Hyperliquid Price Forecast: HYPE sharp decline eyes $40 as upcoming token unlocks sound warning

- Hyperliquid correction from $59.43 record high eyes $40.00 support level.

- Hyperliquid’s medium-term performance hangs in the balance with 237.8 million HYPE token unlocks starting in November.

- The 50-day EMA provides immediate support, signaling a possible trend reversal in the short term.

Hyperliquid (HYPE) extends the correction from its record high of $59.43, trading at $49.29 at the time of writing on Monday. The Decentralized Exchange (DEX) token exhibits technical weakness amid extremely volatile conditions, which could accelerate short-term declines to the next key support at $40.00.

Hyperliquid token unlocks commence in November

Hyperliquid is expected to start the token vesting, according to Maelstrom Fund, which cites data from DefiLlama indicating that 237.8 million HYPE will enter circulation over two years.

“Starting November 29, 237.8M HYPE will begin vesting linearly over 24 months. At $50 per token, that’s $11.9B in team unlocks — nearly $500M notional hitting the market every month,” Maelstrom Fund stated via X.

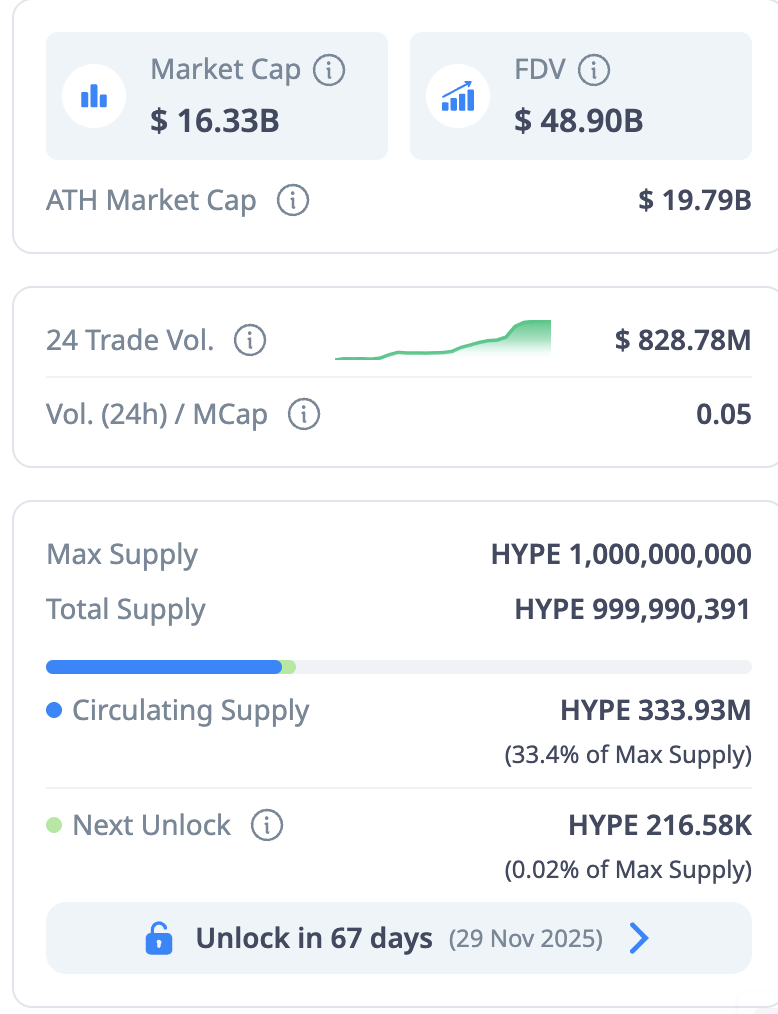

CryptoRank data indicates that the next token unlock, scheduled for November 29, will feature approximately 216,580 HYPE, which is approximately 0.02% of the protocol’s maximum supply.

