortens.

Under the Hood: Lucid's Business Model and Technology Advantage

Lucid's model is based on full-stack vertical integration. From in-house batteries to in-house software platforms, Lucid is not just building cars; it's creating intellectual property. Air Sedan and Gravity SUV serve as the anchor point for a roadmap aimed at both luxury and volume segments through an upcoming midsize platform.

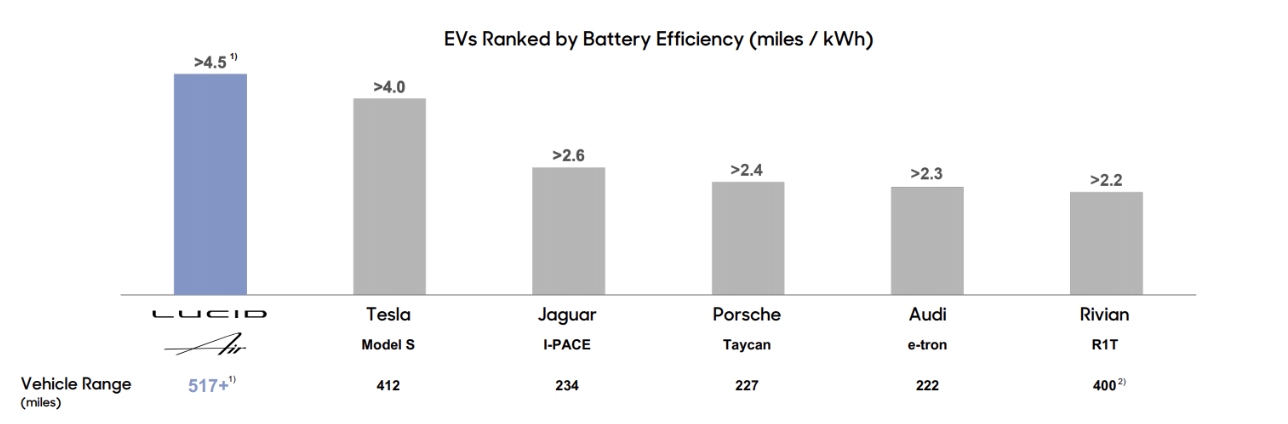

During Q1, Lucid released the Grand Touring trim version of the Gravity SUV, with a proprietary Wunderbox system that allows it to recharge 200 miles in less than 11 minutes. This goes hand in hand with its 5.0 mi/kWh efficiency rate, making Lucid a contender not only in luxury but also in powertrain efficiency.

Source: NASDAQ

Its Saudi-backed AMP-2 facility is already in production through SKD and is expected to be fully in CBU production by late 2025. In the meantime, a newly acquired facility from Nikola Corporation strengthens Lucid's U.S. production footprint. Despite possessing an impressive IP lineup, Lucid is still selling fewer than 15,000 units a year, so the scaling is both the company's greatest challenge and greatest opportunity.

Competition in the Mirror: Shifting Competitive Landscape

The battle in the EV field is nonetheless fierce. Tesla still leads in volume and margin. BYD and NIO's Chinese EVs come in threatening form with slashing prices. And traditional OEMs, Mercedes-Benz, GM, and BMW, scale their own luxury EV models.

Lucid's strength is in vertical integration and efficiency ratios. It beats most luxury electrics at 5.0 mi/kWh. However, customer acquisition is still costly. It has 57 studios and service locations internationally, but no such halo of brand equity and demand flexibility as Tesla.

The actual differentiator may be the Saudi alignment. Public Investment Fund (PIF) not only invests in Lucid (with $1.66 billion of redeemable preferred stock) but also underpins demand through government fleet orders. Such a symbiotic relationship provides Lucid with geopolitical insulation and fiscal maneuverability absent in its peer group.

Meanwhile, established competitors with greater scale are pushing on price. Lucid will need to tread a tightrope: preserve luxury cachet while migrating downmarket without compromising brand or margin.

