Tether Eyes $500B Valuation Amid Explosive Stablecoin Market Growth

The global stablecoin market is surging in 2025, with institutional giants like SoftBank and ARK Investment pursuing investments in infrastructure players like Tether.

While Tether and other stablecoins continue to expand, analysts warn that rapid adoption carries financial risks, particularly to central banks’ ability to control interest rates and maintain exchange rate stability.

Tether’s Expansion and Investor Interest

Tether is reportedly exploring a $20 billion funding round, which could value the company at around $500 billion, potentially placing it among the world’s most valuable private firms. Tether aims to use the capital to diversify beyond its core stablecoin business, which currently supports a USDT supply exceeding $170 billion.

SoftBank has been steadily expanding its cryptocurrency investments, while ARK Invest, led by Cathie Wood, has pursued multiple high-profile crypto funding deals in recent years.

If completed, the round would mark Tether’s most extensive search for external capital yet. Cantor Fitzgerald, a shareholder in Tether, is advising on the potential transaction. Market observers say the move reflects the stablecoin issuer’s dominant position and growing institutional confidence in digital asset infrastructure.

Supported by large US Treasury holdings and a growing Bitcoin reserve, Tether has emerged as one of the most profitable firms in crypto. In Q2 2025, it posted $4.9 billion in net income, up 277% from a year earlier.

Institutional Cash Pours In as Market Explodes

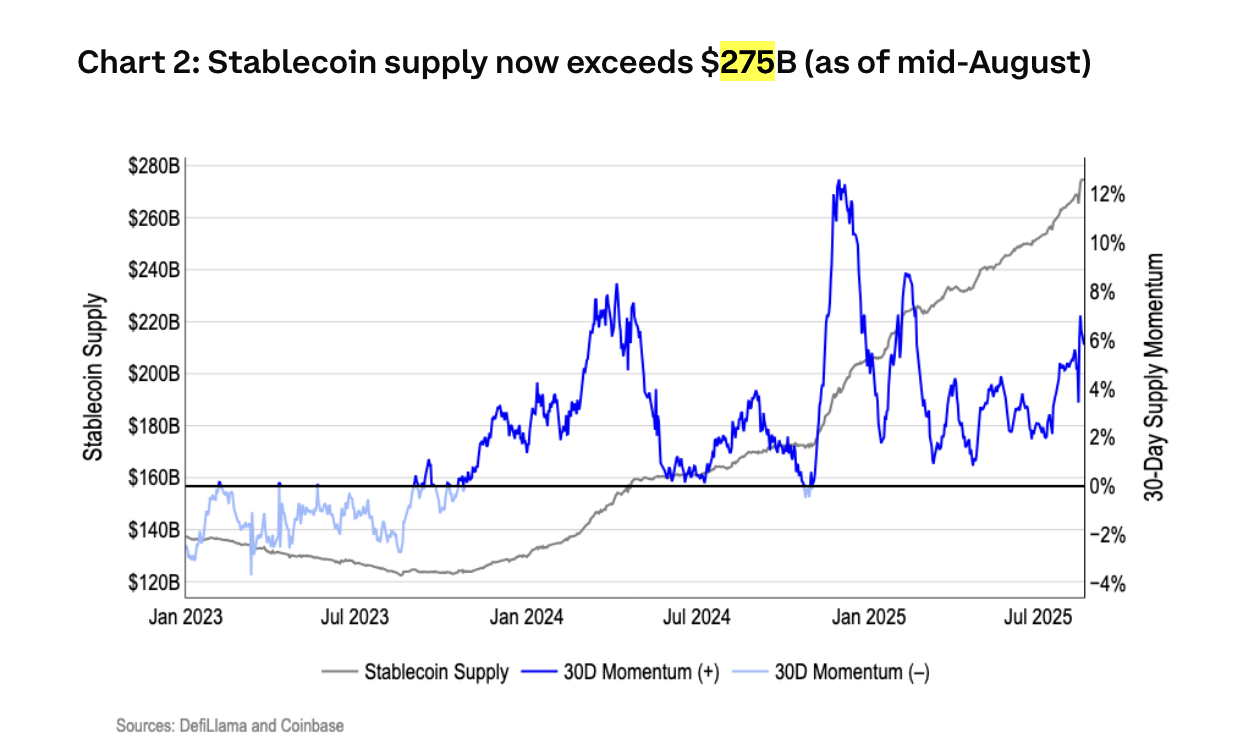

The stablecoin sector is undergoing an explosive growth phase in 2025, driven by unprecedented institutional adoption and emerging regulatory clarity worldwide. According to analysis cited in Coinbase’s August report, the total market capitalization of stablecoins has surged, reaching over $275 billion. Some analysts project the market could reach $1 trillion by 2028.

