Chainlink Price Forecast: LINK adoption expands as partnerships with major firms fuel bullish outlook

- Chainlink’s price hovers around $17.83 on Wednesday after being rejected at a key resistance zone earlier this week.

- Growing adoption across platforms such as Streamex, Arc, Virtune, ANZ, China AMC, and Fidelity International reinforces a bullish narrative for LINK.

- Technical outlook suggests a potential rally toward $23.80 if LINK manages a decisive close above $19.67.

Chainlink (LINK) holds steady near $17.83 at the time of writing on Wednesday after being rejected at a key resistance zone earlier this week. The Oracle network’s growing adoption across firms such as Streamex, Arc, Virtune, ANZ, China AMC, and Fidelity International underscores its growing role in bridging traditional finance with blockchain infrastructure. From a technical perspective, a sustained close above $19.67 could open the door for an upside rally.

Chainlink’s growing adoption

Streamex Corp. (STEX), a Nasdaq-listed Real World Asset (RWA) tokenization company, announced on Monday that it has entered into a strategic partnership with Chainlink as its official oracle provider.

Streamex is making GLDY—its institutional-grade, gold-backed stablecoin—a Cross-Chain Token (CCT) powered by Chainlink CCIP, enabling secure, native transfers of GLDY across Base and Solana. Moreover, Streamex is integrating Chainlink Proof of Reserve to provide real-time, onchain verification of the gold reserves backing GLDY, and Chainlink Price Feeds to deliver tamper-proof market data powering secure, reliable Gold (XAU) markets.

Later on Tuesday, Chainlink announced that it had been selected as a core ecosystem partner of Arc, the newly launched layer-1 blockchain by Circle, the company behind the USDC stablecoin and Circle Payments Network.

“By integrating Chainlink CCIP, Data Feeds, Data Streams, and the Automated Compliance Engine (ACE), Arc enables developers to build advanced cross-chain applications that are compliant across jurisdictions and operate with the highest levels of security and reliability,” said LINK in its X post.

During the same period, Virtune, a leading Swedish-regulated digital asset manager and issuer of crypto Exchange Traded Products (ETPs), announced that it has integrated the Chainlink standard for verifiable data across its digital asset ETPs. This strategic integration positions Virtune as one of the largest adopters of Chainlink Proof of Reserve to date.

