Forex Today: Focus shifts to Fed and BoC policy decisions

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Wednesday, October 29:

The trading action in financial markets quiet down and the US Dollar (USD) stabilizes midweek, as investors gear up for key central bank announcements. Later in the day, the Bank of Canada (BoC) and the Federal Reserve (Fed) will release monetary policy decisions.

US Dollar Price Today

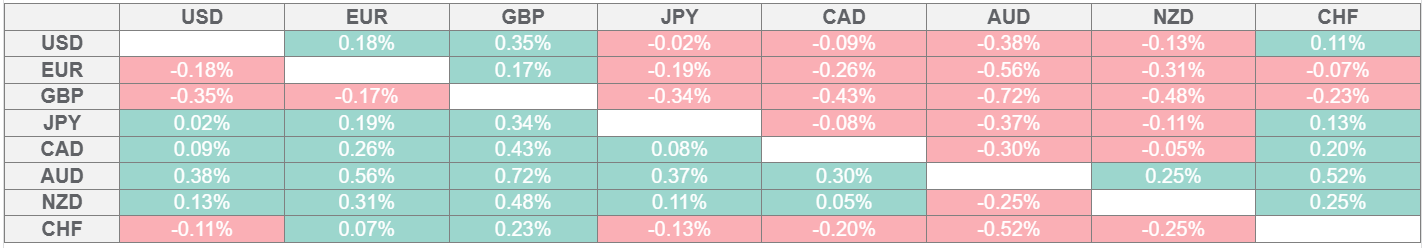

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index registered marginal losses on Tuesday as the bullish action seen in Wall Street's main indexes highlighted a risk-positive market atmosphere. Early Wednesday, US stock index futures trade mixed, while the USD Index clings to modest gains, slightly below 99.00. The Fed is widely anticipated to lower the policy rate by 25 basis points (bps) after the October meeting. Comments from Fed Chair Jerome Powell in the post-meeting press conference will be scrutinized by market participants.

Meanwhile, US President Donald Trump repeated that he thinks that they will have a "great deal" with China and noted that the trade agreement with South Korea will be finalized very soon. Trump further noted that he expects to reduce US tariffs on Chinese goods in exchange for Beijing’s commitment to curb exports of fentanyl precursor chemicals.

USD/CAD stays on the back foot and trades below 1.3950 after losing more than 0.3% on Tuesday. The BoC is forecast to cut the interest rate by 25 bps to 2.25%.

Following Monday's sharp decline, Gold extended its slide on Tuesday and touched its lowest level since early October below $3,900. XAU/USD manages to stage a rebound in the European session on Wednesday and rises toward $4,000. News of Israel and Hamas exchanging fire and accusing each other of violating the ceasefire agreement seem to be causing geopolitical tensions to escalate and helping Gold find support.

USD/JPY trades in a narrow channel, slightly above 152.00, after losing about 0.5% on Tuesday. Japanese Chief Cabinet Secretary Minoru Kihara said in a statement on Wednesday that he expects the Bank of Japan (BoJ) to conduct the monetary policy to appropriately achieve the inflation target.

The data from Australia showed early Wednesday that the Consumer Price Index rose 3.2% on a yearly basis in the third quarter, at a faster pace than the 2.1% recorded in the previous quarter. This print came in above the market expectation of 3%. AUD/USD gathered bullish momentum after hot inflation data and was last seen trading at its highest level in three weeks, above 0.6600.

After closing five consecutive trading days with small gains, EUR/USD turns south in the European session on Wednesday and trades below 1.1650.

GBP/USD remains under bearish pressure after losing nearly 0.5% on Tuesday and trades at its weakest level since early August below 1.3250.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.