Bitcoin Price Forecast: BTC edges below $104,000 as long-term holders intensify sell-off

- Bitcoin price extends its correction, trading below $104,000 on Tuesday.

- On-chain data shows Bitcoin OGs are continuing to offload their holdings, adding to the mounting selling pressure in the market.

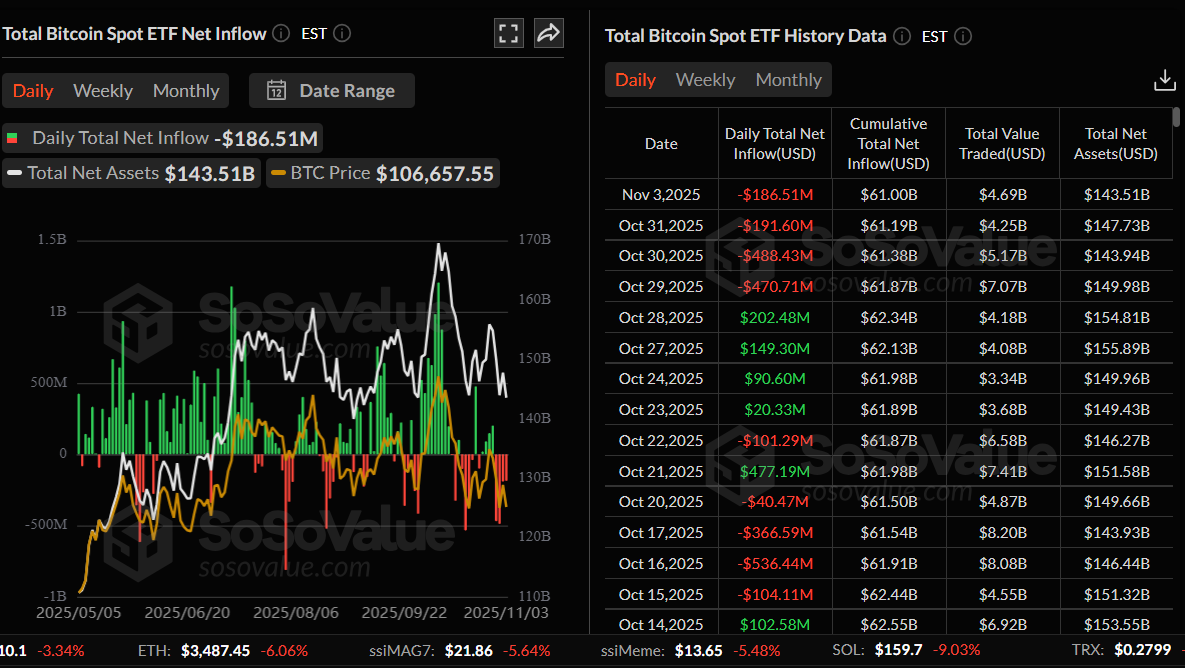

- US-listed spot ETFs recorded an outflow of $186.51 million on Monday, marking another day of consistent withdrawals.

Bitcoin (BTC) extends its correction on Tuesday, slipping below $104,000 and continuing its decline from the previous day. The bearish outlook is further strengthened as Bitcoin long-term holders continue to offload their holdings, adding to the mounting selling pressure. Meanwhile, US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded outflows of over $186 million on Monday, hinting at fading institutional demand for the largest cryptocurrency by market capitalization.

Bitcoin dips as long-term holders continue offloading their BTC holdings

Bitcoin price begins the week on a negative note, closing below $106,600 on Monday and continuing to slide below $104,000 at the time of writing on Tuesday. This price correction is further fueled by Bitcoin OGs’ dumping BTC.

