Ripple Price Forecast: XRP eyes rebound as institutional interest gains momentum

- XRP is stable above $2.00 as bulls eye a short-term recovery in a generally bearish cryptocurrency market.

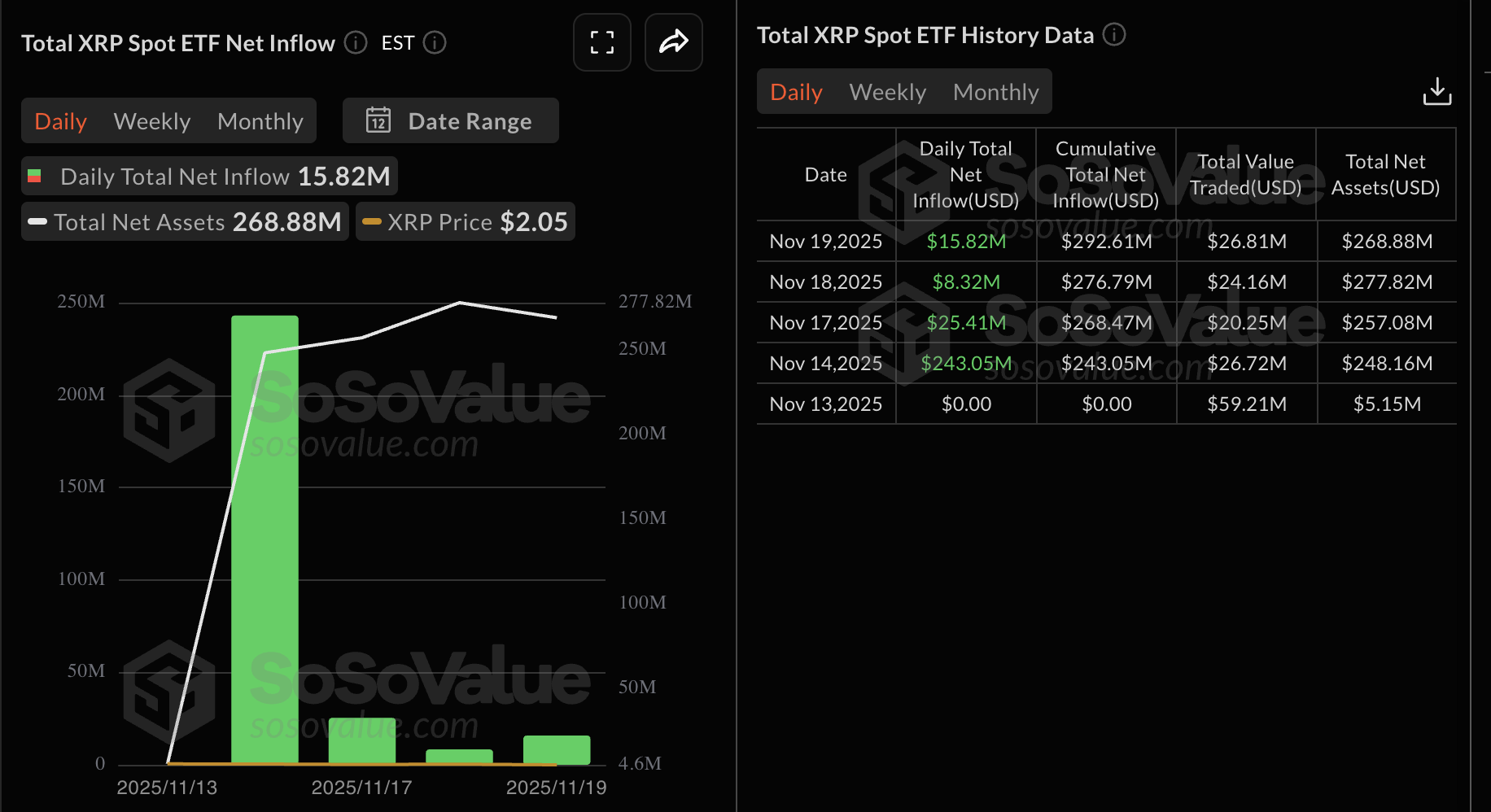

- XRP ETFs record nearly $16 million in inflows as institutional demand steadies.

- A weak derivative market, with Open Interest averaging $3.79 billion, could suppress XRP recovery potential.

Ripple (XRP) steadies above the critical $2.00 level on Thursday, as bulls push to regain control as volatility and bearish sentiment persist across the crypto market.

XRP needs the support of institutional investors through the recently launched Exchange Traded Funds (ETFs) and other related investment products to ensure stability above $2.00 support and sustain its recovery in the fourth quarter.

XRP ETF demand signals institutional appetite

XRP spot ETFs extended their inflow streak with nearly $16 million streaming in on Wednesday. There are two XRP ETFs listed in the United States (US): Canary Capital's XRPC and Bitwise XRP. Combined, they have a total net inflow of approximately $293 million, with net assets averaging $268 million.

Since their October 28 debut, XRP ETFs have not experienced outflows, underscoring the growing risk appetite in altcoin-related investment products.

On the other hand, the XRP derivatives market has remained relatively muted since the October 10 flash crash. The futures Open Interest (OI) averages $3.79 billion on Thursday, down from Wednesday's $3.85 billion, according to CoinGlass data.

OI is a measure of the notional value of outstanding futures contracts; hence, a steady rise is required to support an XRP rebound in the near term.

Technical outlook: XRP seeks stability amid downward pressure

XRP holds above its short-term support at $2.00 on Thursday, as bulls strive to shape the trend in upcoming sessions. The cross-border remittance token remains below the 50-day Exponential Moving Average (EMA), the 100- and 200-day EMAs at $2.45, $2.57 and $2.54, respectively, with all three sloping lower.

The 50-day EMA running beneath the 200-day EMA highlights a Death Cross pattern, which reinforces a bearish setup. At the same time, the Moving Average Convergence Divergence (MACD) indicator remains below its signal and under the zero line, with the negative histogram slightly widening, suggesting strengthening bearish momentum.

The Relative Strength Index (RSI) at 37 stays under the midline, indicating sellers have the upper hand. A descending trend line from $3.66, XRP's record high reached on July 18, caps rebounds, with resistance seen near $2.72.

Overhead, the SuperTrend indicator descends near $2.58, aligning with the 200- and 100-day EMAs to form a heavy resistance band at $2.54-$2.57. The moving averages continue to roll over, so any bounce would face the first cap at the 50-day EMA at $2.45, and a daily close above that barrier could ease downside pressure.

The MACD indicator's stance beneath zero reinforces a bearish bias. Beneath these trend filters, bears remain in control; a break above $2.72 would be needed to improve the tone. Holding below the cited averages keeps risk skewed lower.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool)