Ethereum Price Forecast: Ether under pressure at $2,850 support as FG Nexus sells nearly 11,000 ETH

Ethereum price today: $2,860

- Ethereum treasury firm FG Nexus has sold 10,922 ETH to conduct share buybacks.

- The sale follows a similar move from ETHZilla in October amid weakness in the DAT market.

- ETH faces pressure near the $2,850 support level after failing to recover $3,100.

FG Nexus, an Ethereum treasury company, has begun selling its ETH holdings to buy back shares.

The firm bought 3.4 million common shares at an average price of $3.45 per share using proceeds from the sale of 10,922 ETH and a $10 million loan, according to a Q3 update. The purchase price is below its reported net asset value (NAV) per share of $3.94.

"Since commencing the buyback, we have repurchased 8% of our shares outstanding at a substantial discount to our net asset value while maintaining a strong ETH and cash balance," said FG Nexus Chairman and CEO Kyle Cerminara.

FG Nexus had filed with the Securities and Exchange Commission (SEC) in August to raise about $5 billion via a shelf offering to accelerate its ETH buying momentum. At the time, the company planned to acquire a 10% stake in the Ethereum network.

However, it has walked back that plan after its shares plunged nearly 95% from its August high of $38.30 when it announced an ETH treasury. FGNX is down nearly 10% on Thursday.

"We plan to continue buying back shares while our stock trades below NAV, which creates increasingly asymptotic effect on our per-share valuation metrics as the number of shares outstanding declines and net asset value per share increases," added Cerminara.

DATs demand has faded amid weak crypto prices

FG Nexus is the second ETH treasury to report asset sales to fund share buybacks. ETHZilla did the same in October after selling $40 million worth of ETH.

Several digital asset treasuries (DATs) have come under pressure in recent months as cryptocurrencies faced increased risk-off sentiments. Most of these companies have seen their shares crash by over 90%, sending them below their NAV.

In a report last week, K33 noted that the weakness stems from prolonged dilution, saturated DAT scene and soft demand. The firm had earlier predicted that the DAT market would consolidate, with leading treasuries acquiring smaller firms to boost market share.

FG Nexus said it holds 40,005 ETH and $37 million in cash and USDC as of Wednesday. BitMine is the largest Ethereum treasury with a stash of 3.56 million ETH.

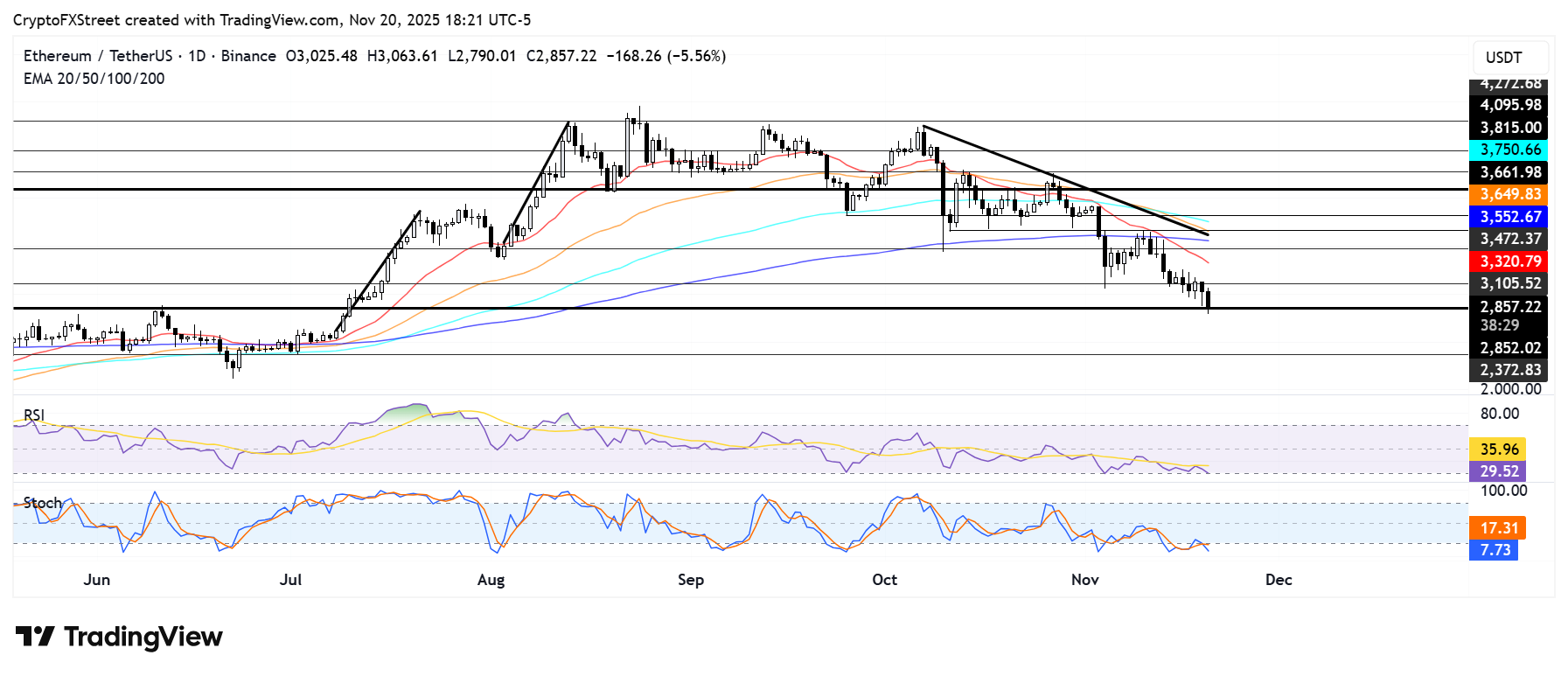

Ethereum Price Forecast: ETH comes under pressure at $2,850 support

Ethereum sustained $170 million in liquidations over the past 24 hours, driven by $142.8 million in long liquidations, per Coinglass data.

ETH is facing intense pressure at the support near $2,850 as the crypto market extended its downtrend on Thursday. A firm decline below $2,850 could send ETH toward the support level near $2,300.

On the upside, ETH has to recover $3,100 and clear the 20-day Exponential Moving Average (EMA) to stage a move toward $3,470.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have crossed into their oversold regions, indicating strong bullish momentum. However, oversold conditions in the RSI and Stoch could lead to a short-term reversal.