Ethereum Price Forecast: ETH faces $4,100 hurdle as VanEck files for Lido staked ETH ETF

Ethereum price today: $3,980

- The VanEck Lido Staked Ethereum ETF would provide investors with exposure to staked ETH's price performance and staking rewards.

- The filing follows SEC guidelines clarifying that proof-of-stake and certain liquid staking activities do not fall under securities transactions.

- ETH faces a hurdle at the $4,100 key level after bouncing off the $3,815 support.

Ethereum (ETH) faces pressure near the $4,100 level despite asset manager VanEck's filing with the Securities and Exchange Commission (SEC) to launch a Lido staked ETH exchange-traded fund (ETF).

VanEck seeks to launch first staked ETH ETF in the US

VanEck has filed with the SEC to launch the first-ever ETF tracking the price of liquid staking protocol Lido staked ETH (stETH) in the US.

The product, the VanEck Lido Staked Ethereum ETF, aims to give investors exposure to the price performance of staked ETH and the accompanying staking rewards.

"If approved, the ETF would give institutional investors a compliant, tax-efficient way to gain Ethereum staking exposure within a regulated investment structure," Lido Finance wrote in statement on Monday.

The platform also highlighted how stETH enables issuers to manage creations and redemptions efficiently while avoiding Ethereum withdrawal delays.

The filing follows improved crypto regulatory developments in the US under President Trump and the new SEC administration. The agency released guidelines in May and August clarifying that proof-of-stake and certain liquid staking activities do not fall under securities transactions.

"This guidance has also provided a clearer foundation for regulated products referencing liquid staking tokens like stETH by confirming that staking receipt tokens, though evidencing ownership of deposited assets, are not securities because the underlying assets themselves are not securities," Lido added.

Meanwhile, the SEC has yet to decide on several digital asset ETF filings, including requests for issuers to enable staking within spot ETH ETFs.

Ethereum Price Forecast: ETH tests the $4,100 key level

Ethereum saw $144.3 million in futures liquidations over the past 24 hours, comprising $62.6 million and $81.7 million in long and short liquidations, per Coinglass data.

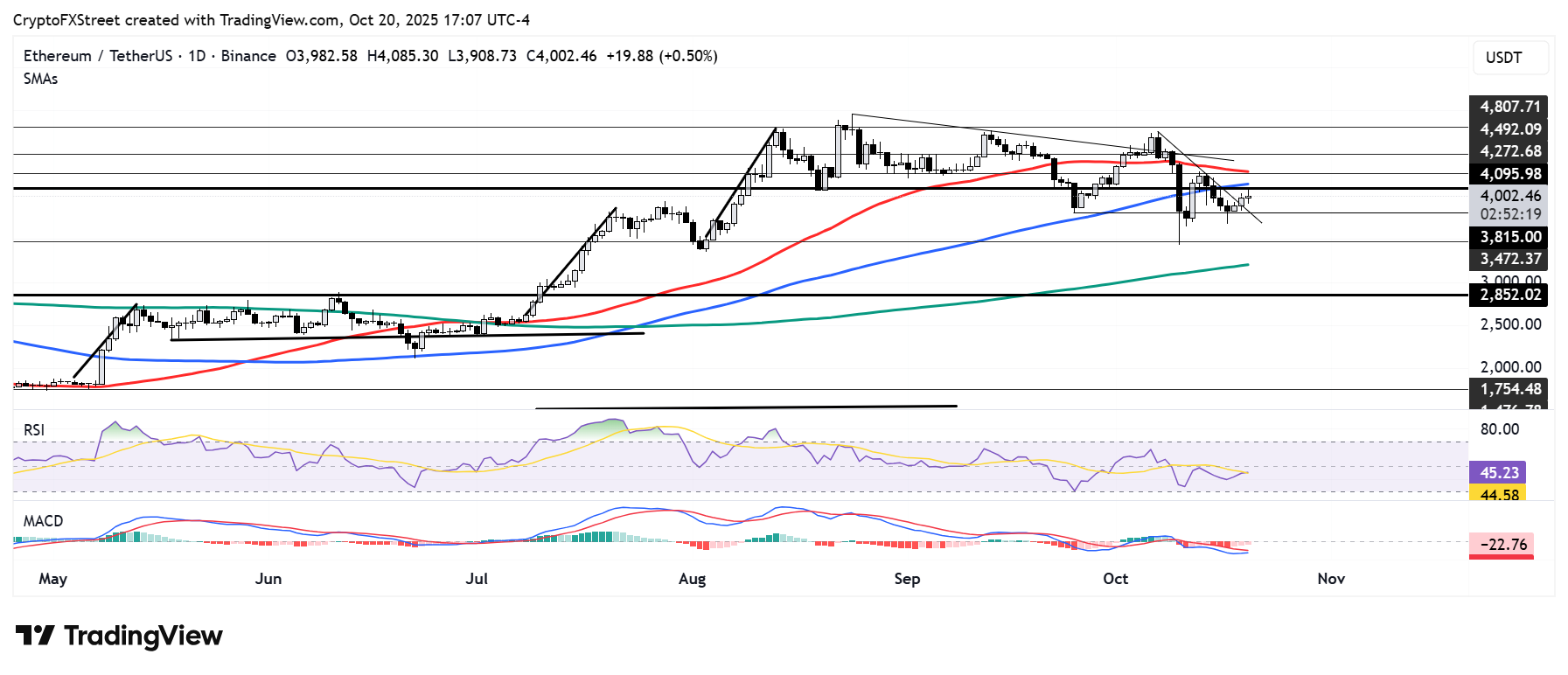

After bouncing off the support at $3,815 and clearing a descending trendline resistance extending from October 7, ETH faces a hurdle at the $4,100 key level. Before surging above $4,100 on August 9, the level stood as a mid-term critical resistance for ETH during key uptrends in 2024.

ETH/USDT daily chart

Above $4,100, the top altcoin also faces key hurdles at $4,270 and $4,500. On the downside, ETH could fall toward the support near $3,500 if it declines below $3,815.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) histogram bars show a continuation of bearish dominance but with mild improvement signs.