Gold surges past $3,400 on Israel-Iran war risk, soft US inflation boosts safe-haven demand

- Bullion rallies to five-week high amid geopolitical tension and dovish Fed outlook

- Israel strikes Iran, fueling fears of broader war and driving flight to safety into Gold.

- XAU/USD hits $3,446 before easing on profit-taking; eyes next week’s Fed decision and US data slate.

Gold price rallied for the third consecutive day after the Israel-Iran conflict erupted on Friday, triggering a risk-off mood in financial markets as fears that it could escalate loom. At the time of writing, XAU/USD trades at $3,422, up more than 1%.

Several factors underpin bullion. On Friday, Israel's attack on Iran's military installations, nuclear facilities and senior officials augmented tension in the area. After the attack, XAU/USD reached a five-week high of $3,446 before retreating somewhat to its current levels as traders booked profits ahead of the weekend.

Softer US CPI and PPI strengthen bets on Fed rate cuts despite improving consumer sentiment

Another factor was that inflation in the United States (US) continued to ease following the release of the Consumer Price Index (CPI) and the Producer Price Index (PPI) figures for May. Recently, a University of Michigan (UoM) Consumer Sentiment survey revealed that households are becoming more optimistic about the economy, yet they remain worried about higher prices.

US President Donald Trump hinted that Iran brought the attack on itself, as Washington warned Iran to restrict its nuclear program.

Next week, traders will be watching the release of the Federal Reserve's (Fed) monetary policy meeting, where officials will update their economic projections. Besides this, Retail Sales, Industrial Production, housing and jobs data could help dictate Gold’s direction.

Daily digest market movers: Gold price surges on risk aversion

- Recently, US President Trump said to Axios that Israel’s attack could help him reach an agreement with Iran. He urged Iran to make a deal, adding, “There has already been great death and destruction, but there is still time to make this slaughter, with the next already planned attacks being even more brutal, come to an end.”

- The University of Michigan (UoM) Consumer Sentiment report in June showed that households are becoming more optimistic about the economy. The Sentiment Index rose from 52.2 to 60.5, while inflation expectations decreased for both one-year and five-year periods, from 6.6% to 5.1% and from 4.2% to 4.1%, respectively.

- Although the data is positive and clears the path for the Federal Reserve to ease policy, the escalation of the Middle East conflict pushed Oil prices up by more than 6%. This suggests that Gasoline prices could increase, and that a reacceleration of inflation looms.

- US Treasury yields are recovering, with the US 10-year Treasury yield climbing over seven basis points (bps) to 4.436%. US real yields followed suit, rising seven basis points to 2.186%, capping Bullion’s advance.

- The Greenback rises after hitting three-year lows, according to the US Dollar Index (DXY). The DXY, which tracks the value of the Dollar against a basket of peers, is up 0.30% at 98.15 after hitting a multi-year low of 97.60.

- Goldman Sachs reiterated that the price of Bullion would rise to $3,700 by the end of 2025 and $4,000 by mid-2026. Bank of America (BofA) sees Gold at $4,000 over the next 12 months.

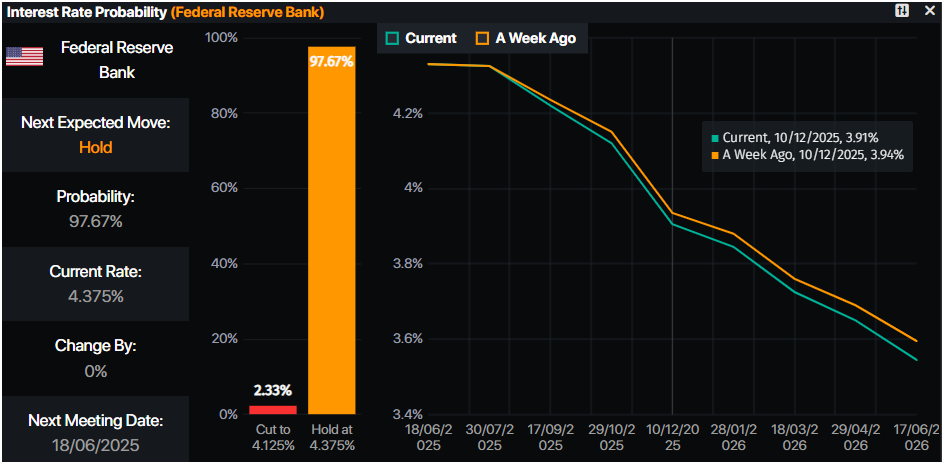

- Money markets suggest that traders are pricing in 47 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates near $3,400

Gold price is set to extend its gains past the $3,450 figure, clearing the path to challenge the record high of $3,500 in the near term. The Relative Strength Index (RSI) shows that momentum remains bullishly biased, and with that in mind, the path of least resistance is tilted to the upside.

Conversely, if XAU/USD tumbles below $3,450, the first support would be the $3,400 mark. If it surpasses, the next stop would be the 50-day Simple Moving Average (SMA) at $3,281, ahead of the April 3 high-turned-support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.