Prediction: DigitalOcean Stock Is Going to Soar After Nov. 5

Key Points

DigitalOcean is a leading provider of cloud services to small and mid-sized businesses (SMBs).

The company is using its successful blueprint in the cloud industry to offer artificial intelligence services to its customers.

DigitalOcean will release its third-quarter operating results on Nov. 5, and its stock looks like a bargain heading into the report.

- 10 stocks we like better than DigitalOcean ›

Earnings season for the quarter ended Sept. 30 is now in full swing. Wall Street remains focused on the technology sector because it's at the epicenter of powerful trends like artificial intelligence (AI) that are creating significant amounts of value right now.

DigitalOcean (NYSE: DOCN) is an under-the-radar company valued at just $3.6 billion. It provides cloud computing services exclusively to small and mid-sized businesses (SMBs), and it now offers an expanding portfolio of tools designed to help those enterprises affordably deploy AI.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

DigitalOcean stock has soared by 46% since reporting its second-quarter operating results back in August. The company is scheduled to release its third-quarter results on Nov. 5, and here's why I predict the stock will build on those gains after the report.

Image source: Getty Images.

Making AI affordable for even the smallest businesses

The cloud computing industry is dominated by trillion-dollar giants like Amazon and Microsoft, but they typically fight over the highest-spending customers. Startups and SMBs don't really move the needle for those cloud providers from a revenue standpoint, but they are highly valuable customers for a smaller player like DigitalOcean.

The company offers affordable and transparent pricing, highly personalized service, and a simple dashboard that makes it easy to deploy cloud services. These attributes are ideal for SMBs because most of them have limited financial and technical resources. Now, DigitalOcean is using its expertise to enter the artificial intelligence space with a growing portfolio of affordable services.

The company operates data centers fitted with graphics processing units (GPUs) from top chip makers like Nvidia and Advanced Micro Devices. Larger cloud platforms allow businesses to tap into thousands of GPUs at a time, but DigitalOcean offers fractional capacity, which means its customers can start with just one and add more as required.

This is ideal for small AI workloads, like operating a product recommendation engine or a customer service chatbot for an e-commerce website.

Earlier this year, DigitalOcean also launched a cloud-based workspace called Gradient. SMBs can use it to access ready-made large language models (LLMs) from leading third parties like OpenAI and Anthropic, which they can use to accelerate AI software development. The platform can also be used to train AI agents, and usage almost doubled in that area between the first and second quarter this year, so investors should look out for an update on Nov. 5.

AI revenue will be front and center on Nov. 5

DigitalOcean generated $218.7 million in revenue during the second quarter, which was a 14% increase from the year-ago period. Beneath the surface, the company said its AI revenue rocketed by more than 100%, although it didn't reveal an actual dollar figure.

Management's guidance suggests DigitalOcean generated around $226.5 million in revenue during the third quarter, which would represent another increase of 14%. Wall Street will be paying close attention to any update on the contribution from the company's AI business on Nov. 5, because at a triple-digit growth rate, it won't be long before it becomes an influential piece of the overall revenue base.

Another thing investors should watch is DigitalOcean's full-year forecast for 2025. After the second quarter, management raised the midpoint of its revenue guidance from $880 million to $890 million, and a further increase on Nov. 5 would be very bullish for DigitalOcean stock.

DigitalOcean stock looks like a bargain ahead of Nov. 5

As I mentioned earlier, DigitalOcean stock is up 46% since it reported its strong second-quarter results in August. But it's still trading at an attractive valuation, so I think it can build on those gains after Nov. 5.

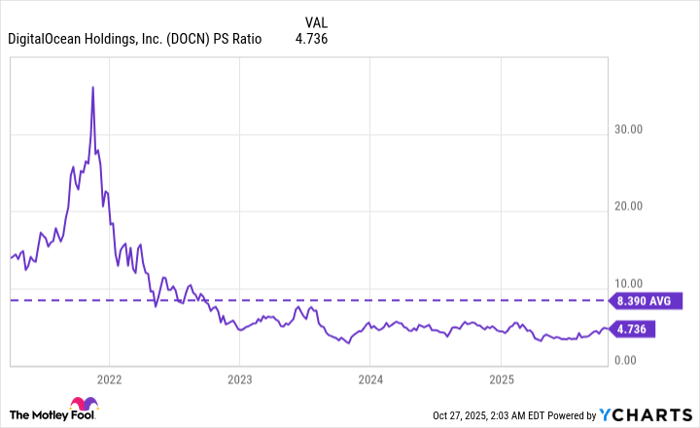

The stock is hovering at a price-to-sales (P/S) ratio of 4.7 as I write this, which is a 43% discount to its average of 8.3 dating back to when the company went public in 2021:

DOCN PS Ratio data by YCharts

Based on DigitalOcean's trailing-12-month earnings of $1.29 per share, its stock also trades at a price-to-earnings (P/E) ratio of 30.5. That is a discount to the 33.2 P/E ratio of the Nasdaq-100 technology index, which hosts top cloud providers like Amazon, Microsoft, and Alphabet.

But it gets better, because DigitalOcean delivered earnings of $0.77 per share during the first half of 2025 alone, more than doubling its year-ago result of $0.35 per share. If the company grew at a similar pace in the third quarter, its P/E ratio will look even better after Nov. 5.

In summary, DigitalOcean stock looks very attractive right now, no matter which way you slice it, so it could deliver significant upside after Nov. 5 as long as its third-quarter results meet or exceed expectations.

Should you invest $1,000 in DigitalOcean right now?

Before you buy stock in DigitalOcean, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DigitalOcean wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, DigitalOcean, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.