Prediction: This Will Be Nvidia's Stock Price 3 Years From Now

Key Points

Nvidia's GPUs are the defining pillar supporting AI development.

Hyperscalers are expected to spend trillions on AI infrastructure over the next several years.

Nvidia is poised for sustained revenue and profit growth as the company continues capturing infrastructure spend.

- 10 stocks we like better than Nvidia ›

Since I began my investing journey about 10 years ago, I've witnessed my share of emerging themes built on hype, euphoria, and hope. From blockchain technology to the metaverse, I don't think I've seen anything quite like the excitement around the artificial intelligence (AI) megatrend.

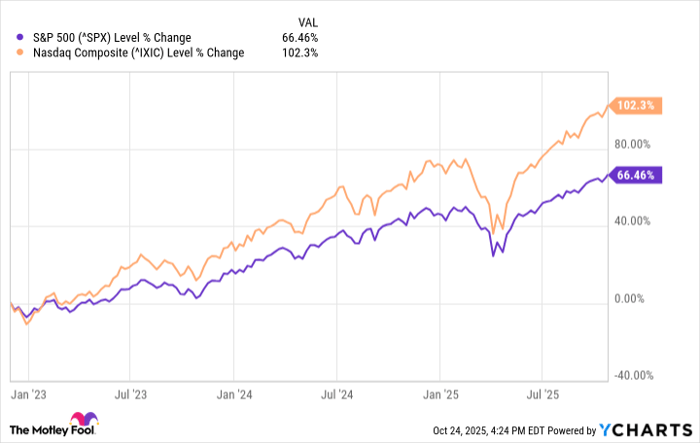

Since OpenAI commercially launched ChatGPT on Nov. 30, 2022, the S&P 500 (SNPINDEX: ^GSPC) has returned 66% while the tech-heavy Nasdaq Composite (NASDAQINDEX: ^IXIC) has soared by more than 100%. In case you're new to investing, these are abnormally high returns for such a short time period.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

^SPX data by YCharts

That said, the AI revolution has been anything but ordinary. One company in particular -- semiconductor powerhouse Nvidia (NASDAQ: NVDA) -- has emerged as the most potent company in the tech sector over the last few years. And I don't think its momentum is slowing anytime soon.

Image source: Getty Images.

Let's explore how Nvidia became the most powerful force in the AI arena and assess what catalysts are on the horizon.

How and why Nvidia became king of the AI realm

Back in the late 1990s, Nvidia developed a piece of hardware known as the graphics processing unit (GPU). At the time, these chips were primarily used for one application: enhancing visuals for video games.

However, the company's visionary CEO, Jensen Huang, understood that the GPU was far more ubiquitous. While use cases remained limited for years, the rise of AI paved the way for Nvidia to make a splash given these applications' need for higher processing power.

Today, Nvidia is the gold standard for training and inferencing myriad generative AI products -- from humanoid robotics, autonomous vehicles, and large language models (LLMs).

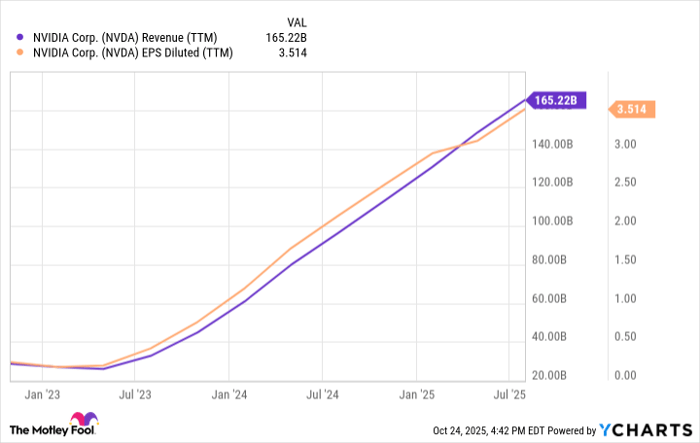

NVDA Revenue (TTM) data by YCharts

Unprecedented demand for Nvidia's GPUs has ushered in a wave of historical revenue acceleration that's been augmented with record profit growth -- a testament to the company's enormous pricing power in the chip market.