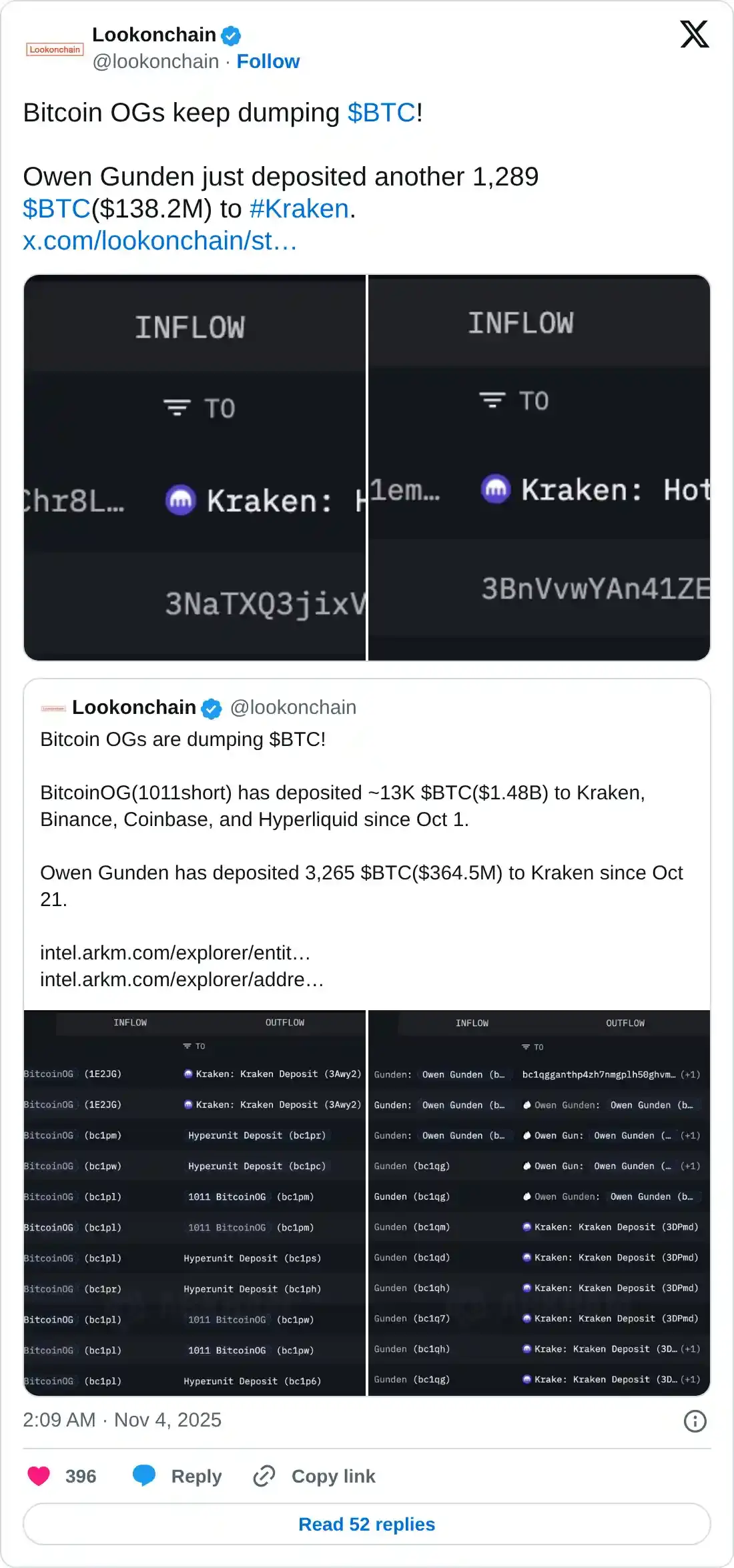

According to Lookonchain data, Owen Gunden deposited another 1,289 BTC to Kraken on Tuesday. Another Bitcoin OG wallet(1011short) has transferred 13,000 BTC to major exchanges, including Kraken, Binance, Coinbase, and Hyperliquid, since October 1. Combined with Gunden’s total deposits of 3,265 BTC since October 21, this trend indicates profit-taking and increasing selling pressure from early Bitcoin holders.

QCP Capital analyst reported on Monday that the view that OG holders are driving crypto’s idiosyncratic consolidation appears reasonable. Recent sell-offs, including Monday’s, came with no clear macro catalyst, even as equities and other risk assets outperform under supportive policy conditions.

The analyst continued that while price action may remain capped until these legacy holders finish redistributing, BTC’s resilience is notable. The market has absorbed roughly 405K BTC in legacy supply over the past month without breaching the 100,000 level.

