U.S. September Rate Decision Preview: What It Means for Bitcoin and Could It Spark a New Rally?

TradingKey – Bitcoin’s rally stalls ahead of the Fed meeting — has the bullish momentum already been priced in?

On Monday, September 15, Bitcoin (BTC) entered a consolidation phase, hovering near $116,000 as its recent uptrend slowed. This Wednesday, September 17, the Federal Reserve will hold its fourth rate-setting meeting of the year. The question now is whether this event can reignite momentum for Bitcoin and the broader crypto market.

Bitcoin Price Chart – Source: TradingView

Since the start of the year, President Trump’s global tariff campaign has raised concerns about its impact on U.S. economic data. Despite these headwinds, the Fed has held rates steady in its previous three meetings, making this week’s decision especially pivotal.

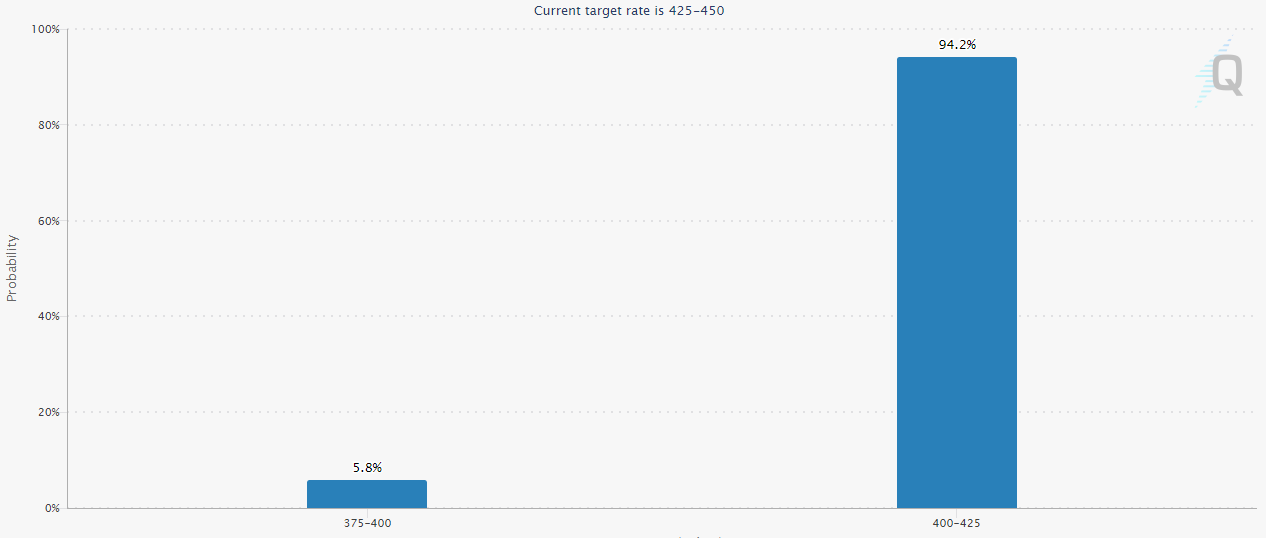

Currently, markets widely expect a 25 basis point rate cut. According to the CME FedWatch tool, there’s a 94.2% probability of a 25 bp cut and a 5.8% chance of a 50 bp cut. Major institutions including JPMorgan, Morgan Stanley, and Wells Fargo also forecast a 25 bp reduction.

Market Expectations for Fed Rate Cut – Source: CME

Rate cuts typically signal looser monetary policy, which can drive capital into risk assets like BTC and other cryptocurrencies. Since early September, Bitcoin has rebounded from around $107,000 to $116,000 — a 9% gain in just two weeks. Altcoins have also rallied to varying degrees, suggesting the market may have already priced in this week’s expected rate cut. So, is crypto facing a “buy the rumor, sell the news” moment?

Addressing this concern, crypto financial platform Matrixport stated today: “In a dovish environment, fears of a ‘priced-in’ reaction are unfounded. Instead, easing expectations are likely to extend the bullish trend and could fuel Bitcoin’s push to new highs.”

There’s also a chance the Fed could cut rates by 50 basis points — exceeding market expectations. If that happens, Bitcoin and institutionally favored large-cap tokens like Ethereum (ETH), Ripple (XRP), and Solana (SOL) could see a surge in liquidity.

Standard Chartered believes a 50 bp cut is possible. The bank previously noted: “Following August’s disappointing nonfarm payrolls and a rise in unemployment to 4.3%, we expect the Fed to cut rates by 50 basis points in September.”Additionally, President Trump has publicly urged Fed Chair Jerome Powell to “slash rates immediately,” suggesting a more aggressive policy move may be on the table.

Ultimately, the key to crypto’s trajectory for the rest of 2025 and into 2026 lies in the Fed’s forward guidance — especially its rate path projections (the dot plot) and outlook on inflation and economic growth. These signals will shape medium-term market sentiment and risk appetite, determining whether the crypto bull market can sustain its momentum.