WTI Oil consolidates above $61.30 on easing global trade fears and geopolitical tensions

- WTI Crude is trading around $61.50, supported by the de-escalation of the EU-US trade rift.

- Concerns that OPEC+ will increase Oil production from July are capping gains.

- Technical indicators show a lack of clear momentum.

Oil prices are standing comfortably above $61.30, supported by US President Trump’s decision to put tariffs on Eurozone imports on hold until July 9th and escalating tensions in Gaza, but oversupply worries are limiting gains.

Trump backed off on Friday’s threat to impose 50% levies on EU imports from next week, after a phone call with EU Commission President Ursula von der Leyen. The market has welcomed the news, as a trade rift between the US and the EU would significantly slash global growth and curb oil demand expectations.

On the geopolitical front, Israel keeps pounding an already devastated Gaza Strip. A recent report talks about an attack on a school killing 36, many of them Children. This news raises tensions in the area, which, coupled with the lack of advances on the US negotiations with Iran, are keeping Oil prices from falling further.

Higher supply expectations keep upside attempts limited

From a wider perspective, however, WTI prices keep moving within the last three weeks’ range, 25% below January’s highs. The OPEC+ is meeting next week, and the market is fearing a decision to increase output by 411 million barrels per day, which, in times of global trade uncertainty, might lead to an Oil glut.

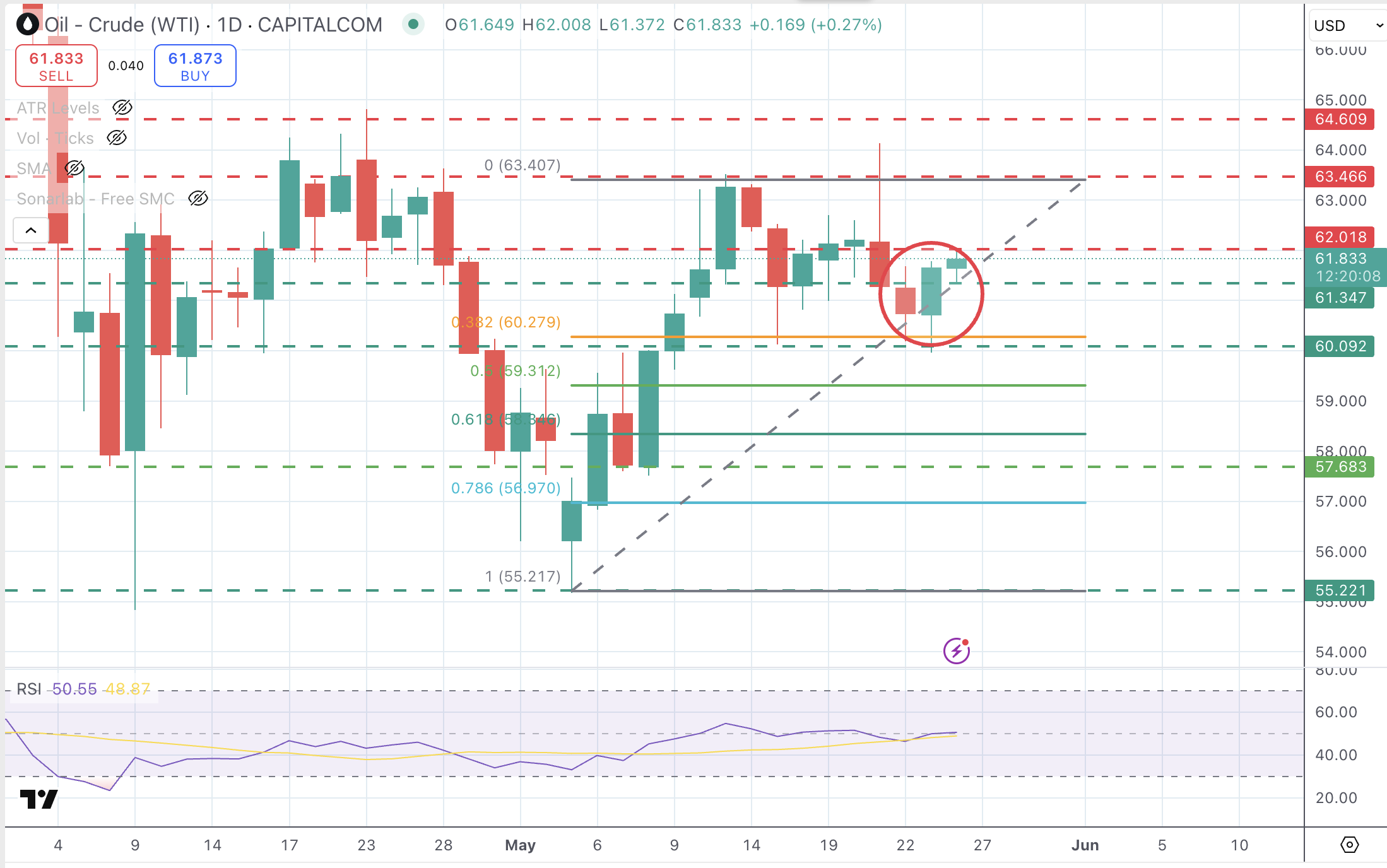

From a technical perspective, the daily chart shows a bullish engulfing candle on Friday, which is a positive sign, but the RSI remains flat around the 50 level, highlighting a lack of clear momentum. Intra-day charts are mildly positive but lacking strength.

Resistances are $62.00 and $63.45. Below $61.30, the next support is the $60.00 psychological level.

WTI Oil Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.