Forex Today: US Dollar clings to weekly gains as central bank dust settles

- Gold Price Forecast: XAU/USD slumps to near $4,000 on US-China trade progress

- Gold holds gains near $3,950 ahead of Trump-Xi meeting

- Gold declines as traders brace for trade talks, US CPI inflation data

- US CPI headline inflation set to rise 3.1% YoY in September

- Australian Dollar maintains position due to US-China trade optimism

- Bitcoin, cryptos fail to rally as Fed Chair sparks cautious sentiment

Here is what you need to know on Friday, October 31:

The US Dollar (USD) stays resilient against its rivals early Friday, following a two-day rally that saw the USD Index climb to its highest level since early August. The European economic calendar will feature the preliminary October inflation data and several Federal Reserve (Fed) policymakers will be delivering speeches in the second half of the day.

US Dollar Price This week

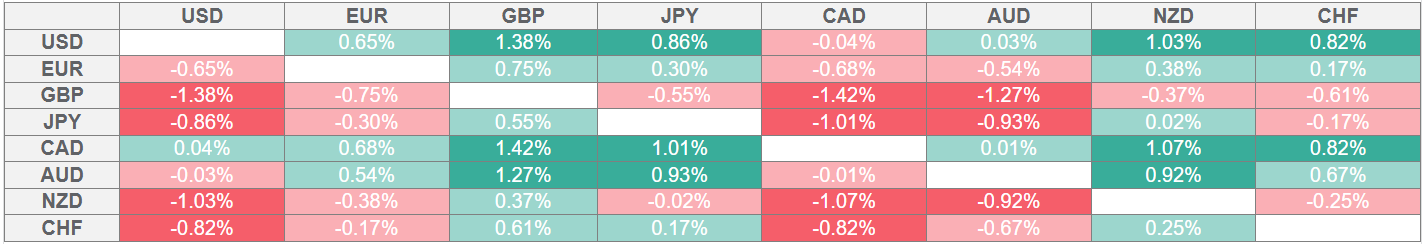

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The European Central Bank (ECB) announced on Thursday that it left key rates unchanged following the October policy meeting, as expected. In the policy statement, the ECB reiterated that they not "pre-committing" to a particular rate path. While responding to questions from the press, ECB President Chritsine Lagarde noted that they are in a period of great uncertainty and added that a stronger Euro (EUR) could bring down inflation further than expected. After losing more than 0.4% on Wednesday, EUR/USD extended its slide on Thursday and lost about 0.3% for the day. Early Friday, the pair fluctuates in a tight channel above 1.1550. On a yearly basis, the Harmonized Index of Consumer Prices (HICP) in the Eurozone is forecast to 2.1% in October.

The data from Japan showed early Friday that annual inflation in Tokyo, as measured by the change in the Consumer Price Index (CPI), rose to 2.8% in October from 2.5% in September. After gaining about 1% and climbing to its highest level since early February near 154.50 on Thursday, USD/JPY seems to have entered a consolidation phase. At the time of press, the pair was virtually unchanged on the day at 154.20. In response to excessive Japanese Yen weakness, Japan’s Finance Minister Satsuki Katayama intervened verbally on Friday, noting that it was “important for currencies to move in a stable manner, reflecting fundamentals.” Once again, he repeated that the government was “closely watching FX moves with a high sense of urgency.”

With the CME Group FedWatch Tool's probability for a 25 basis points (bps) Fed rate cut in December dropping below 70% from around 90% ahead of the Fed meeting earlier in the week, the USD continued to outperform its rivals. Early Friday, the USD Index holds steady above 99.50, while US stock index futures trade in positive territory.

Pressured by the broad-based USD strength, GBP/USD closed the third consecutive day in negative territory on Wednesday. The pair stays relatively quiet in the European morning on Friday and trades below 1.3150, losing about 1.3% on a weekly basis.

Gold rose more than 2% on Thursday and snapped a four-day losing streak. XAU/USD moves sideways above $4,000 early Friday but remains on track to end the second consecutive week in negative territory.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.