Australian Dollar receives support following cautious remarks from RBA Hauser

- Gold Price Forecast: XAU/USD tumbles to near $3,950 on Fed's hawkish comments, trade optimism

- Gold drifts higher amid growing concerns over US government shutdown

- XRP, BNB, and SOL record major losses as Bitcoin slides to $105,000

- Goldman Sachs and Morgan Stanley warn of potential 20% market decline

- Gold draws support from safe-haven flows and Fed rate cut bets

- Bitcoin Stalls Below $110,000 as Miners Step In to Sell

Australian Dollar rises as RBA’s Hauser highlights policy challenges and stresses the need for tight conditions to curb inflation.

China temporarily lifts its ban on exporting dual-use items like gallium, germanium, and antimony to the U.S.

The US Dollar holds steady as news suggests the government shutdown is close to ending.

Australian Dollar (AUD) advances against the US Dollar (USD) on Monday, extending its gains for the second successive session. The AUD/USD pair strengthens as the AUD receives support from cautious comments from Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser, who highlighted the unusual challenges facing monetary policy and stressed the need to maintain tight conditions to curb inflation.

Deputy Governor Hauser noted that Australia’s monetary policy is navigating a tricky phase, as the economic recovery began with demand already exceeding potential output, leaving limited room for near-term easing. He added that demand was “slightly” above potential when GDP growth accelerated last year, marking the tightest recovery since the early 1980s and signaling little scope for expansion without reigniting inflation pressures.

The AUD also receives support from easing United States (US)-China trade tensions. China's Ministry of Commerce said that it would temporarily lift its ban on approving exports of “dual-use items” related to gallium, germanium, antimony, and super-hard materials to the US. The suspension takes effect from Sunday until November 27, 2026, Reuters reported on Sunday. Any change in the Chinese economy could impact the AUD as China is a major trading partner for Australia.

China’s Consumer Price Index (CPI) climbed 0.2% year-over-year in October, recovering after a decline of 0.3% in September. The market consensus was for 0% in the reported period. CPI inflation increased 0.2% MoM in October, against 0.1% prior. Producer Price Index (PPI) dropped 2.1% YoY in October, following a 2.3% fall in September. The data came in above the market consensus of -2.2%.

US Dollar steadies amid possible end of US government shutdown

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is holding ground and trading around 99.60 at the time of writing. The Greenback moves little following a Bloomberg report, suggesting a group of centrist US Senate Democrats agreed to support a deal to reopen the government and fund some departments and agencies for the next year.

The agreement would ensure federal employees receive back pay and allow states to resume delayed federal transfers. It would fund some departments through January 30, while others would receive full-year allocations.

US Treasury Secretary Scott Bessent said on Monday that the US federal shutdown impact getting worse for the economy. Making substantial progress on inflation and expecting prices to come down over the coming months, Bessent added.

The University of Michigan reported on Friday that its Consumer Sentiment Index dropped to 50.3 in November, the lowest since June 2022, down from 53.6 in October and below expectations of 53.2. US consumer sentiment fell to a three-and-a-half-year low amid growing concerns over the government shutdown.

The Challenger Job Cuts report announced that companies cut over 153,000 jobs in October, marking the biggest reduction for the month in more than 20 years.

ADP Employment Change in the US climbed by 42,000 in October, compared to the 29,000 decrease (revised from -32,000) seen in September. This figure came in better than the estimations of 25,000. US ISM Services PMI climbed to 52.4 in October, from 50.0 prior and exceeding analysts’ forecasts of 50.8.

China's Trade Balance arrived at CNY640.4 billion for October, narrowing from the previous figure of CNY645.47 billion. China's Exports fell 0.8% year-over-year (YoY) in October against 8.4% in September. Meanwhile, imports rose 1.4% YoY in the reported period vs. 7.5% recorded previously. In US Dollar (USD) terms, China’s Trade Surplus expanded less than expected in October. Trade Balance arrived at +90.07B versus +95.60B expected and +90.45 prior.

China's RatingDog Services Purchasing Managers' Index (PMI) fell to 52.6 in October from 52.9 in September. The data matched the market forecast of 52.6 in the reported period. Manufacturing PMI declined to 50.6 in October from 51.2 in September. The market forecast was for a 50.9 print.

Australia’s Trade Surplus widened to 3,938 million month-over-month (MoM) in September, exceeding the 3,850 million expected and 1,111 million (revised from 1,825 million) in the previous reading. Exports rose by 7.9% MoM in September, swinging from a previous decline of 8.7% (revised from -7.8%). Meanwhile, Imports rose by 1.1% MoM, compared to a previous rise of 3.3% (revised from 3.2%).

Australian Dollar targets 50-day EMA near 0.6550

AUD/USD is trading around 0.6520 on Monday. Technical analysis of the daily chart shows the pair consolidating within a rectangle pattern, trading sideways. It is positioned slightly above the nine-day Exponential Moving Average (EMA), indicating a stronger short-term momentum.

The initial barrier lies at the 50-day EMA of 0.6535. A break above this level would improve the medium-term price momentum and support the AUD/USD pair to explore the region around the rectangle’s upper boundary, around 0.6630. Further advances would support the pair to approach the 13-month high of 0.6707, recorded on September 17.

On the downside, the AUD/USD pair may find the immediate support at the psychological level of 0.6500, followed by the lower boundary of the rectangle around 0.6470 and the five-month low of 0.6414, which was recorded on August 21. Further support lies at the six-month low at 0.6372.

Australian Dollar Price Today

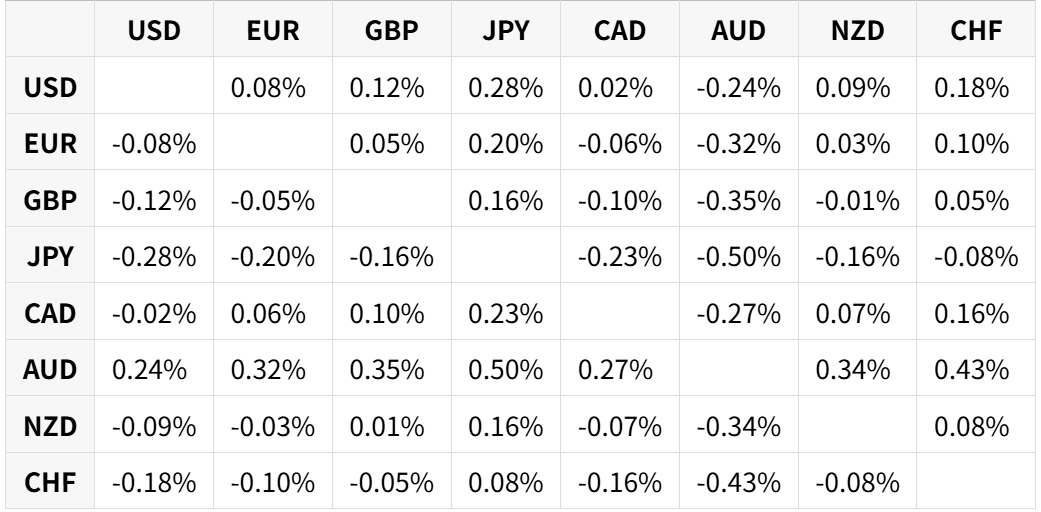

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.