Ripple Price Forecast: XRP could plunge 12% despite whale support

- XRP extends its early week correction, targeting the 200-day EMA ahead of the weekend.

- XRP derivatives market weakens further as the futures Open Interest drops to $7.4 billion.

- Large volume holders of XRP hold steady, unfazed by the ongoing sell-off.

Ripple (XRP) declines for two consecutive days as weak sentiment prevails in the broader cryptocurrency market. The cross-border token is testing support at $2.70 at the time of writing on Friday, amid concerns that the downtrend may continue ahead of the weekend.

Interest in digital assets has declined significantly over the past two weeks, aligning with the general perception that September tends to be a bearish month for crypto.

XRP derivatives market weakens as short-term losses linger

XRP has experienced a noticeable decline in retail interest, according to data from CoinGlass on the derivatives markets. The futures Open Interest (OI), which currently averages at $7.4 billion, peaked at $8.95 billion in September.

OI refers to the notional value of outstanding futures contracts. Hence, a sticky decline in the metric implies that traders are increasingly losing confidence in the token’s ability to sustain gains. It could also indicate that bets on higher XRP prices are on a free fall, increasing the chances of an extended downtrend.

XRP Open Interest | Source: CoinGlass

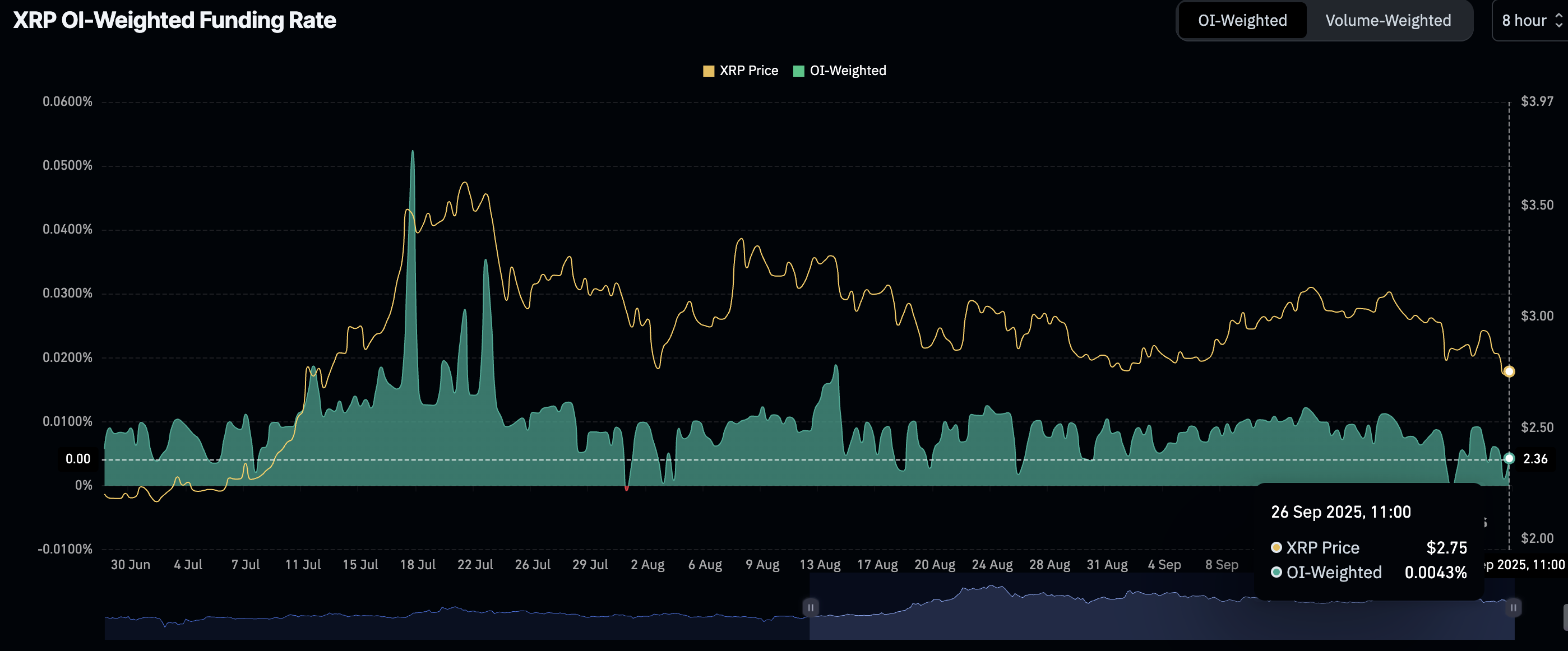

Despite interest in XRP fading, the XRP OI-Weighted Funding Rate remains positive at 0.0043%. This suggests that more traders are willing to take long positions in XRP, backing a short-term recovery outlook.

A consistent upward trend in this metric would support bullish sentiment, fostering an environment where bulls could push for a breakout toward the key $3.00 level.

XRP XRP OI-Weighted Funding Rate | Source: CoinGlass

Meanwhile, large-volume holders of XRP appear unfazed by the persistent drop in the price. The chart below shows that wallets holding between 1 million and 10 million XRP account for 10.48% of the total supply and are hesitant to sell, even as the price declines.

After the wallet cohort holding between 100 million and 1 billion XRP aggressively purchased XRP in August, they have stabilized their holdings around 14% of the total supply, with no signs of selling insight.

[13-1758888927373-1758888927374.44.52, 26 Sep, 2025].png)

XRP Supply Distribution | Source: Santiment

The adamance exhibited by XRP whales amid prevailing market volatility highlights the confidence investors have in the token and its ecosystem. Exhaustion in retail selling could drive the next recovery phase.

Technical outlook: Why XRP decline could persist?

XRP is currently holding below the 50-day Exponential Moving Average (EMA) at $2.93 and the 100-day EMA at $2.83, reinforcing the risk-off sentiment that began earlier this week.

The steady decline in the Relative Strength Index (RSI) to 37 indicates that bullish momentum is continuing to fade. Lower RSI readings could accelerate the losses below the short-term $2.70 support.

It could become increasingly difficult for bulls to regain control in the near term, especially with the Moving Average Convergence Divergence (MACD) indicator sustaining a sell signal since Monday. Investors will likely reduce their exposure as long as the blue line remains above the red signal line, contributing to selling pressure.

XRP/USDT daily chart

Still, a trend correction from the support at $2.70 cannot be ruled out yet. If investors buy the dip and sentiment in the broader cryptocurrency market improves, the XRP price could rebound toward the critical $3.00 level.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.