Down 12%, Should You Buy the Dip on Arista Networks Stock?

Key Points

Supply chain challenges are keeping Arista Networks from growing at a faster pace.

The company is witnessing healthy order inflow for its components and software solutions that speed up data transmission in data centers.

The muted growth that Arista is clocking, along with its expensive valuation, could keep weighing on the stock.

- 10 stocks we like better than Arista Networks ›

Arista Networks (NYSE: ANET) is playing an important role in the global artificial intelligence (AI) infrastructure rollout by providing high-speed networking equipment, such as switches and routers, along with related software. The demand for the company's offerings has been picking up as they help transfer huge amounts of data at high speeds with low latency in data centers.

Unsurprisingly, Arista stock has registered an impressive rally of 55% over the past six months. However, its run came to a grinding halt following the release of its third-quarter 2025 results on Nov. 4. Shares of Arista fell more than 8% following its report. As of the time of this writing, Arista's stock is down 12% since its results. Let's look at why that's the case and see whether the latest dip in Arista stock is an opportunity for investors to buy more shares.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Arista Networks beat expectations, but investors probably expected better

Arista's Q3 revenue increased 27.5% from the year-ago period to $2.31 billion, while non-GAAP (generally accepted accounting principles) earnings increased by 25% to $0.75 per share. The numbers were slightly ahead of analysts' expectations. The midpoint of Arista's guidance came in at $2.35 billion, and even that was slightly higher than the $2.33 billion consensus estimate.

However, it looks like the market was expecting more from a stock that's trading at an expensive 20 times sales and 51 times earnings. Arista's guidance points toward a 22% increase in revenue from the year-ago period. Its earnings growth is also expected to slow down to a pace of 17% on a year-over-year basis.

There are other companies involved in the AI infrastructure space that are clocking faster growth but can be bought at cheaper valuations. So, it is easy to see why investors pressed the panic button following the company's latest report. Arista needed to deliver stronger guidance to justify its rich valuation.

Here's what's going wrong for the company

Arista estimates that its AI offerings will produce $1.5 billion in revenue in 2025. That would account for almost 17% of its projected top line of $8.85 billion for the year. The company expects its AI revenue to jump to $2.75 billion in 2026, with overall revenue expected to increase by 20% to $10.65 billion. However, Arista's revenue growth estimate for next year is a step down from the 26% increase it is set to deliver in 2025.

But Arista management points out that the demand for the company's offerings remains solid. The company isn't reading much into the quarterly variances in growth, pointing out that its top line depends on how much product it can ship. So, it looks like the variability in Arista's supply chain is proving to be a headwind for the company right now.

CEO Jayshree Ullal remarked on the earnings call that the "lead times on many of our components, including standard memory and chips and merchant silicon and everything, are nothing like 2022, but they have very long lead times." She added that the lead times range from 38 weeks to almost a year.

The long lead times are also evident from the company's deferred revenue balance. Arista's deferred revenue jumped to $4.7 billion in the previous quarter, up from $2.5 billion in the year-ago period. This metric refers to the money received by a company in advance for products or services that will be delivered at a later date.

It is recorded as a liability on the balance sheet and is recognized as revenue once the product or service is actually delivered. So, Arista has received orders for its solutions, but its inability to fulfill those orders on account of component shortages is weighing on its growth. Arista points out that its purchase commitments doubled year over year in the third quarter to $4.8 billion.

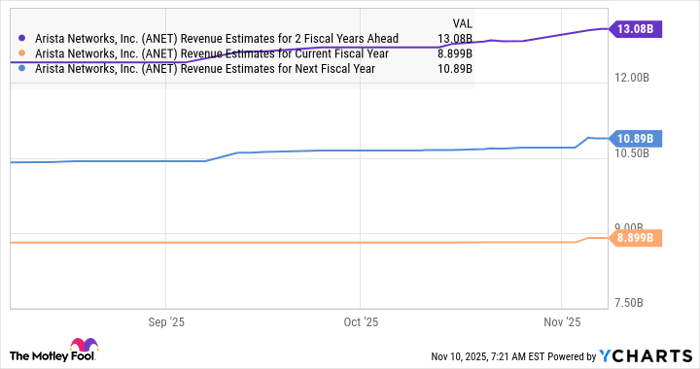

In all, it can be concluded that Arista is indeed witnessing terrific demand. But component shortages are keeping the company from converting that demand into financial growth. Not even analysts are expecting a significant acceleration in Arista's growth over the next couple of years.

ANET Revenue Estimates for 2 Fiscal Years Ahead data by YCharts.

So, it won't be surprising to see this AI stock remain under pressure in the near term, owing to its rich valuation and the supply-related constraints that are weighing on its growth. That's why investors would do well to wait for a further pullback in Arista's shares before they consider buying it. That's because the company could eventually step on the gas once its component issues are sorted out and it starts fulfilling its orders at a faster pace, which should enable it to capture a bigger chunk of the $105 billion addressable market it is sitting on.

Should you invest $1,000 in Arista Networks right now?

Before you buy stock in Arista Networks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arista Networks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Arista Networks. The Motley Fool has a disclosure policy.