Gold vs Silver ETFs: GDX Offers Broader Mining Exposure Than SIL

The Global X Silver Miners ETF (NYSEMKT:SIL) and the VanEck Gold Miners ETF (NYSEMKT:GDX) both target the mining sector, but with distinct emphases: SIL tracks global silver mining companies, while GDX invests in firms primarily engaged in gold mining. This comparison highlights key differences in cost, returns, risk, and portfolio composition to help clarify which may appeal depending on your objectives.

Snapshot (cost & size)

| Metric | SIL | GDX |

|---|---|---|

| Issuer | Global X | VanEck |

| Expense ratio | 0.65% | 0.51% |

| 1-yr return (as of Oct. 27, 2025) | 61.0% | 69.0% |

| Dividend yield | 1.3% | 0.6% |

| AUM | $3.5 billion | $21.2 billion |

Beta measures price volatility, with figures based on available data.

GDX is more affordable with a lower expense ratio, while SIL stands out for its higher payout. For cost-focused investors, the difference is modest, but yield-oriented buyers may notice the gap.

Performance & risk comparison

| Metric | SIL | GDX |

|---|---|---|

| Max drawdown (5 y) | -55.93% | -46.52% |

| Growth of $1,000 over 5 years | $1,576 | $1,914 |

What's inside

At 19.5 years old, VanEck Gold Miners ETF is fully invested in the basic materials sector, with 52 holdings as of October 2025. Its largest positions include Agnico Eagle Mines Ltd (NYSE:AEM), Newmont Corp (NYSE:NEM), and Barrick Mining Corp (NYSE:B). The fund provides broad access to global gold mining companies.

Global X Silver Miners ETF, by contrast, concentrates on the silver mining niche. Its portfolio is 100% basic materials, with 38 holdings. Top positions include Wheaton Precious (NYSE:WPM), Pan American Silver Corp (NYSE:PAAS), and Coeur Mining Inc (NYSE:CDE). SIL’s focus makes it more specialized within the silver industry.

For more guidance on ETF investing, check out the full guide at this link.

Foolish take

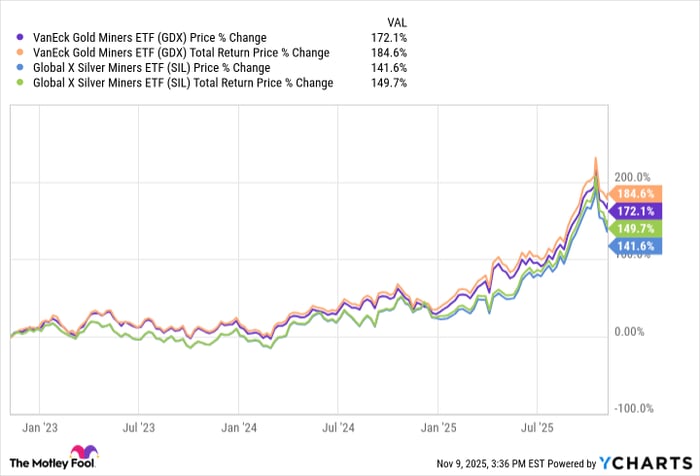

Prices of both gold and silver have surged in 2025, rising more than 50% each due to geopolitical tensions, economic uncertainly, and central bank buying. Gold and silver are considered as safe-haven assets and a hedge against inflation and uncertainty. For silver, a tight global supply has also been a key price driver since silver is used extensively in industries like electronics, solar panels, and electric vehicles. 60% of global demand for silver comes from the industrials sector.

Investors seeking exposure to gold and silver have plenty of investment options, including buying bullion, gold and silver stocks, futures, or gold and silver ETFs like the VanEck Gold Miners ETF and the Global X Silver Miners ETF. These ETFs invest in a basket of gold and silver mining stocks worldwide, respectively. Since the fortunes of mining companies are tied closely to metal prices, these ETFs provide exposure to metal prices without the risk of buying and holding physical bullion.

GDX data by YCharts

Investors may choose between the two ETFs depending on whether they want to bet on silver or gold. The Global X Silver Miners ETF, however, is a pure-play silver mining ETF. The VanEck Gold Miners ETF owns shares in large and mid-tier gold miners as well as some silver producers, including Wheaton Precious and Pan American Silver.

So, the VanEck Gold Miners ETF is slightly more diversified and also cheaper, with a lower expense ratio, than the Global X Silver Miners ETF. GDX has also historically outperformed SIL, although rising demand for silver could help SIL close the gap in the coming years.

Glossary

ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges, holding a basket of assets like stocks or bonds.

Expense ratio: The annual fee, as a percentage of assets, that a fund charges its investors.

Dividend yield: The annual dividends paid by an investment, shown as a percentage of its current price.

Beta: A measure of an investment's volatility compared to the overall market; higher beta means greater price swings.

AUM (Assets Under Management): The total market value of assets managed by a fund or investment company.

Max drawdown: The largest percentage drop from a fund’s peak value to its lowest point over a specific period.

Holdings: The individual securities or assets owned within a fund or portfolio.

Basic materials sector: Industry segment focused on companies producing raw materials, such as metals, mining, and chemicals.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,036%* — a market-crushing outperformance compared to 191% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of November 3, 2025

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.