Old Bitcoin Supply Awakens – Long-Term Holders Move 4,657 BTC After Years of Inactivity

Bitcoin is attempting to push higher after weeks of consolidation and sustained selling pressure that followed the sharp October 10 crash. The market remains in a delicate recovery phase, with volatility compressing as traders await the next major catalyst. This week could prove decisive, as all eyes turn to Wednesday’s Federal Reserve meeting, where policymakers are expected to announce their next move on interest rates — a decision that could shape global risk sentiment for the remainder of the year.

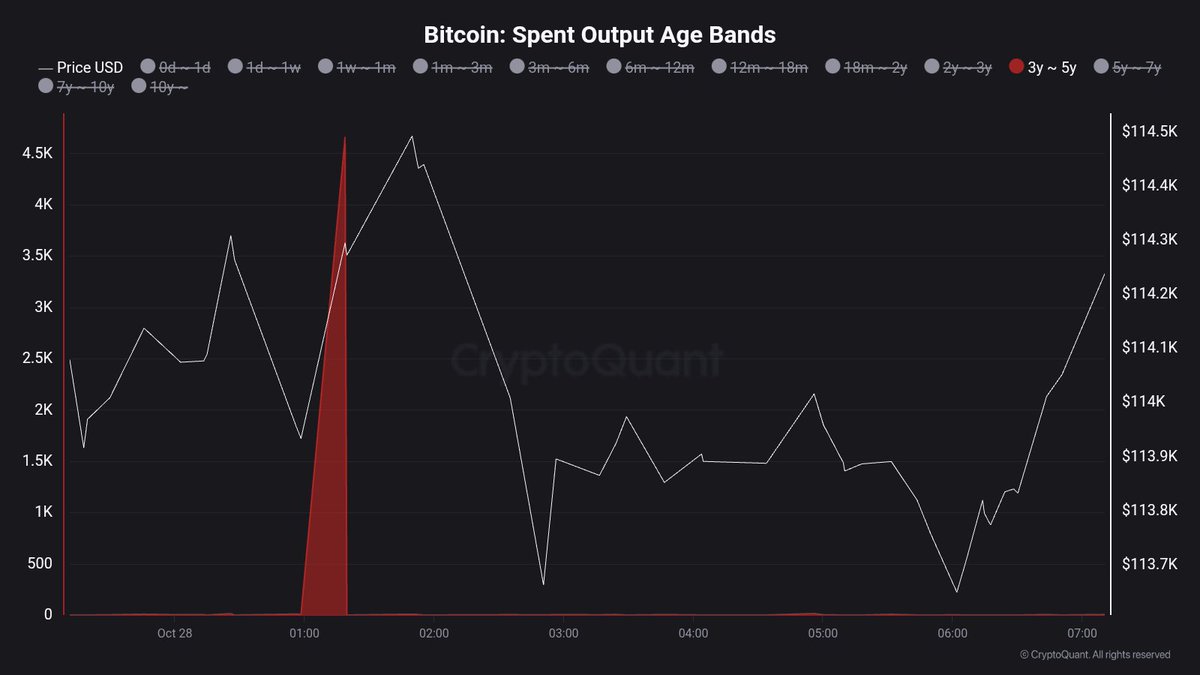

On-chain data adds another layer of intrigue to the current setup. According to CryptoQuant, Bitcoin’s dormant supply is waking up, with long-inactive coins — held between three and five years — showing significant movement in recent blocks. Such activity often signals renewed engagement from long-term holders, sometimes preceding key market inflection points.

While the short-term outlook remains mixed, analysts note that the reactivation of old coins amid tightening macro conditions suggests growing investor anticipation. If the Fed signals a softer stance on monetary policy, Bitcoin could see renewed capital inflows. However, another hawkish surprise might extend the consolidation phase, keeping BTC locked below resistance until clearer macro conditions emerge.

Long-Term Holders Make A Move

Top analyst Maartunn shared data revealing that Bitcoin’s 3–5 year dormant supply has seen a sudden spike in activity, with 4,657.48 BTC spent in a single recent block. This metric tracks coins that have been untouched for several years — a cohort often associated with early bull-cycle investors or strategic long-term holders. When such coins move, it typically signals renewed activity from investors who have weathered multiple market phases.

In the historical context, similar awakenings in long-term supply have preceded major shifts in market structure. For instance, during past consolidation periods, old coins were reactivated as investors prepared for volatility — either to take profits near local highs or to reposition ahead of a trend reversal. The magnitude of this recent movement suggests that seasoned holders are once again reassessing their allocations amid tightening macro conditions and elevated expectations for the Federal Reserve’s rate decision this week.

What makes this particularly interesting is the contrast with current sentiment. Despite the spike in long-term holder activity, on-chain indicators such as the Bull-Bear Structure Index and Unified Sentiment Index remain in mildly bullish territory. This implies that while some early investors are realizing profits or reallocating, broader market conviction is improving — especially as Bitcoin holds above the $113,000–$114,000 range.

This movement shouldn’t be interpreted as panic selling but as healthy on-chain rotation. Long-term holders moving coins after years of dormancy often signal the beginning of liquidity redistributions that accompany the next phase of market growth. If Bitcoin maintains its current support levels and macro conditions remain stable, these shifts could fuel the liquidity needed for a new impulse phase toward higher prices.

BTC Bulls Regain Momentum

Bitcoin is showing renewed strength on the 3-day timeframe, currently trading near $114,485, as it attempts to recover from the sharp sell-off seen earlier in October. The chart shows BTC holding firmly above both the 50-day (blue) and 100-day (green) moving averages — a key structural signal suggesting that the medium-term trend remains intact despite recent volatility.

The next major resistance level sits at $117,500, a zone that has repeatedly capped Bitcoin’s advances over the past two months. A successful breakout and daily close above this level could open the door for a retest of $125,000, marking the potential start of a new bullish impulse. However, rejection here could signal another short-term consolidation, as traders take profits and reassess risk amid macroeconomic uncertainty.

On the downside, immediate support lies near $111,000–$112,000, while the 200-day moving average (red) around $96,000 continues to provide long-term structural backing.

Momentum indicators and on-chain data, including a rebound in sentiment and stable liquidity conditions, suggest that buying interest is gradually returning. If the broader market remains calm following the upcoming Federal Reserve rate decision, Bitcoin could confirm its recovery and aim higher toward the $120,000–$125,000 range.

Featured image from ChatGPT, chart from TradingView.com