Will the New Taiwan Dollar’s Surge Continue? Likely Not!

TradingKey - Recent internal and external factors have driven a sharp appreciation of the New Taiwan Dollar (TWD). Looking ahead, despite potential pressure from the U.S., Taiwan’s export-oriented economy, emerging economic weakness, and China’s monetary easing (rate cuts and reserve requirement reductions) suggest that the Central Bank of the Republic of China (CBC) may intervene in the foreign exchange market. In the short term, the TWD is expected to stabilize around 30, with a moderate depreciation being a likely scenario. Consequently, we maintain a neutral to bullish outlook on USD/TWD.

Source: Refinitiv, TradingKey

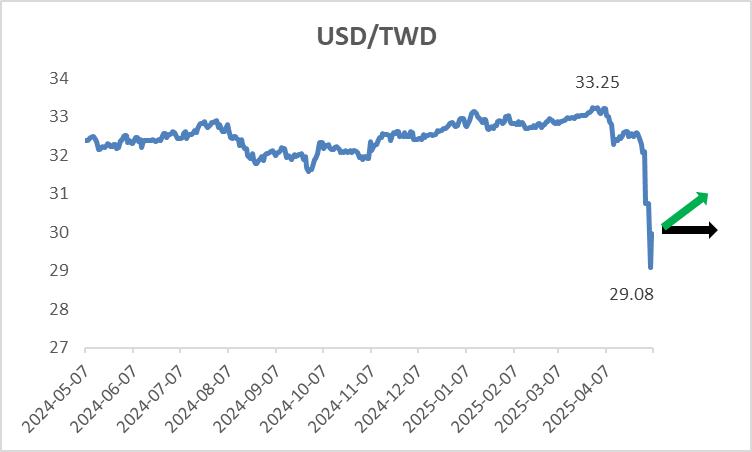

Since 2 April 2025, when President Trump announced “reciprocal tariffs”, the TWD has appreciated significantly. The USD/TWD exchange rate plummeted from a high of 33.25 in early April to a recent low of 29.08, stunning markets. The TWD has also strengthened against other major currencies, such as the Euro and Japanese Yen (Figure 1).

Figure 1: TWD Against Major Currencies

Source: Refinitiv, TradingKey

This rally can be attributed to five key factors:

· U.S. Tariff Disruptions: High U.S. tariffs have disrupted the U.S. economy, triggering a sell-off of the USD.

· Taiwan Stock Market Rebound: A rally in Taiwan’s stock market has attracted foreign capital inflows, boosting TWD demand.

· U.S. Treasury Sell-Off: Falling U.S. Treasury prices have prompted Taiwanese life insurers to divest U.S. bonds and redirect funds into local real estate and equities.

· Exporter Behaviour: The sharp decline in USD/TWD has led Taiwanese exporters to convert USD earnings into TWD, further strengthening the TWD.

· CBC Inaction: The CBC’s lack of intervention has fuelled speculation about potential U.S.-Taiwan agreements, with some even suggesting a “Plaza Accord 2.0”. This has triggered panic buying of TWD and selling of USD.

