Bitcoin Cash Price Forecast: BCH hints at recovery with 6% gain, while derivatives remain weak

- Bitcoin Cash jumps 6% on Monday, reclaiming the $500 psychological level after a sharp selloff on Sunday.

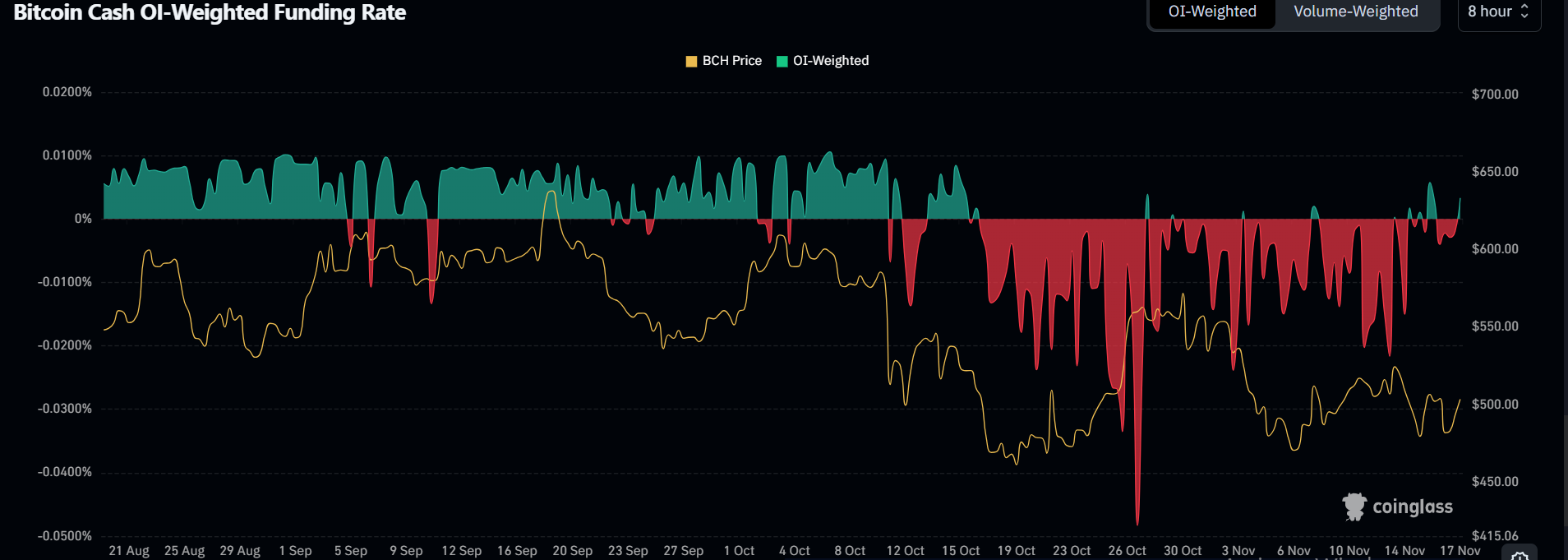

- Derivatives data indicate weakness for the Bitcoin fork as its funding rates have been largely negative since the October 10 crash.

- BCH is testing the 200-day EMA after bouncing off the support near $470.

Bitcoin Cash (BCH) is showing signs of recovery on Monday after recouping losses from Sunday's sharp plunge to the $470 region. The Bitcoin fork has proven an outlier over the past 24 hours, up 6%, while top altcoins Ethereum (ETH), BNB, and Solana (SOL) struggle to post gains.

Bitcoin Cash holders show strength amid market weakness

Despite the crypto market's decline over the past few weeks, Bitcoin Cash holders have held steady, according to data from crypto analytics platform Santiment.

The Mean Coin Age metric, which tracks the average number of days all coins have been held in their current addresses, has maintained an upward trend, indicating investors are holding onto their assets.

[19-1763403090985-1763403090987.10.01, 17 Nov, 2025].png)

The BCH supply distribution sheds further light on holders' activity. Investors with a balance of 10,000-100,000 BCH maintained collective holdings of 4.52 million BCH over the past week. Their holdings steadily increased into early November after resuming accumulation in late October.

On the other hand, wallets holding 100,000-1,000,000 BCH, largely dominated by exchanges, reduced their holdings by 160,000 BCH during the same period. This indicates accumulation activity from earlier in the month, as the outflows coincide with inflows into the wallets of the 10,000-100,000 BCH cohort.

[19-1763403125206-1763403125208.09.38, 17 Nov, 2025].png)

A similar sentiment is evident in the Network Realized Profit/Loss metric, which recorded minimal profit-taking and loss realization activity.

However, Bitcoin Cash derivatives data show weak sentiment. Funding rates have been largely negative since the October 10 crypto leverage flush, according to Coinglass data.

Funding rates are periodic payments between perpetual futures traders to keep a contract's price anchored to its underlying spot counterpart. Negative funding rates indicate most traders are flipping bearish, and vice versa for positive funding rates.

Additionally, BCH's futures open interest — total worth of outstanding contracts — remains weak at 652,000 BCH, over 40% below September's peak of 1.11 million BCH.

Bitcoin Cash Price Forecast: BCH tackles 200-day EMA, eyes $532

Bitcoin Cash reclaimed the $500 psychological level on Monday, rising over 5% in the past 24 hours after bouncing off the support near $470. The coin is testing the 200-day Exponential Moving Average (EMA) as it approaches the $532 key level. Just below the level is the confluence of the 50-day and 100-day EMAs.

BCH could rise toward the $583 resistance if it clears these hurdles, alongside a descending trendline extending from September 18. On the downside, the Bitcoin fork could find support near $428 if it fails to hold $470.

The Relative Strength Index (RSI) is testing its neutral level line, while the Stochastic Oscillator (Stoch) has crossed above its midline. A cross above in the RSI could strengthen the bullish momentum for BCH.