Gold smashes record at $3,747 as Fed cut bets sink US Dollar

- Gold skyrockets as traders fully price in Fed rate cuts at remaining 2025 meetings.

- Russia’s advance in Ukraine and lingering geopolitical tensions bolster safe-haven flows into precious metals.

- Societe Generale notes central banks' Gold demand rebounded to 63 tonnes in 2025, matching post-2022 averages and supporting upside.

Gold price hit a fresh all-time high at $3,747 on Monday and appears poised to test higher prices as the US Dollar slumps, with traders anticipating further easing by the Federal Reserve (Fed) later this year. XAU/USD trades above $3,745, up more than 1.60%.

Bullion surges 1.6% as easing speculation, geopolitical tensions, and central bank demand fuel momentum

Market mood remains upbeat due to growing speculation that the Fed will cut rates in each of the two monetary policy meetings left in 2025. Consequently, the US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, tumbles 0.30% at 97.39.

Bullion prices also advanced as the end of the Russia–Ukraine war looks far from being achieved, despite efforts by the White House. Reuters revealed that “Russia's defence ministry said on Monday its forces had taken control of the settlement of Kalynivske, in Ukraine's Dnipropetrovsk region.”

The Fed parade resumed on Monday, with several policymakers crossing the wires. The day began with Atlanta Fed Raphael Bostic, followed by Richmond Fed Thomas Barkin, St. Louis Fed Alberto Musalem, Fed Governor Stephen Miran and Cleveland Fed Beth Hammack.

In the meantime, Societe Generale wrote in a note that central banks' demand for Gold rebounded to 63 tonnes in 2025, equaling the post-2022 average, a tailwind for Bullion prices.

Ahead this week, further officials, including the Fed Chair Jerome Powell, will cross the wires. On the data front, S&P Global Flash PMIs, Durable Goods Orders, the final print of the Gross Domestic Product (GDP) for Q2 and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, will update the status of the US economy.

Daily market movers: Gold surges amid high US Treasury yields

- US Treasury yields are rising, with the 10-year Treasury note up one and a half bps at 4.145%. US real yields—calculated by subtracting inflation expectations from the nominal yield—, which correlate inversely to Gold prices, climb one bp at 1.755%.

- Atlanta Fed President Raphael Bostic said that inflation concerns keep him hesitant to support cutting rates in October, via the Wall Street Journal. Despite this, he acknowledged that the risks of weakened employment increased.

- St. Louis Fed Alberto Musalem supported the cut as a precautionary move to support the labor market, though he said that policy would continue to prioritize inflation. He would support further easing if signs of a weaker labor market emerged and inflation expectations had not increased. He added that tariffs are adding to inflation, but the impact on prices has not yet been fully felt.

- Fed Governor Stephen Miran said that policy is very restrictive and projects the neutral rate for the fed funds rates at around 2%.

- Richmond Fed Thomas Barkin said that a modest amount of tariff costs is paid by consumers and that economic uncertainty is starting to lift.

- Cleveland Fed Beth Hammack said that the Fed is being challenged on both sides of the mandate, though sees risks of inflation, higher. Regarding the labor market, she sees a low-hiring, low-firing market, with businesses reluctant to hire.

- Swiss Gold exports to the US in August tumbled 99% after the US Customs and Border Protection revealed that bars would be subject to tariffs. Nevertheless, China came to the rescue, as shipments more than tripled in August from 9.9 tonnes to 35, its highest level since May 2024, while exports to India rose.

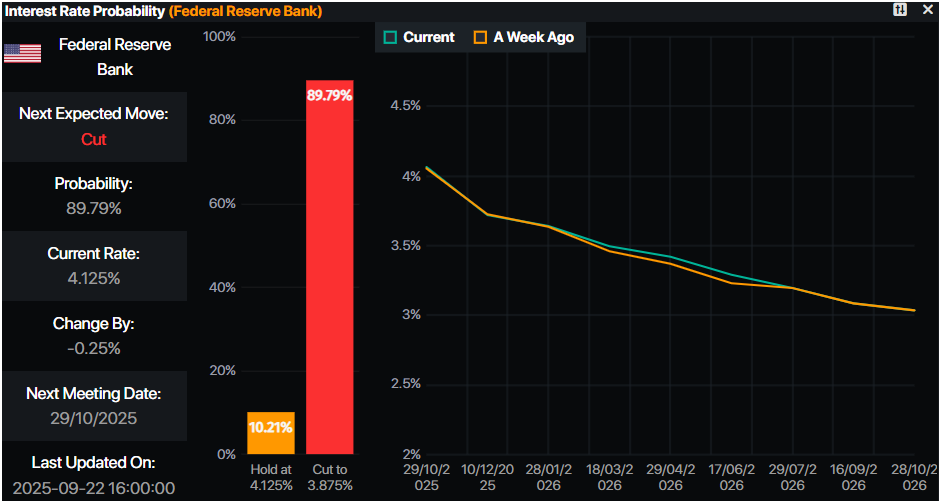

- The Federal Reserve is expected to cut rates by 25 bps at the October 19 meeting, according to data from Prime Market Terminal. Odds are at 89%, while for a hold stand at 11%.

Source: Prime Market Terminal

Technical outlook: Gold hits new record high, eyes on $3,750

Gold prices are poised to challenge higher prices and reach record highs. The first area of interest would be $3,750, followed by the $3,800 mark. On subsequent strength, $3,900 and $4,000 could be tested.

The Relative Strength Index (RSI), despite being overbought after bouncing off the 70 level, hints that bulls are gathering traction.

On the other hand, if XAU/USD tumbled beneath $3,700, this would clear the path to challenge $3,650, the September 11 low at $3,613, and the $3,600 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.