Australian Dollar advances as RBA is widely expected to keep its interest rates unchanged on Tuesday.

Australia posted a budget deficit of nearly A$10 billion, well below the Treasury’s forecast of A$27.9 billion.

The US Dollar declined after August inflation data reinforced expectations of another Fed rate cut in October.

The Australian Dollar (AUD) appreciates on Monday, with the AUD/USD pair extending its gains for the second consecutive session. The US Dollar (USD) weakens as traders brace for shutdown risks of the United States (US) government, beginning from October 1.

The AUD also draws support from fading odds of near-term policy easing by the Reserve Bank of Australia (RBA), driven by recent data showing a hotter-than-expected consumer price index in August. Markets now price only a 6.5% chance of a 25-basis-point rate cut at September’s meeting scheduled on Tuesday and 38.2% probability at its subsequent meeting in November.

Australia posted a budget deficit of nearly A$10 billion (approximately $6.55 billion) for the year ending June 2025, marking the end of two consecutive years of surpluses. The shortfall was far smaller than the Treasury’s A$27.9 billion forecast.

Australian Dollar advances as US Dollar loses ground on Fed rate cut bets

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is losing ground and trading around 98.00 at the time of writing. Traders will likely observe the multiple speeches from the Federal Reserve (Fed) officials later on Monday.

The Greenback weakens after the US August inflation report boosted the likelihood that the US Federal Reserve (Fed) will likely deliver another interest rate cut in October. Markets are now pricing in nearly an 88% chance of a Fed rate cut in October and a 65% possibility of another reduction in December, according to the CME FedWatch Tool.

The US Personal Consumption Expenditures (PCE) Price Index climbed 2.7% year-over-year in August, compared to 2.6% prior. This figure was in line with analyst forecasts. The core PCE, which excludes food and energy prices, came in at 2.9% YoY during the same period, also matching expectations.

US President Donald Trump will meet congressional leaders on Monday to discuss government funding. Without a deal, a shutdown will coincide with new tariffs on trucks, pharmaceuticals, and more. The standoff could also delay the September payrolls report and other key data, per Reuters.

President Trump shared plans to impose a 100% tariff on imports of branded or patented pharmaceutical products from October 1, unless a pharmaceutical company is building a manufacturing plant in the US. Trump also unveiled tariffs of 50% on kitchen cabinets and bathroom vanities and 25% on trucks.

The US Gross Domestic Product (GDP) Annualized grew 3.8% in the second quarter (Q2), coming in above the previous estimate and the estimation of 3.3%. Meanwhile, the GDP Price Index rose 2.1% in the same period, as compared to the expected and previous 2.0% growth.

The White House announced that Australian Prime Minister Anthony Albanese and US President Donald Trump will hold their first in-person meeting in Washington, D.C. on October 20 to discuss the Aukus nuclear submarine pact.

Australia’s Monthly Consumer Price Index (CPI), which climbed by 3.0% year-over-year in August, following a 2.8% increase reported in July. The ASX 30 Day Interbank Cash Rate Futures indicate that markets now price just a 4% chance of a September rate cut. According to Reuters, prospects for a Reserve Bank of Australia (RBA) rate reduction at its November meeting faded to 50% from almost 70% before the data.

RBA Governor Michele Bullock said earlier this week that labor market conditions have eased slightly, with unemployment ticking higher. Bullock noted that recent rate cuts should support household and business spending, while stressing that the RBA must stay vigilant to changing conditions and be ready to respond if needed.

Australian Dollar rises above 50-day EMA of 0.6550

AUD/USD is trading around 0.6560 on Monday. Technical analysis on the daily chart shows that the pair remains within a descending channel pattern, indicating the market sentiment is bearish. Additionally, the 14-day Relative Strength Index (RSI) is positioned slightly below the 50 level, strengthening the bearish bias.

On the downside, the AUD/USD pair may find its immediate support at the 50-day Exponential Moving Average (EMA) of 0.6550, followed by the lower boundary of the descending channel around 0.6500. A break below this crucial support zone would strengthen the bearish bias and put downward pressure on the pair to navigate the region around the three-month low at 0.6414, which was recorded on August 21.

The initial resistance lies at the nine-day EMA of 0.6579, followed by the descending channel’s lower boundary around 0.6590. A break above the channel would weaken the prevailing bearish bias and support the pair to explore the region around the 11-month high of 0.6707, recorded on September 17.

AUD/USD: Daily Chart

Australian Dollar Price Today

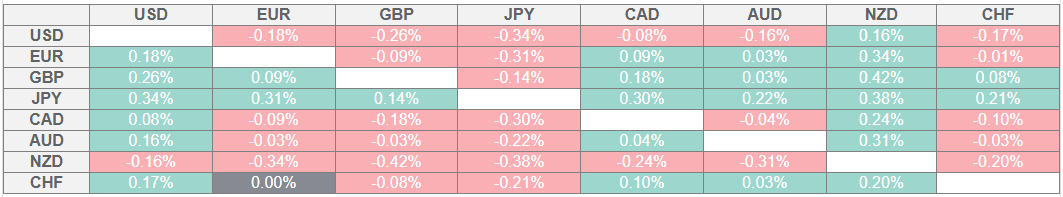

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.