Scaling or Sputtering? Strategic and Financial Deep Dive

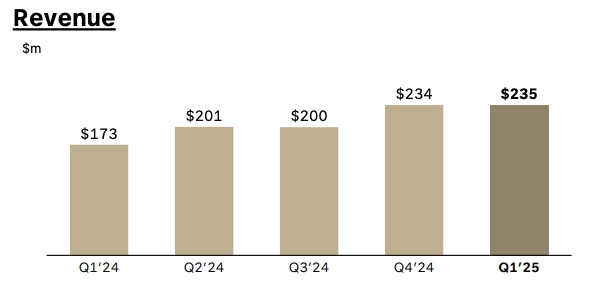

Q1 2025 revenue at Lucid stood at $235 million, even with the previous quarter, but ahead of $173 million in the prior year. Losses decreased: net loss of $366 million versus $681 million in the previous year. Adjusted EBITDA stood at -$563 million versus -$598 million, indicating incremental cost discipline.

Source: Lucid, First Quarter 2025 Earnings Release

Encouragingly, the company's gross margin accelerated 37 percentage points QoQ on a YoY basis, a good indicator of manufacturing efficiency. CapEx totaled $161 million during the quarter, a reasonable number in light of factory builds in Arizona and Saudi Arabia.

Source: Macrotrends, Lucid Gross Margin 2020-2025

Liquidity is in good shape at $5.76 billion, supported by a recent registration of a $1.1 billion convertible note offering and upsizing of the GIB facility. Nonetheless, burn rate is still a concern. Free cash flow was sharply negative at -$429 million. Inventory grew to $471 million, indicating deliveries are falling behind the production rate.

Lucid's profitability path heavily relies on the Gravity SUV and the upcoming midsize model, arriving in 2026. These models need to ramp up rapidly to cover fixed costs. If operating leverage does not come through by 2026, dilution or debt might return to be valuation headwinds.

Uncovering the Cost: A Cost Analysis

Lucid's market cap is approximately $6.6 billion, with book equity of $3.18 billion, keeping its P/B ratio at less than 3. Although this generally suggests undervaluation, the negative earnings complicate the situation. The company is priced at ~6.6x trailing sales and ~4.2x forward revenue, rich versus traditional automakers but modest for a tech-savvy EV play.

Versus competitors such as Rivian (RIVN) or Fisker (FSR), Lucid’s valuation suggests doubt. A long-term re-rating is based on whether or not Lucid will scale to 100,000+ units/year in 2027 with a positive gross margin. If so, a 1.5–2x forward EV/sales on $4–5 billion of revenue implies a $6 billion – $10 billion valuation, about in line with where it is today, limiting upside unless execution is a surprise.

Yet, when Lucid commercializes its tech stack (e.g., powertrain licensing, Saudi partnerships), it might free up high-margin, asset-light streams of income, recasting valuation in terms of a platform model rather than merely autos.

Brake Lights or Tailwind? Risk Factors

Lucid is exposed to macro, execution, and liquidity risk in a triple threat. Macro-wise, tight consumer credit and high interest rates suppress luxury EV sales. Execution risk is also increasing: the Gravity will have to ramp without delay, while the midsize platform is under intense price competition.

Last but not least, Lucid's cash position is good today but is supported by constant injections of capital. If sentiment reverses or geopolitics interrupts Saudi alignment, funding may become problematic. The firm also has in excess of $1.6 billion in redeemable preference shares, with future dilution risk in the case of conversion.

To sum it up, Lucid is not on the verge of collapse, but the journey to self-sufficiency remains long, circuitous, and upward.

Final Lap: Takeaway on Investment

Lucid is no longer a bet on hypergrowth EV – it's an efficiency play with a premium brand, sovereign sponsorship, and a chance at vertical profitability. But it's still in the promise versus proof column. Long-term investors are rewarded in terms of margin scalability and ecosystem monetization. But you need patience and faith in execution.

Lucid's case is being repriced. It's either underpriced or fairly priced for the risk, based on your belief in their transformation.

Copyleaks Report: https://app.copyleaks.com/report/xthnihwnpt4khyhp/preview?key=ui281wj49i16yau6&viewMode=one-to-many&contentMode=text&sourcePage=1&suspectPage=1&showAIPhrases=false&alertCode=suspected-ai-text