“Still, as BTC continues to consolidate in a multi-month band reminiscent of pre-breakout 2024, speculation has emerged on whether this cycle is nearing its end. Whether this marks the onset of another crypto winter is unclear. For now, long-term holders are realizing profits, while institutional inflows and adoption continue to strengthen the market’s foundation,” concludes QCP’s analyst.

Institutional demand continues to weaken

Bitcoin institutional demand continues to weaken as the week begins. SoSoValue data shows that spot Bitcoin ETFs recorded an outflow of $186.51 million on Monday, continuing its daily streak of outflows since October 29. If these outflows continue and intensify, BTC could extend its ongoing price correction, as it suggests declining institutional confidence.

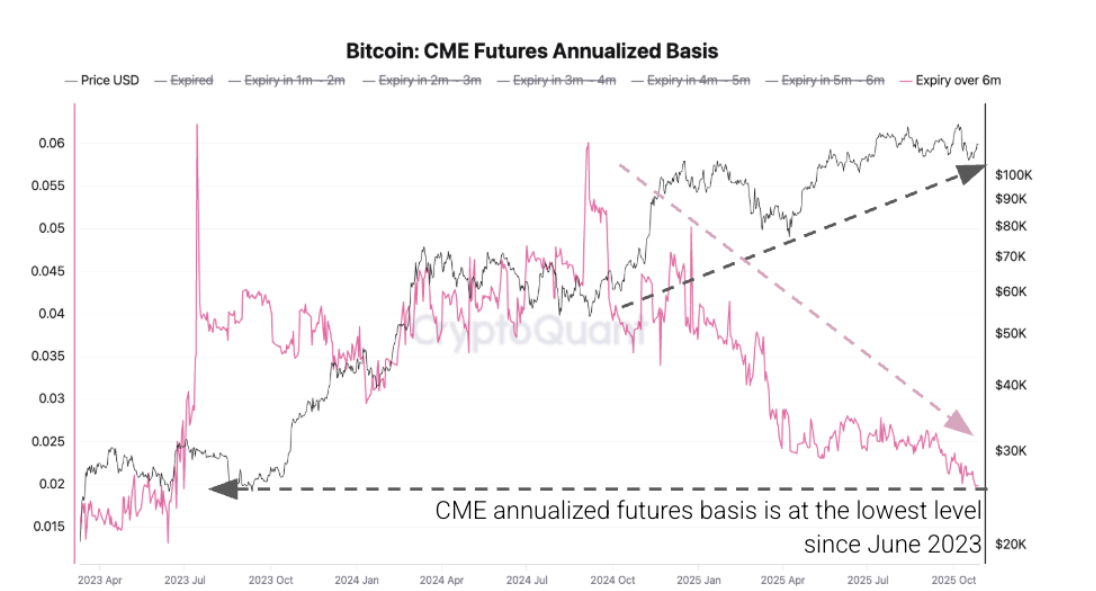

CryptoQuant’s on-chain metrics further highlight a bearish outlook for Bitcoin, as US investor demand in the Bitcoin futures market is also at low levels. This is evident in the downward trend of the CME’s Futures annualized basis, which has fallen to 1.98%, the lowest level in more than two years. This situation indicates that demand to hold Bitcoin futures with 6-month or longer expiries is lower than in recent months and has declined as Bitcoin spot prices rallied from $80,000 to $120,000.

Despite the decline in institutional demand, Strategy announced on Monday that it had acquired 397 BTC, bringing the total to 641,205 BTC, highlighting the firm’s continued long-term conviction in Bitcoin amid short-term market weakness.

Bitcoin Price Forecast: BTC heading toward the $102,000 low

Bitcoin price faced rejection at the 78.6% Fibonacci retracement level (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199) at $115,137 last week and declined by 3.51%. BTC continued its correction by 3.58% on Monday after being rejected near the previously broken trendline. At the time of writing on Tuesday, it trades below the 61.8% Fibonacci retracement level at $106,453.

If BTC closes below the $106,453 support level on a daily basis, it could extend the decline toward the October 10 low of $102,000.

The Relative Strength Index (RSI) on the daily chart reads 35, below the neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) showed a bearish crossover on Monday, signaling a sell and indicating a downward trend.

However, if BTC recovers, it could extend the recovery toward the 100-day EMA at $112,152.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.