Ethereum Price Forecast: SharpLink repurchases 1M shares as ETH eyes bounce off 20-day EMA

Ethereum price today: $4,490

- SharpLink repurchased 1 million shares of its common stock as part of its ongoing $1.5 billion share buyback program.

- The company's market capitalization has been trading at a discount to the value of its net assets.

- ETH eyes a bounce off the 20-day EMA after breaching the $4,500 level.

Ethereum (ETH) briefly dropped below $4,500 on Tuesday as SharpLink Gaming continued its share buyback program with a repurchase of 1 million shares of its common stock.

SharpLink buys back 1 million shares amid decline below the value of its net assets

Ethereum treasury firm SharpLink Gaming announced it had repurchased 1 million shares of its common stock, SBET, during Monday's trading session.

The Minnesota-based firm said it made the purchase at an average price of $16.67 in an effort to continue its ongoing stock buyback program, according to a Tuesday statement. As a result, the company has now spent nearly $32 million to repurchase 1.93 million shares of SBET since approving a $1.5 billion share buyback program in late August.

The buyback follows a compression in the shares of digital asset treasuries (DATs) over the past few weeks.

SharpLink's share price is down 0.5% at the time of publication on Tuesday, extending its decline to 20% since August 22. During the same period, ETH has only declined by about 8%.

Hence, the company's market capitalization is trading at a discount to its net assets, a scenario in which it has stated that it will prioritize share buybacks over capital raises.

"...[SharpLink Gaming] continues to believe its common stock is significantly undervalued in the market, and that stock repurchase represent the best method to maximize stockholder value under current market conditions," the company wrote.

SharpLink also announced holdings of 838,152 ETH, placing it behind Thomas Lee-backed BitMine Immersion (BMNR), which boasts a 2.15 million ETH stash. Since gaining popularity in June, the total holdings of Ethereum DATs have surpassed 3.88 million ETH, according to data from the Strategic ETH Reserve website.

Standard Chartered analysts predict that Ethereum DATs have "the highest probability" of maintaining long-term success over their Bitcoin and Solana counterparts despite the falling share prices of global DATs.

Ethereum Price Forecast: ETH eyes support near the 20-day EMA

Ethereum experienced $50.9 million in futures liquidations over the past 24 hours, according to Coinglass data. The total amount of long and short liquidations is $42.3 million and $8.6 million, respectively.

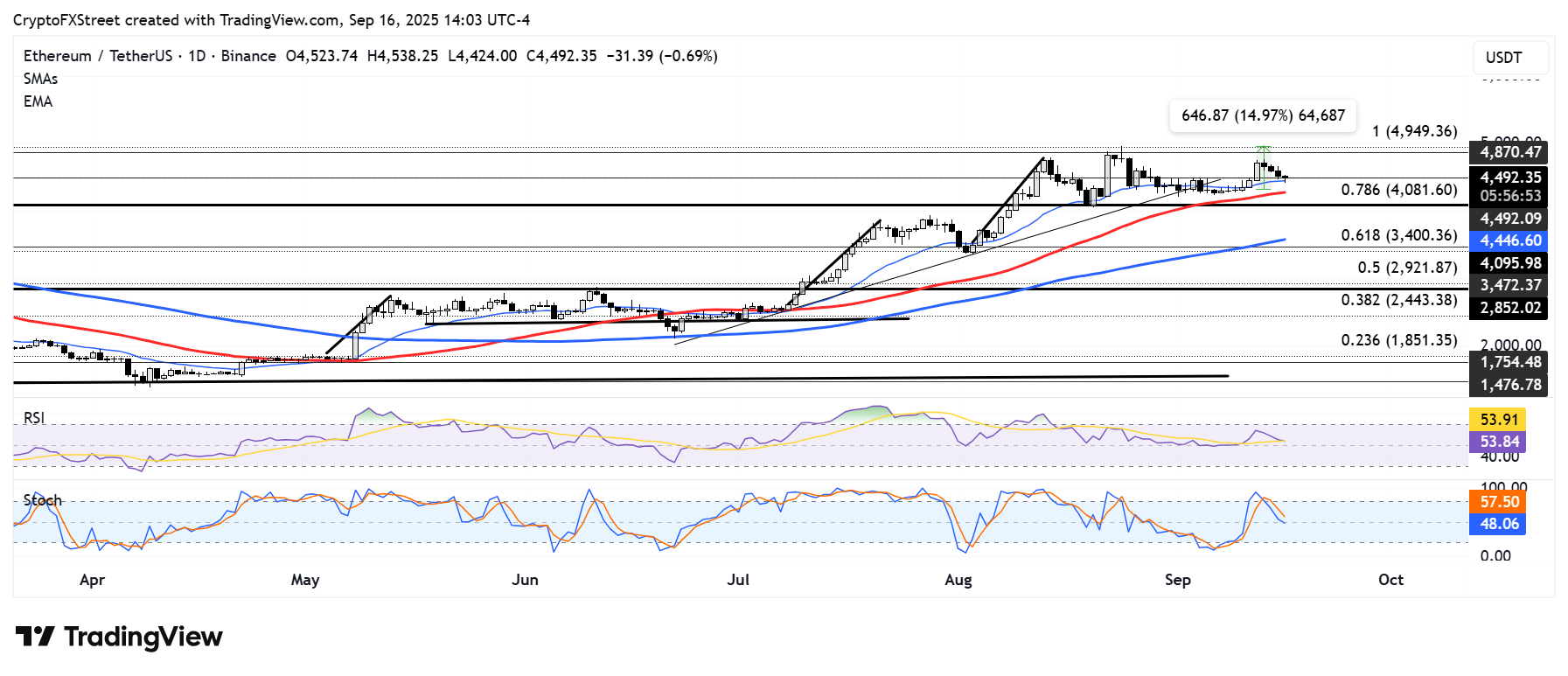

ETH briefly declined below the $4,500 level and is testing the 20-day Exponential Moving Average (EMA). A bounce off the 20-day EMA could see the top altcoin reclaim $4,500 and rally toward the $4,800 level.

ETH/USDT daily chart

On the downside, ETH could find support around the 50-day Simple Moving Average (SMA) at $4,300. The level is strengthened by strong historical demand between the $4,300-$4,400 range, where accumulation addresses purchased over 1.7 million ETH in the past few weeks. Further down, the $4,000 psychological level serves as another key support zone.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downward and testing their neutral levels, indicating a weakening bullish momentum. A crossover below could accelerate bearish pressure.

A decline below $4,000 will invalidate the thesis and potentially send ETH toward support near the 100-day SMA.