Hyperliquid next token unlock | Source: CryptoRank

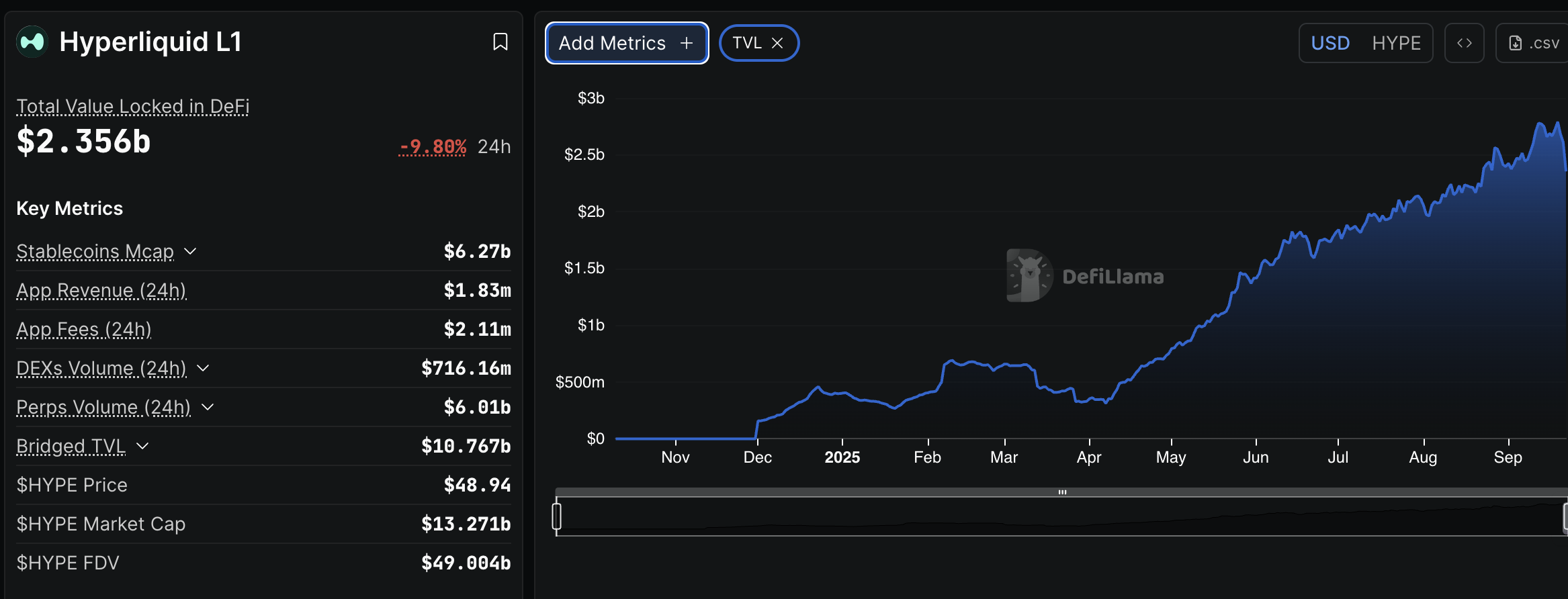

Hyperliquid has a maximum supply of 1 billion HYPE with approximately 334 million in circulation. According to DefiLlama, Hyperliquid has a total value locked (TVL) of $2.35 billion, suggesting a slight correction from $2.79 billion, the highest level on record.

Hyperliquid DeFi TVL | Source: DefiLlama

Meanwhile, interest in Hyperliquid remains relatively high according to CoinGlass data on the futures Open Interest (OI). The chart below shows the OI averaging $2.35 billion on Monday, down from an all-time high of $2.59 billion on September 12, which is significantly higher than the $1.92 billion on September 1.

Hyperliquid Open Interest | Source: CoinGlass

A higher OI, which refers to the notional value of outstanding futures contracts, suggests that traders have a strong conviction in HYPE’s ability to sustain an uptrend in the short term. If the correction persists, traders may change their approach from bullish to bearish, with de-risking activity likely to increase the chances of a continued decline in the price of HYPE.

Technical outlook: What’s next as Hyperliquid encounters risk-off sentiment

Hyperliquid delicately holds onto the 50-day Exponential Moving Average (EMA) at $48.43, representing an 18% decline from its record high of $59.43.

The path of least resistance appears downward, underpinned by a sharp drop in the Relative Strength Index (RSI) on the daily chart to 44 from last week’s near-overbought conditions.

Similarly, the Moving Average Convergence Divergence (MACD) indicator upholds a sell signal triggered on Sunday when the blue line crossed beneath the red signal line on the same daily chart. Investors will consider reducing exposure, emphasizing a risk-off sentiment if the sell signal remains intact.

HYPE/USDT daily chart

Key areas of interest for traders are the immediate support provided by the 50-day EMA at $48.43 and the 100-day EMA at $43.93, in case investors sell aggressively in upcoming sessions.

Due to the surge in volatility and the perception of September being a bearish month in the cryptocurrency market, a further drop to $40.00, a support last tested on August 22, cannot be ruled out just yet.

Traders should also watch out for possible buy-the-dip moves, which could boost risk-on sentiment, allowing Hyperliquid to reclaim its position above the key $50.00 round-number level.

A steady uptrend above this level could increase the probability of a medium-term run-up toward HYPE’s all-time high.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.