Dogecoin Price Forecast: DOGE under pressure despite optimism in derivatives market

- Dogecoin struggles to hold $0.1500, reflecting uncertainty in the broader crypto market.

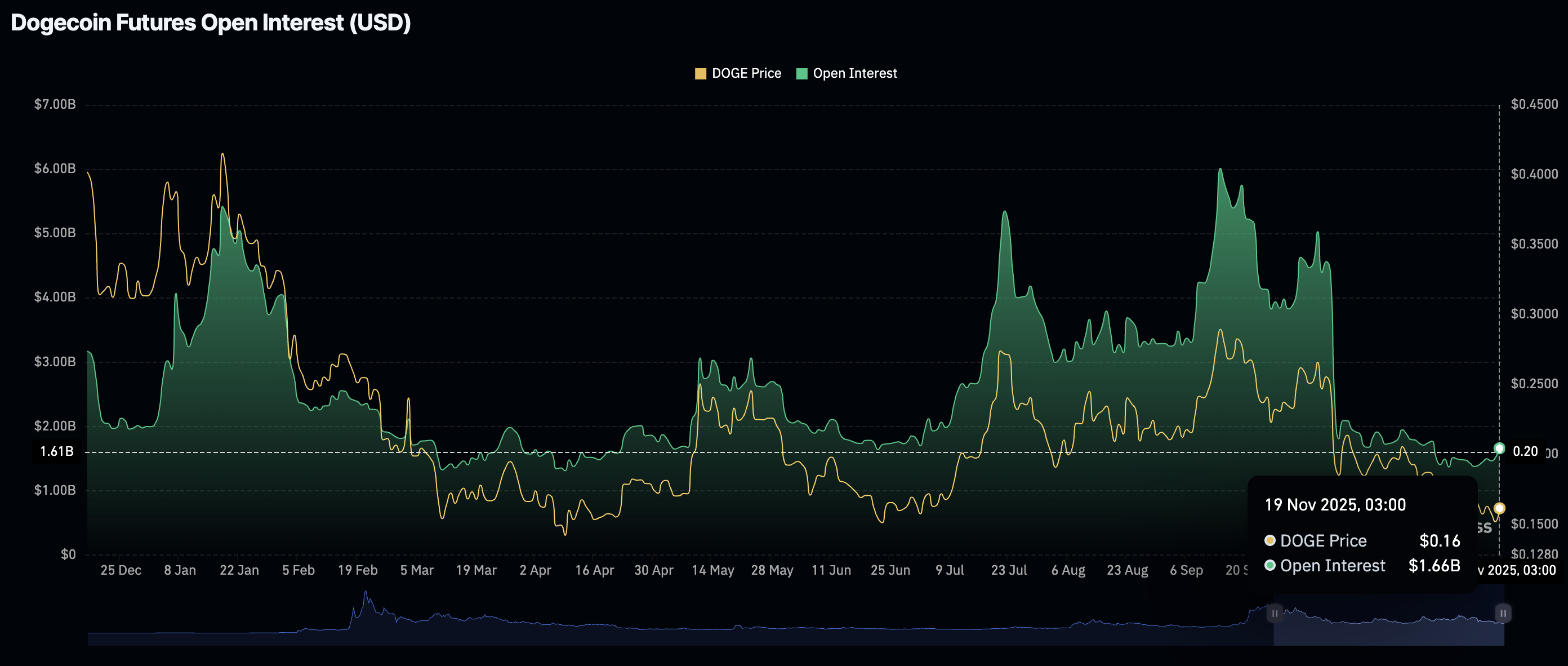

- DOGE’s derivatives market shows signs of stability as Open Interest rises to $1.66 billion.