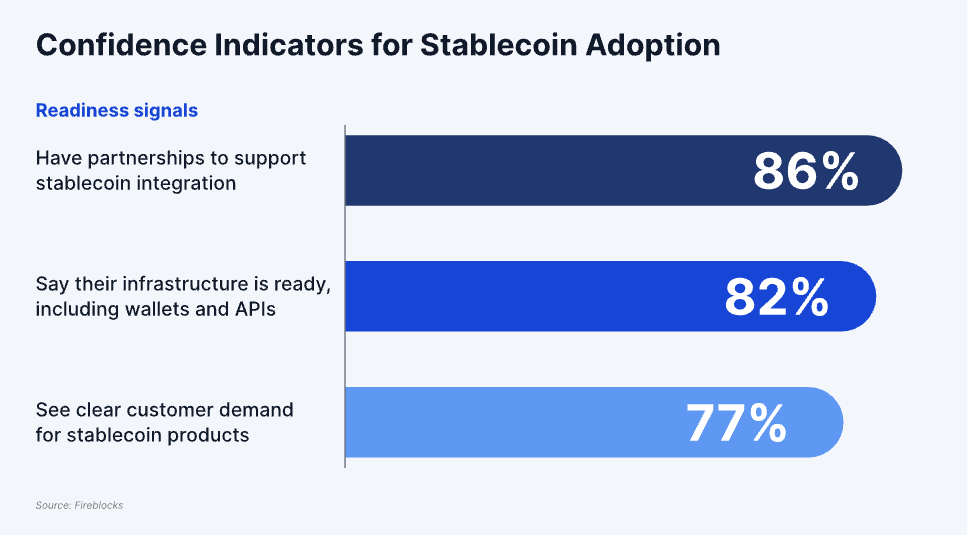

This growth is fueled by the stablecoins’ utility in cross-border payments, which are used for over 43% of B2B transactions in Southeast Asia. This year marks an inflection point where institutions are actively integrating stablecoins; a Fireblocks survey indicated that 90% of surveyed institutions are now taking action on stablecoin integration, embracing them for treasury management and international settlement.

Beyond Tether’s ambition, other major players are reshaping the landscape: nine major European banks (including ING, UniCredit, and Danske Bank) have joined forces to launch a MiCA-compliant euro-denominated stablecoin, and companies like Finastra have partnered with Circle to integrate stablecoins into bank payment flows.

The movement is gaining momentum in Asia as well. South Korea’s major financial institutions are deeply engaged in preparing for the stablecoin era, aggressively pursuing a “Two-Track Strategy” involving both internal development and strategic partnerships to launch their own Korean Won-backed stablecoins.

For example, a group of at least eight major banks, including KB Kookmin Bank and Shinhan Bank, is reportedly forming a consortium to create a joint venture and infrastructure specifically for the co-issuance of a Won-backed stablecoin. Furthermore, leading banks are meeting directly with foreign stablecoin issuers, such as the US company Circle (USDC issuer), to discuss cooperation, while simultaneously establishing internal task forces to conduct Proof-of-Concept (PoC) testing for real-world settlement using their own digital currency systems.

