Bitcoin Nears All-Time High as Whale Behavior Suggests Further Upside

Bitcoin continues to show signs of recovery as its price rebounds from a brief correction last week. At the time of writing, the crypto is trading at $109,693, reflecting a 0.4% increase over the past 24 hours. Despite this upward movement, the current price remains roughly 2% below its all-time high of over $111,000, recorded last month.

This ongoing strength in price performance has been accompanied by notable on-chain signals, particularly from large holders. CryptoQuant contributor Crypto Dan recently analyzed the current market structure and behavior of Bitcoin whales.

Bitcoin Whale Behavior Suggests Further Upside

In his latest analysis, Dan observed that despite Bitcoin hovering near record levels, there is little evidence of the profit-taking behavior typically observed during previous market tops. According to him, whales are not engaging in mass selloffs, suggesting that these investors expect the rally to continue.

Dan emphasized that these large holders are likely waiting for more pronounced market euphoria and higher valuations before initiating substantial sell activity, a pattern often seen near the final stages of a bull market.

Bitcoin – Near All-Time Highs but No Profit-Taking

“Whales show no intention of taking profits at this price level and are likely to wait for higher prices, where significant market overheating and a bubble form, before making their moves.” – By @DanCoinInvestor pic.twitter.com/W5PtrHo0Q5

— CryptoQuant.com (@cryptoquant_com) June 11, 2025

Whale Exchange Activity Indicates Similar Move

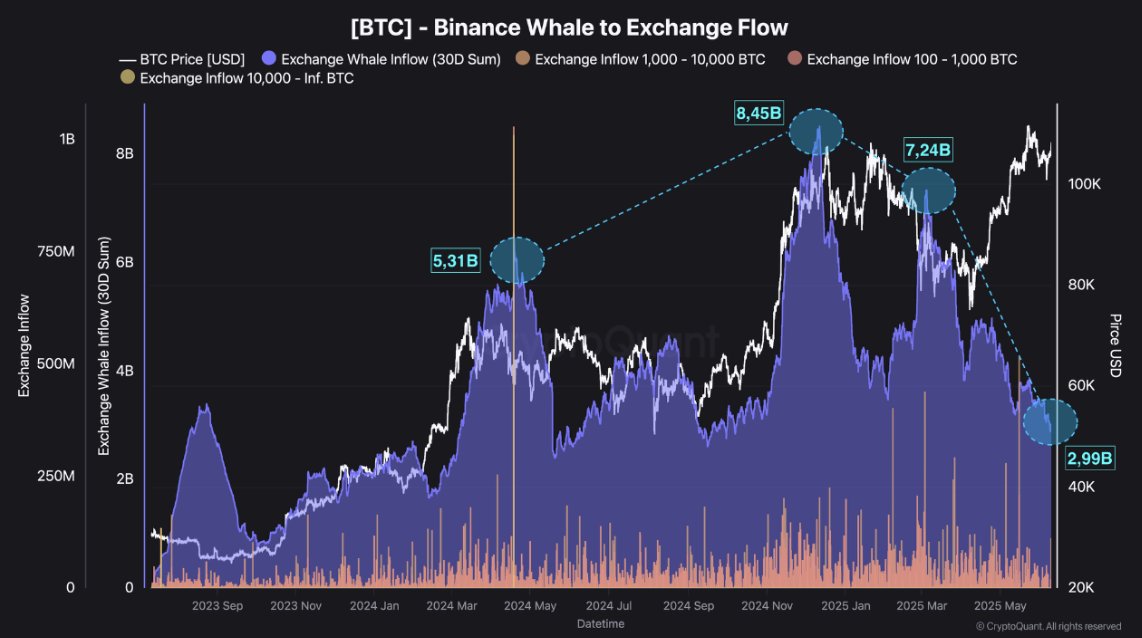

Further reinforcing the current sentiment, another CryptoQuant analyst, Darkfost, highlighted a significant trend in Binance whale behavior.

According to Darkfost, historical data shows that when Bitcoin approaches or breaches its all-time high, there is typically a sharp rise in exchange inflows, driven by whales seeking to take profits.

This pattern was visible during earlier cycle peaks, where inflows reached $5.3 billion in early 2024, and even higher levels of $8.45 billion and $7.24 billion in previous cycles.

A strong bullish signal from Binance whales!

“Today, however, inflows are just around $3 billion and are continuing to decline, suggesting that these whales prefer to keep holding.” – By @Darkfost_Coc

Full analysis

https://t.co/T1FlLnM4nK pic.twitter.com/O3XrqhAyEc

— CryptoQuant.com (@cryptoquant_com) June 11, 2025

In contrast, recent inflows to Binance remain substantially lower. Darkfost reports current inflows hovering around $3 billion, and more importantly, on a declining trajectory. This divergence from historical patterns suggests that whales are refraining from selling at current levels.

Their reduced activity implies an expectation that higher prices may lie ahead, and that they are positioning for potentially greater returns later in the cycle. This restraint from large holders is seen as an important signal, especially given the influence whale movements can have on market liquidity and price action.

BTC) price chart on TradingView" width="3250" height="1796">

Featured image created with DALL-E, Chart from TradingView

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.