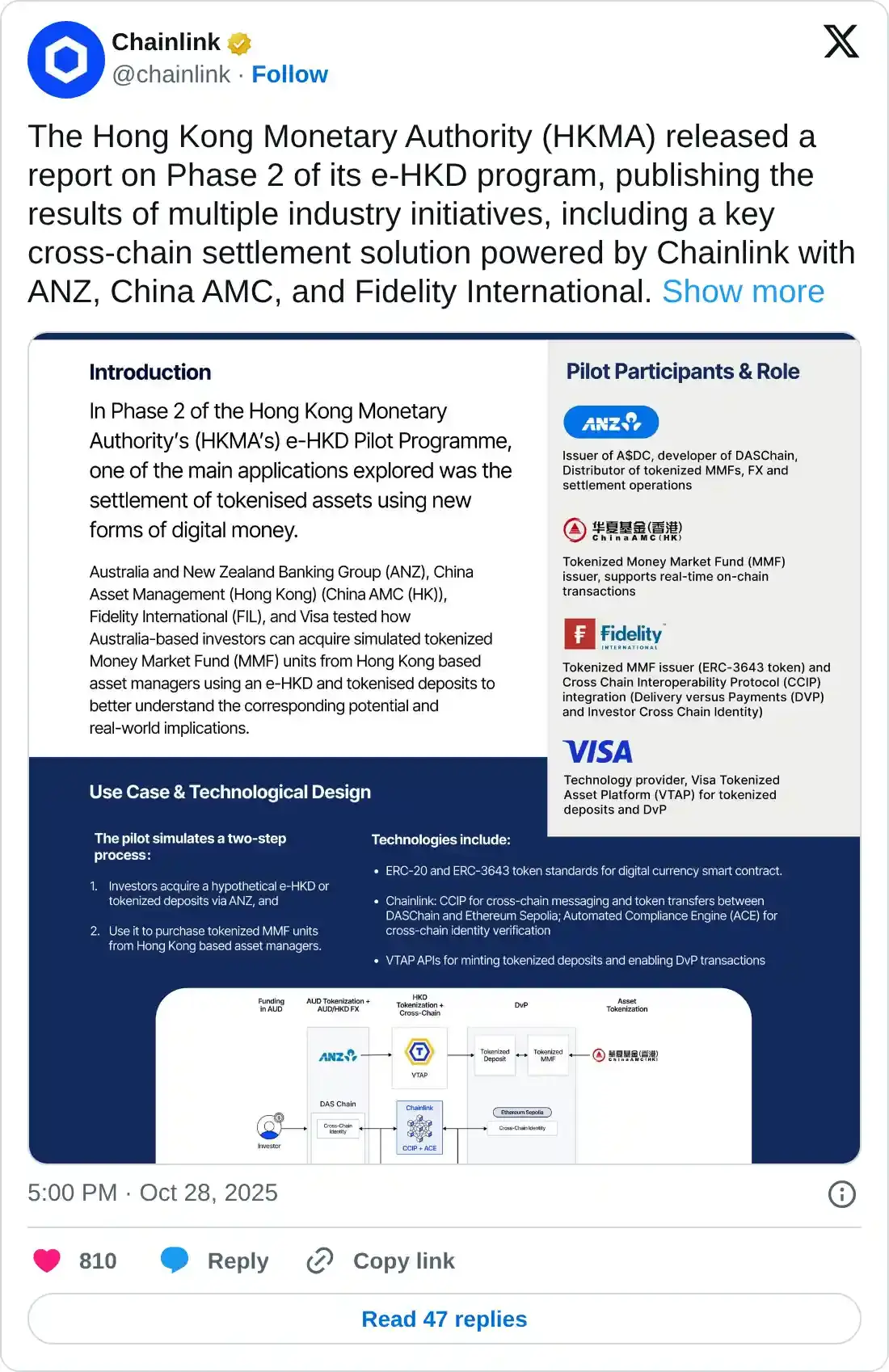

Additionally, the Hong Kong Monetary Authority (HKMA) released a report on Phase 2 of its e-HKD program this Tuesday, publishing the results of multiple industry initiatives, including a key cross-chain settlement solution powered by Chainlink with ANZ, China AMC, and Fidelity International. In the solution, ANZ, China AMC, and Fidelity International leveraged Chainlink CCIP and the Automated Compliance Engine (ACE) to meet both institutional cross-chain interoperability and compliance requirements for secure cross-chain settlement of tokenized assets.

These growing developments and partnerships underscore Chainlink’s enhanced real-world utility, increased institutional credibility, and broader adoption, which support a bullish outlook for its native token in the long term.

Chainlink’s derivatives data shows bullish bias

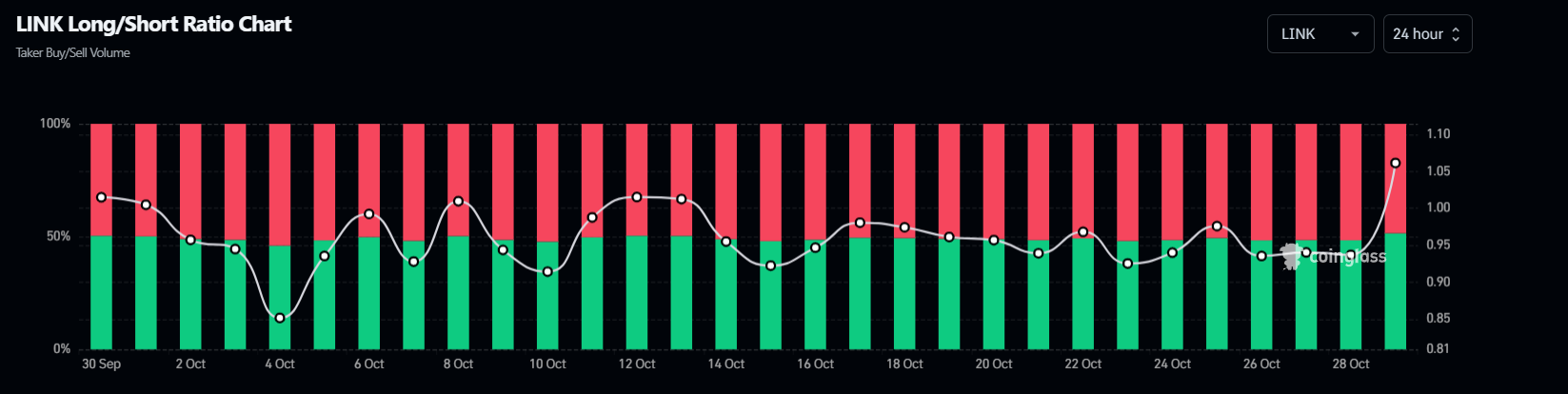

On the derivatives side, Coinglass’s long-to-short ratio for LINK reads 1.06 on Wednesday, the highest level over a month. The ratio above one suggests that more traders are betting on the Chainlink price to rally.

Chainlink long-to-short ratio chart. Source: Coinglass

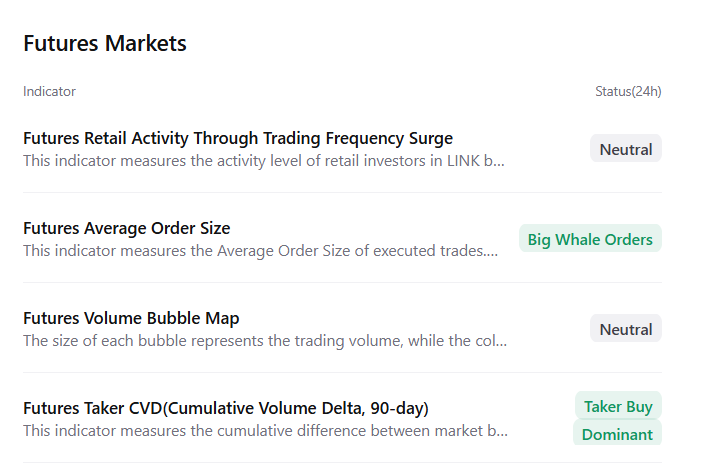

CryptoQuant’s futures market summary data for Chainlink also showed a bullish outlook, as it showed large whale orders and buy dominance, signaling a potential rally ahead.

Chainlink Price Forecast: LINK could hit above $23 if it closes above key resistance

Chainlink price faced rejection from its 200-day Exponential Moving Average (EMA) at $18.90 on Monday and declined nearly 4% by the next day. At the time of writing on Wednesday, it hovers at around $17.83, finding support around the 61.8% Fibonacci retracement level at $17.68.

If the support level at $17.68 holds and LINK closes above the daily resistance at $19.67, it could extend the rally toward the next daily resistance at $23.81.

The Relative Strength Index (RSI) on the daily chart is 43, near the neutral 50 level, suggesting fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which still holds, supporting the bullish thesis.

LINK/USDT daily chart

On the other hand, if LINK closes below $17.68 support, it could extend the decline toward the daily support level at $15.07.