Rising Stablecoin Use Poses Financial Risks

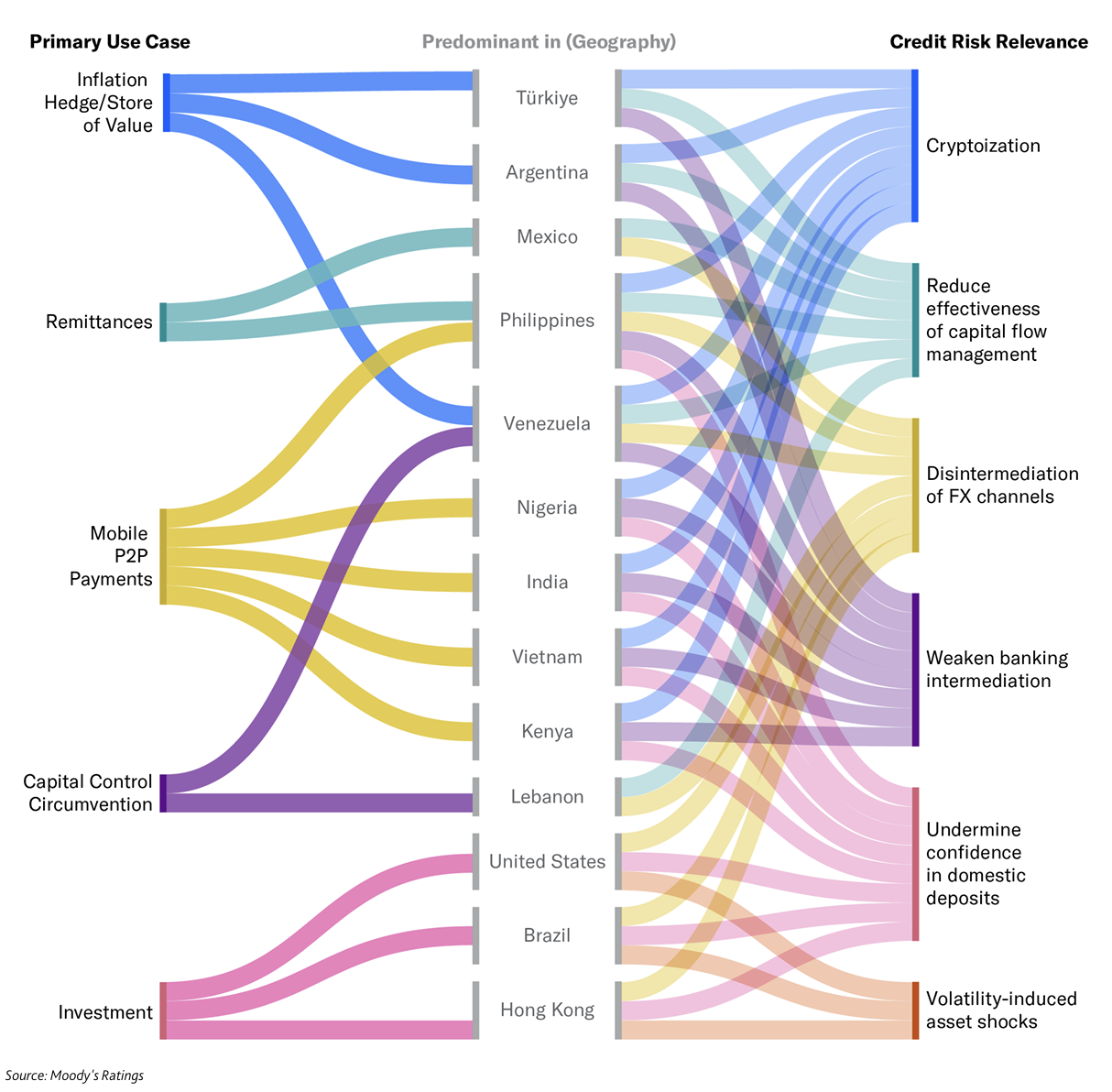

A new report from Moody’s Ratings, published on September 25, warns that digital currency ownership has surged globally, reaching 562 million people by 2024, up 33% from the previous year. Emerging markets in Southeast Asia, Africa, and Latin America are leading adoption, often using cryptocurrencies for inflation hedging, remittances, and financial inclusion.

The rapid expansion of stablecoins introduces systemic vulnerabilities. Widespread use could reduce central banks’ control over interest rates and currency stability, a trend termed “cryptoization.” Banks may experience deposit erosion as savings shift into stablecoins or crypto wallets, and underregulated reserves could trigger liquidity runs requiring government intervention.

Cryptocurrency adoption carries different risks in different markets / Source: Moody’s Ratings

Cryptocurrency adoption carries different risks in different markets / Source: Moody’s Ratings

However, uneven regulatory frameworks leave countries exposed. Advanced economies are beginning to regulate stablecoins more rigorously, with Europe implementing MiCA and the US passing the GENIUS Act, while Singapore applies a tiered framework. In contrast, many emerging markets lack comprehensive rules, and fewer than one-third of countries have full-spectrum regulation in place.