Binance founder CZ predicts Bitcoin could hit peak between $500K-$1 million as institutional adoption grows

- Binance co-founder Changpeng Zhao issued a prediction that Bitcoin price could reach up to $1 million during an interview on Tuesday.

- CZ cites institutional adoption of crypto ETFs and US states’ accumulation of BTC as current growth drivers.

- Bitcoin price presses against the $97,000 resistance level at press time, up 3.3% for the day.

Binance founder CZ predicts Bitcoin price could reach $1 million, citing surging ETF demand and US state-level crypto accumulation trends.

CZ says institutional demand could propel BTC to $1 million

During an interview on Rug Radio YouTube channel on Tuesday, Binance co-founder Changpeng Zhao forecasted that Bitcoin price could reach $1,000,000. The bold prediction echoes growing institutional demand. CZ specifically pointed to US-listed Bitcoin ETFs as early signals of Wall Street’s full-scale entry into digital assets.

“Crypto’s in a weird spot right now. We’re seeing crazy bullish sentiment—Bitcoin could hit a million bucks in the next few years, I’m not kidding. I mean, look at the trends: institutional adoption, ETFs, countries like El Salvador holding it as a reserve.

If the US does something like a strategic Bitcoin reserve, which Trump’s been hinting at, that’s a catalyst. Half a million to a million, it’s not crazy when you think about the supply cap and demand,” Zhao said.

According to Zhao, the entrance of asset managers like BlackRock and Fidelity is only the beginning of broader institutional adoption of Bitcoin.

