1 Magnificent High-Yield Dividend Stock Down 16% to Buy and Hold Forever

Key Points

Chevron's stock is slumping on economic worries and lower oil prices.

The recently closed Hess acquisition will help boost oil and gas production.

Reinvesting dividends makes a tremendous difference for Chevron's shareholders.

- 10 stocks we like better than Chevron ›

Despite the broader stock market trading near all-time highs, there are numerous instances outside the technology sector where things aren't quite as peachy.

Oil and gas giant Chevron (NYSE: CVX) hasn't reached a new high in nearly three years and currently sits about 16% off its peak. Months of uncertainty over a blockbuster acquisition, as well as worries over the economy, have weighed on Chevron's stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But with an impressive dividend yield of 4.3%, now could be an excellent time to buy this magnificent high-yielding stock and hold it for the foreseeable future. Here's why.

Image source: Getty Images

Resilience is the name of the game

The oil and gas business can be volatile. Market prices for natural gas and crude oil directly impact profits and how companies within these industries operate. If you want to own an oil and gas stock for the long haul, the company must be resilient.

Chevron certainly fits that bill. The company is diversified, with operations across both upstream and downstream oil and gas segments. That means Chevron explores for and extracts oil and gas, refines it, and sells those products through retail channels.

So, when one segment of Chevron's business is struggling, another often helps to pick up the slack. It's not perfect; Chevron's business suffers when oil and gas prices are too low for too long. However, Chevron has managed to navigate the industry's price cycles for decades, evidenced by its 37 consecutive annual dividend increases.

While oil prices have slumped over the past year due to recession fears, investors can be reasonably confident that Chevron will endure. The company's balance sheet has $8 billion in cash on hand, a strong credit rating (AA-), and debt levels on par with its decade averages.

Chevron will likely always face ups and downs in its line of work. The important thing is that Chevron remains well-equipped for tough times. There aren't any obvious signs that things have changed in that regard.

A bright future ahead

In late 2023, Chevron agreed to acquire Hess in an all-stock transaction worth $53 billion at the time. After a failed attempt by archrival ExxonMobil to block the acquisition, the merger formally closed a few months ago.

With Hess in the fold, Chevron gains exposure to the Stabroek Block off the coast of Guyana, a massive oil discovery that will help boost Chevron's upstream production moving forward.

Chevron's management team recently held an investor event to discuss the company's prospects. Among the key takeaways were that Chevron anticipates:

- Growing its free cash flow and earnings per share by more than 10% annually through 2030, assuming $70 per barrel of Brent Crude Oil.

- Generating enough cash to fund capital expenditures and dividends through 2030, even if Brent Crude Oil falls to $50 per barrel.

- Increasing oil and gas production by 2% to 3% annually through 2030.

That puts the company in a strong position to grow the dividend over the next five years and produce some solid total investment returns along the way.

How to get the most out of this high-yield stock

Investors can only look so far ahead in the oil and gas business, because a company such as Chevron must continuously manage its assets and position itself for new oil and gas production as its projects run dry over time. Fortunately, the immediate future looks good, and the company's long history of excellence bodes well for the years beyond that.

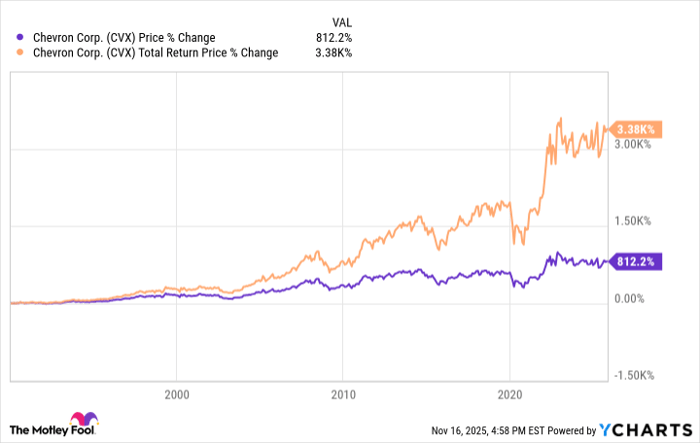

Consider reinvesting dividends to maximize the stock's returns. That adds another compounding effect, which makes a big difference in the stock's performance over time.

Here's how vital dividends have been for Chevron shareholders over the years.

CVX data by YCharts

Chevron has outlined a clear path to growing its oil and gas production over the coming years while simultaneously lowering its break-even price per barrel of oil. The resulting cash flow growth, assuming reasonably stable oil and gas prices, should produce ample dividend growth for shareholders over the next five years and possibly beyond.

That makes the stock's current slump a buying opportunity worth considering.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,786!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,832!*

Now, it’s worth noting Stock Advisor’s total average return is 1,021% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.