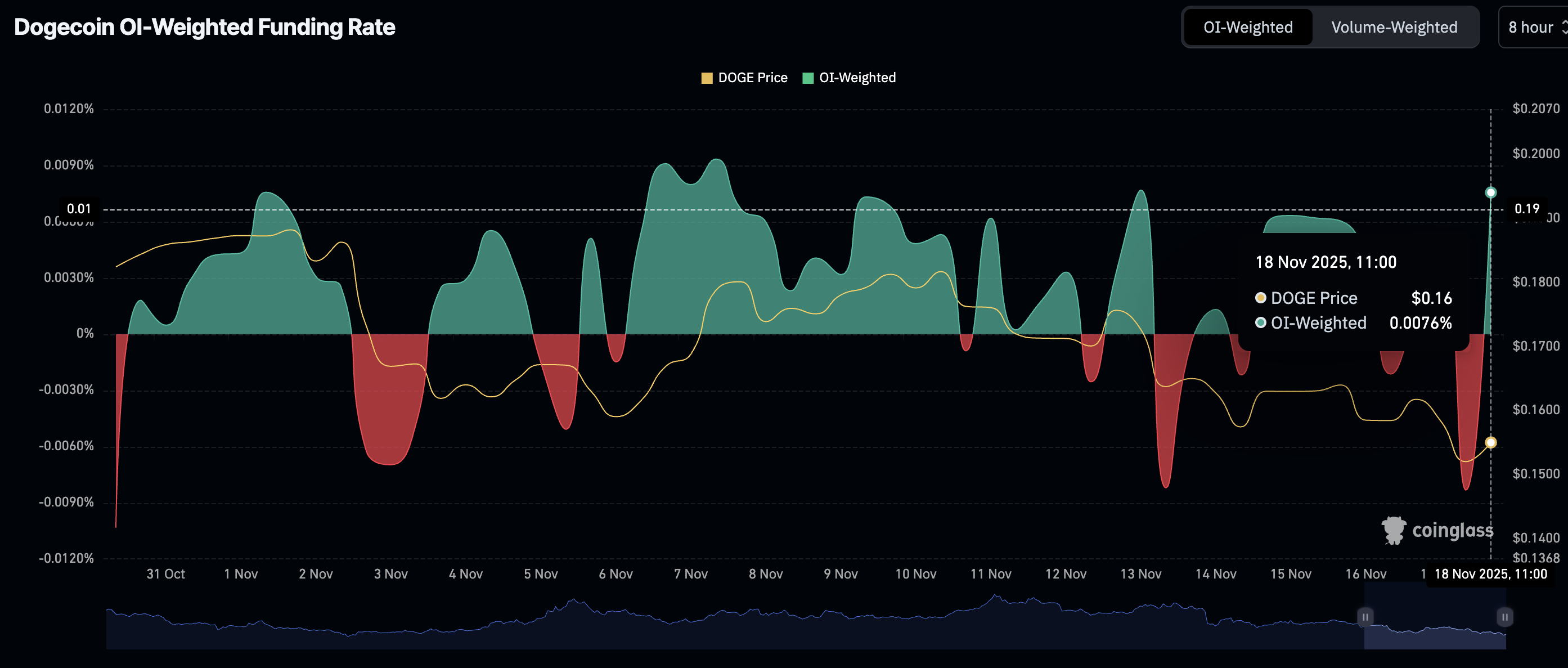

- Dogecoin’s OI-Weighed Funding Rate shoots to 0.0076% as traders increasingly pile into long positions.

Dogecoin (DOGE) is extending its decline, trading at around $0.1587 at the time of writing on Wednesday. Since the October 10 flash crash, which liquidated over $19 billion in crypto assets in a single day, the leading meme coin with a market capitalisation of $24 billion has lost 37% of its value.

The steady sell-off reflects bearish sentiment in the broader cryptocurrency market, driven by uncertainty ahead of the next Federal Reserve (Fed) monetary policy meeting in December and a lack of significant price catalysts in the crypto space.

Fed Chair Jerome Powell said during the October policy meeting that a December rate cut was not guaranteed, which spooked investors and fueled risk-off sentiment.

An analysis of Dogecoin’s derivatives market could provide insight into the next direction the meme coin may take, especially as futures Open Interest (OI) stabilizes.

Assessing Dogecoin’s bullish potential

Dogecoin’s derivatives market is stabilizing, supported by futures OI rising to $1.66 billion on Wednesday. Following the massive deleveraging on October 10, DOGE’s OI dropped to $1.37 billion on November 7, highlighting a sticky risk-off.

Since OI represents the notional value of outstanding futures contracts, a steady increase suggests that investor interest in DOGE is growing. Traders are slowly regaining confidence in Dogecoin’s ability to sustain short-term recovery. As investors increase their risk exposure, the tail force on DOGE intensifies, increasing the probability of a steady recovery.

Dogecoin OI-Weighted Funding Rate has risen to 0.0076% on Wednesday from Tuesday's -0.0083% , as traders increasingly pile into long positions. The meme coin must hold onto short-term gains above the $0.1500 support to steady this risk appetite. Otherwise, any sign of weakness may reinforce the bearish outlook.

Technical outlook: Dogecoin vulnerable amid bearish signals

Dogecoin’s recovery remains a pipe dream despite its derivatives market showing signs of stability. The Relative Strength Index (RSI) on the daily chart at 39 risks extending its decline toward oversold territory, potentially escalating the downtrend below $0.1500.

Dogecoin also sits below the 50-day Exponential Moving Average (EMA) at $0.1893, the 100-day EMA at $0.2024, and the 200-day EMA at $0.2090, all of which point to a weak technical structure.

The Money Flow Index (MFI) indicator holds below a descending trendline on the same daily chart, suggesting that money is flowing out of DOGE, which would make recovery an uphill task.

A break below the immediate support at $0.1500 could push Dogecoin toward $0.1424, a level tested in June. Still, a recovery could occur from the current level if investors increase exposure, supported by a relatively stable derivatives market.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.