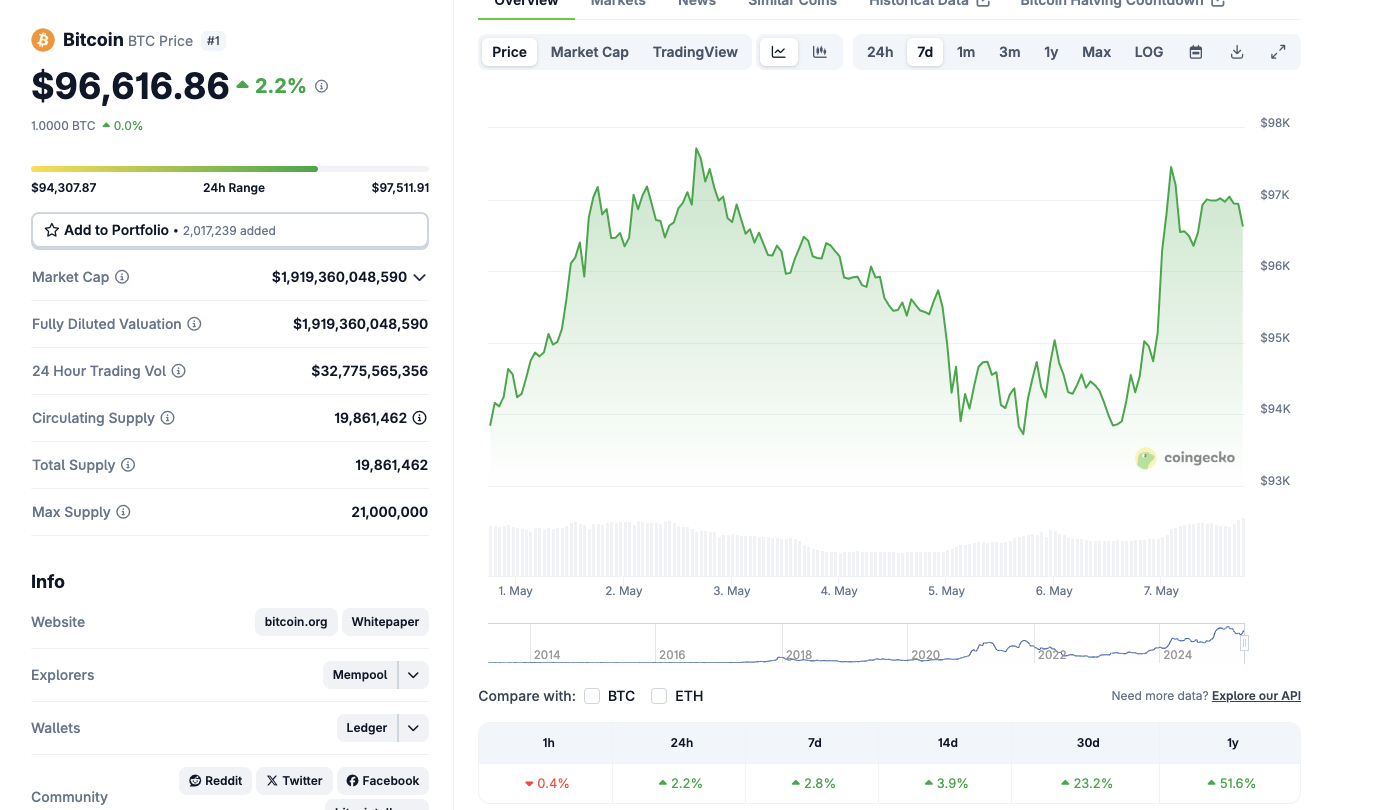

Bitcoin price action, May 7 | Coingecko

At press time, Bitcoin price hovered near $97,000, up 3.3% over the last 24 hours. Zhao called this a “mere prelude” to longer-term valuation, especially as ETF-driven demand accelerated amid growing geopolitical tensions in late Q1 2025.

US states accumulating Bitcoin add public sector legitimacy

Zhao also highlighted a new but powerful trend: US state governments adding Bitcoin to their balance sheets.

He described public sector accumulation as a foundational shift in perception, moving Bitcoin from speculative to strategic.

The quote, while referencing national strategies, aligns with recent developments in Wisconsin and Florida, where state-level funds disclosed BTC and ETF holdings.

Zhao sees such moves as early signals of normalisation across finance departments. He implied that a strategic US Bitcoin reserve, if implemented, could provide a major demand boost for BTC.

While CZ did not comment directly on specific state actions, the ongoing congress review of BTC reserved proposals in states like Florida, Arizona and New Hampshire suggests further affirmation of the optimistic stance on Bitcoin demand.

What next: Can Bitcoin really hit $1 million?

In addition to ETF absorption and sovereign adoption, CZ’s bullish BTC price forecast further highlighted supply scarcity.

“People ask me, ‘CZ, is a million-dollar Bitcoin realistic?’ And I say, yeah, it’s possible. Not tomorrow, not next month, but in a few years? Sure. Think about it: Bitcoin’s fixed supply, 21 million coins, right? Now you’ve got BlackRock, Fidelity, all these big players buying in. If global wealth starts flowing into it, even just 1%, you’re talking massive price spikes. $500,000 is probably a safer bet in the midterm, but a million’s not out of the question,” CZ explained.

On-chain data supports this scenario. On Tuesday, Coinglass reported over $734 million in BTC short liquidations at $95,600. Longs now dominate derivatives markets, with $2.14 billion in bullish positions. Beyond that, Santiment data also shows that Bitcoin Age Consumed is trending down 90% in the last 48 hours.

Bitcoin Age Consumed vs BTC Price, May 7, 2025 | Source Santiment

By multiplying the total number of BTC traded by days spent unmoved, the Age Consumed metric tracks activity of long-term holders around key market events.

The chart above shows BTC Age consumed has declined from 49.2 million as on Monday to hit 4.3 million on Wednesday, reflecting that 90% fewer long-held BTC are currently being traded.

Following bullish predictions from top industry stakeholders like CZ, and China hinting at opening trade deals with the US, investor confidence has improved in the last 48 hours.

Looking ahead, geopolitical instability across Europe, the Middle East and South Asia has triggered significant fiat skepticism in recent months. Zhao believes Bitcoin’s role as a non-sovereign store of value will intensify, arguing that markets still underprice this momentum.

At press time, Bitcoin trades at $97,012, holding strong support. A break above $98,200 could ignite a run to $100,000 before Q3.