Retirees: These 2 Reliable Dividend Stocks Could Pay You Every Month

Key Points

You can attempt to buy dividend stocks in such a way that you collect dividends every month, or just buy some stocks that pay dividends monthly.

Realty Income is a high-yield REIT with a long history of reliably paying monthly dividends.

Agree Realty is a faster-growing REIT with a strong dividend history and an attractive yield.

- 10 stocks we like better than Realty Income ›

What's the best way to generate monthly income if you are retired? There are two big-picture methods when it comes to stocks. Either buy enough quarterly dividend-payers that you get dividends each month, or just buy investments that pay monthly.

If you choose the latter route, you'll want to take a close look at Realty Income (NYSE: O) and Agree Realty (NYSE: ADC).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here's why.

Image source: Getty Images.

3-to-1 is a tough ratio to ignore

In order to generate a monthly income stream with quarterly dividend payers, you need to buy three different stocks. It isn't rocket science, but it is a complicated logistical feat to ensure that you generate a roughly steady income stream every month through the year. It requires three companies with roughly similar yields that pay in different months.

Oh, and you should probably make sure they are good investments, while you are at it. And then you have to keep track of three different companies, which is much more work than following just one stock.

If you don't want to get that deep into the weeds, you can just focus on monthly paying dividend stocks. There aren't all that many of them, however, so you need to make sure you actually like the stocks you are buying.

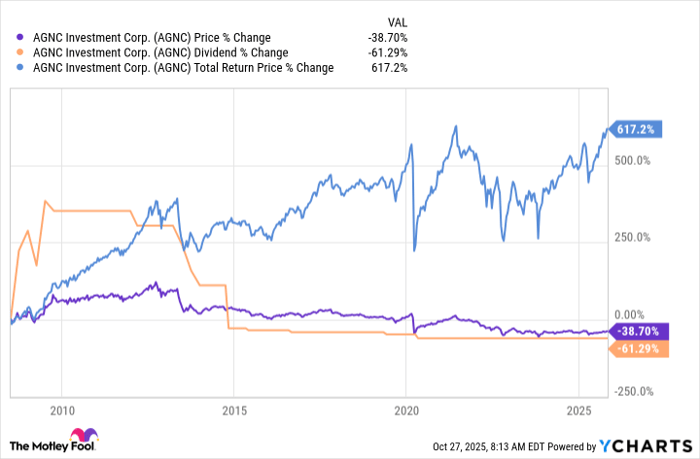

For example, AGNC Investment (NASDAQ: AGNC) pays monthly, but it has an erratic dividend history. In fact, over the past decade or so the dividend has fallen steadily and so has the stock price. Sure, it has a 14% dividend yield, but if you had spent that dividend to pay your bills you would now have less income and less capital.

AGNC data by YCharts

In fairness to AGNC Investment, it is a mortgage real estate investment trust (REIT), which is a pretty specialized niche of the REIT sector. It actually does a pretty good job of achieving its stated goal, which is total return (which requires dividend reinvestment). But the dividend history highlights the importance of knowing what you own when you buy any dividend stocks, let alone a monthly pay dividend stock.

Realty Income and Agree Realty

By contrast, Realty Income and Agree Realty are both traditional property-owning REITs. They just buy physical properties and lease them out to tenants, which is what you would do if you owned a rental property. Both companies use the net-lease approach, which means that their tenants pay for most property-level operating costs.

It is a fairly low-risk way to invest in real estate, assuming the property portfolio is large enough. Realty Income is the industry giant with more than 15,600 properties. Agree Realty is a smaller, but faster-growing REIT, with a still sizable portfolio of around 2,600 assets.

They each have monthly dividends, with Realty Income offering a yield of 5.4% and Agree sporting a 4.2% yield. For reference, the S&P 500 index has a yield of just 1.2% or so. They have vastly different dividend streaks going, with Realty Income having increased its dividend annually for three decades. Agree's streak is around 10 years or so with a shift to monthly payments in 2021, but it is a much younger company. Both, however, have fairly strong businesses and ample scale to support their dividends at this point.

The big question that investors have to ask when comparing these two net-lease REITs is on the growth side of the equation. Realty Income's yield is higher, providing more income now, but its dividend has only increased about 30% over the past decade. Agree Realty's dividend is a bit lower, but its dividend has grown by 60% over the past decade. Given the fact that Agree's portfolio is much smaller than that of Realty Income, it is going to be easier for Agree to keep growing at a faster pace.

Foundational investments

There are other monthly pay dividend stocks out there, and you can even find monthly pay closed-end funds and exchange-traded funds (ETFs). So you have other options, but Realty Income and Agree Realty have proven to be two very reliable income stocks that provide a mix of yield and dividend growth. They could be foundational investments on top of which you add more aggressive income choices. In fact, it might even make sense to buy them both.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.