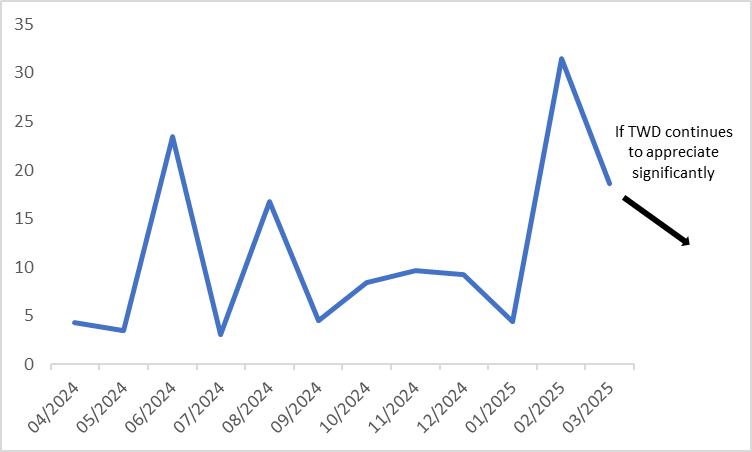

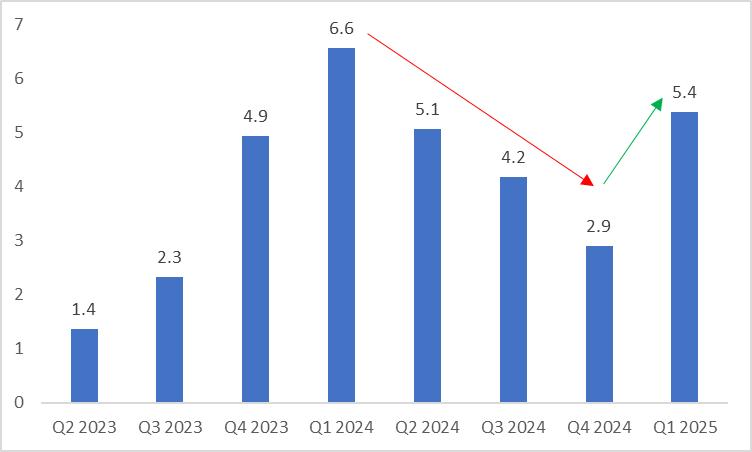

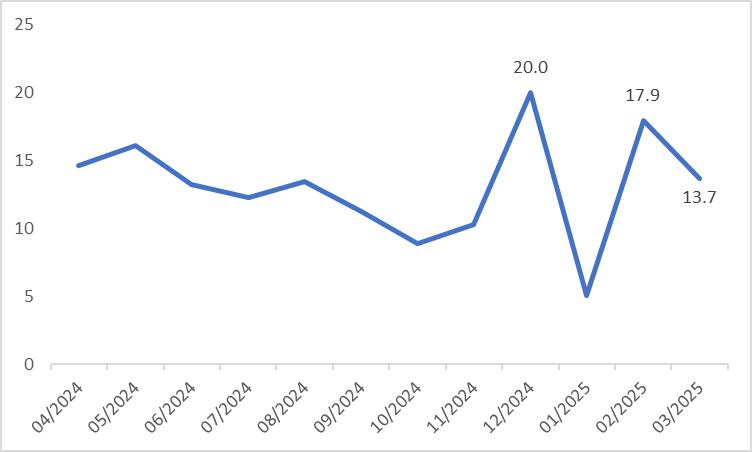

Looking forward, a sustained TWD appreciation to 25 or below against the USD would severely impact Taiwan’s exporters. As an export-driven economy, a sharp decline in exports (Figure 2) could trigger widespread corporate bankruptcies—an outcome Taiwan’s authorities are unlikely to tolerate. From a fundamental perspective, while Taiwan’s GDP growth rebounded in Q1 2025, the broader trend of slowing economic growth since early 2024 is expected to persist (Figure 3). High-frequency data also signal early signs of economic slowdown: although Industrial Production growth remains in double digits, March 2025 figures dropped by 4.2 percentage points from February (Figure 4). Taiwan’s Manufacturing PMI continued its decline, recording 47.8 in April 2025, down from 49.8 in March and below the 50 threshold. Additionally, China’s planned rate cuts and reserve requirement reductions are likely to weaken the RMB, bolster the USD index, and indirectly temper the TWD’s strength against the USD.

Figure 2: Exports (y-o-y, %)

Source: Refinitiv, TradingKey

Figure 3: Real GDP (y-o-y, %)

Source: Refinitiv, TradingKey

Figure 4: Industrial Production (y-o-y, %)

Source: Refinitiv, TradingKey

In summary, despite external pressures from the U.S., Taiwan’s export-oriented nature, emerging economic softness, and China’s monetary easing suggest that the CBC will likely intervene to stabilize the currency market. In the short term, we expect the TWD to hover around 30, with a moderate depreciation being probable. Thus, we maintain a neutral to bullish stance on USD/TWD.