Perhaps unsurprisingly, Nvidia has seen its market value rise by a factor of nearly 13 times during the AI revolution -- propelling the company past Apple and Microsoft as the most valuable business in the world.

Tailwinds worth trillions

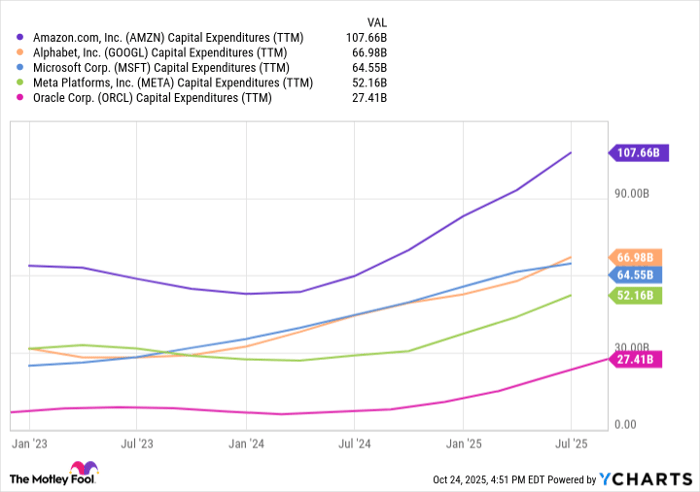

At its core, a large portion of Nvidia's future growth can be summed up by one accounting term: capital expenditures (capex). Capex is just Wall Street jargon for spending related to infrastructure and property buildouts, such as data centers.

AMZN Capital Expenditures (TTM) data by YCharts

Over the last three years, hyperscalers have collectively spent several hundred billion dollars on capex -- much of which has been allocated to procuring Nvidia's GPUs. While investors may be wary that demand is peaking, think again.

According to Huang, AI infrastructure buildouts are in their early innings. He expects capex to accelerate to $4 trillion by 2030. Management consulting firm McKinsey & Company is even more optimistic -- calling for nearly $7 trillion to be spent on data centers, networking equipment, and renewable energy services to keep up with chip and power demand through the rest of the decade.

Piggybacking off of this opportunity is an emerging service called the neocloud. Companies such as Nebius Group, CoreWeave, and Iren are pioneers of the neocloud movement -- a business model in which businesses equip data centers with GPUs and then rent that hardware to other companies.

The value proposition of infrastructure services is that it helps mitigate supply chain bottlenecks while offering companies with limited financial resources access to industry-leading AI development protocols. This is important for Nvidia, as neocloud providers help ensure demand for the company's chips remains steady.

Lastly, Nvidia has been using some of its excess cash flow to strike a number of strategic partnerships. Perhaps most notable was a deal announced last month with Intel. As part of their alliance, Intel will be designing custom CPUs for Nvidia's infrastructure -- potentially giving the chip behemoth even more of a leg up in its chief rival, Advanced Micro Devices.

Image source: Getty Images.

What will Nvidia's stock price be in three years?

The secular tailwinds explored above -- namely, accelerating capex from hyperscalers -- has one analyst on Wall Street, Beth Kindig of the I/O Fund, forecasting a market capitalization of $6 trillion for Nvidia by the end of 2026 -- a target that I, too, think is well within reach.

Furthermore, I recently broke down in a separate article what growth rates would be required in order for Nvidia to reach a $10 trillion valuation by 2030.

By 2028, I think Nvidia could be trading around the midpoint of the ranges above -- close to $8 trillion. But what does that mean in terms of share price? Let's break down the math.

Nvidia currently boasts a market value of roughly $4.5 trillion and has 24.3 billion outstanding shares. This translates to a share price of about $185. For the sake of this analysis, I'll hold the company's share count steady. This means an $8 trillion valuation would yield an implied future share price of about $329 -- representing 78% upside from current levels.

For investors, the key here is not to get too hung up on the precision of future price targets. After all, the analysis above is more of a theoretical exercise -- having a bit of fun with numbers.

While I do not have a crystal ball, I remain bullish over Nvidia's prospects over the next few years as AI infrastructure spending continues to accelerate and view the stock as a compelling buy-and-hold opportunity.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Intel, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Nebius Group and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.