Cardano Price Forecast: ADA traders’ sentiment shifts from bearish to bullish

- Cardano price finds support around its daily level at $0.70, suggesting a potential rebound in the near term.

- Derivatives data hints at a recovery as funding rates turn positive and bullish bets reach the highest level over a month.

- Cardano Foundation, IOTA, and INATBA collaborate to influence the UK’s Financial Conduct Authority on crypto regulation.

Cardano (ADA) shows early signs of recovery as market sentiment shifts from bearish to bullish. ADA price finds support around its key level and continues its recovery on Monday after falling nearly 13% the previous week. Derivatives data support recovery ahead as ADA’s funding rates flip positive and bullish bet rises among trades. Moreover, Cardano’s involvement in regulatory discussions with the UK’s Financial Conduct Authority underscores its commitment to shaping a balanced regulatory landscape.

Derivatives market hints at a recovery ahead

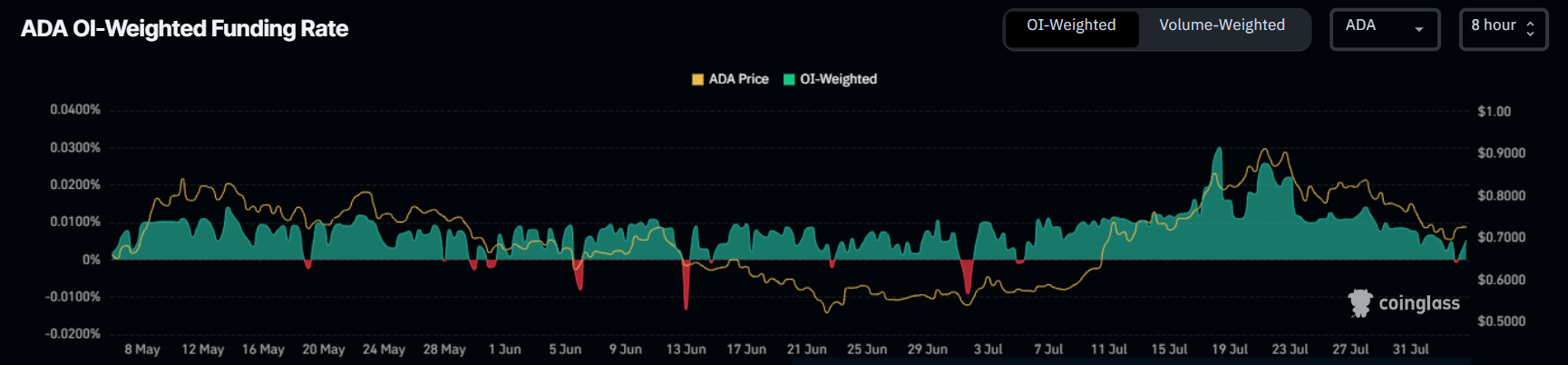

Cardano’s derivatives data shows a bullish bias. CoinGlass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Cardano will slide further is lower than that anticipating a price increase.

The metric has flipped a positive rate on Sunday and reads 0.0053% on Monday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, the Cardano price has rallied sharply.

Cardano’s funding rate chart. Source: Coinglass

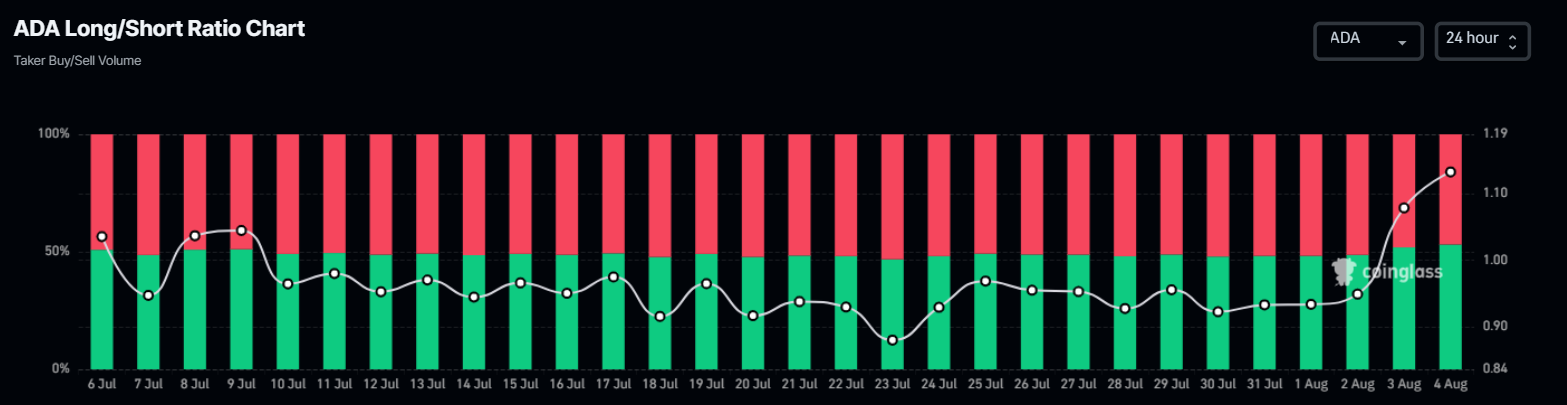

Apart from the positive funding rates, Cardano’s long-to-short ratio reads 1.13, the highest level over a month. The ratio above one suggests that more traders are betting on ADA’s price to rally.

ADA long-to-short ratio chart. Source: Coinglass

Cardano Foundation joins hands with IOTA and INATBA for regulations in the UK

According to the IOTA report last week, the IOTA Foundation, in collaboration with INATBA and the Cardano Foundation, has urged the UK’s Financial Conduct Authority (FCA) to reconsider its approach to crypto regulation. This collaboration critiques the current FCA’s one-size-fits-all approach and emphasizes the need to differentiate between centralized custodial services and decentralized non-custodial protocols.

“Most consumer harm in crypto hasn’t come from DeFi. It comes from centralized custodians with opaque practices – exactly the kind of services that traditional regulation handles well. These practices aren’t inherent to the design of DeFi protocols with transparent and auditable code,” says the blog report.

The coalition advocates for industry-led self-regulation in DeFi and urges the UK to seize the opportunity to become a global leader in smart, innovation-friendly crypto policy.

Cardano Price Forecast: ADA rebounds after resting on its key support level

Cardano price faced rejection from its daily level at $0.84 on July 28 and declined 16.17% last week. ADA rebounded after retesting its daily support at $0.70 on Sunday. This daily level roughly coincides with the 200-day Exponential Moving Average (EMA) at $0.70, making this a key reversal zone. At the time of writing on Monday, it continues to recover, trading above $0.73.

If ADA continues its recovery, it could extend the rally toward its daily resistance at $0.84.

The Relative Strength Index (RSI) on the daily chart reads 47 and points upward toward its neutral level of 50, indicating fading bullish momentum. For the recovery rally, the RSI must move above its neutral level.

ADA/USDT daily chart

However, if ADA faces a correction, it could extend the decline to find support around the daily level at $0.70.