EUR/USD nudges lower with ECB's monetary policy, US CPI on tap

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Euro extends losses below 1.1700 with investors awaiting the ECB monetary policy decision and US CPI data.

The ECB might deliver a "dovish hold" and add pressure on the Euro.

August US CPI is expected to pave the way for Fed interest rate cuts.

The EUR/USD pair is posting losses on Thursday, trading intra-day lows below 1.1690 on the European morning session. The US Dollar is outperforming its peers in a calm trading session, with trading volumes at relatively low levels, and Investors awaiting the outcome of the European Central Bank's (ECB) monetary policy meeting and the release of US Consumer Price Index (CPI) figures to make decisions.

The ECB has anticipated that it will keep monetary policy unchanged, but the economic consequences of the unfavourable trade deal with the US and the uncertain political situation in some member countries might have brought the possibility of further easing to the table. Traders will be looking for any dovish turn at President Christine Lagarde's conference that might add bearish pressure on the Euro (EUR).

Later in the day, the US CPI release will be the last key dataset ahead of the Federal Reserve's monetary policy meeting next week. The weak US labor figures seen recently and Wednesday's benign Producer Prices Index (PPI) numbers have practically confirmed a rate cut in September. With this in mind, August US CPI figures will be watched to determine the size of next week's monetary easing pace by the Fed, with the odds for a jumbo cut, 50 basis points, growing.

Beyond the macroeconomic data domain, the market is already recovering from news that Poland required assistance from the North Atlantic Treaty Organisation (NATO) forces to shoot down drones, allegedly from Russia, in its airspace. The issue did not have further implications as of yet, but concerns about the Ukrainian conflict spilling over NATO territory have been weighing on the Euro over the last sessions.

Euro Price Today

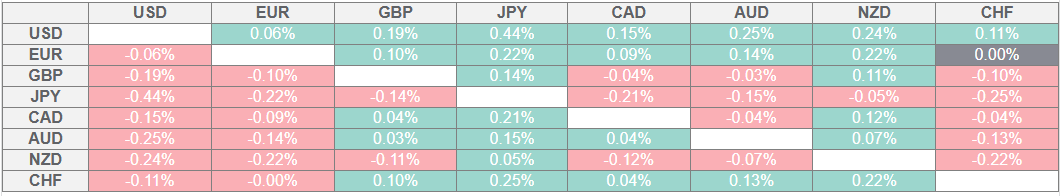

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Sideways trading ahead of the ECB and US inflation figures

The EUR/USD keeps trading within previous ranges with the Euro a tad weaker as investors bid their time ahead of the outcome of the ECB's monetary policy meeting and the release of August´s US CPI figures. The US Dollar Index is showing a mild positive tone, but market volatility is likely to remain at relatively low levels.

The ECB is widely expected to leave its benchmark Rate on the Deposit Facility at 2% after having cut 250 basis points from the 4.5% level of May 2024. Some officials have hinted that the central bank might have reached its terminal rate, but the soft economic outlook and the uncertain political scenario in some countries, and a flawed trade deal with the US, might force the ECB to ease its monetary policy further in the near term. Any hint in that direction is likely to add pressure on the Euro.

In the US, CPI figures are expected to confirm that inflation pressures remain moderate, clearing the path for Fed interest rate cuts. Headline inflation is expected to have accelerated at a 0.3% pace in August, from 0.2% in July, and 2.9% year-on-year (YoY) after a 2.7% reading in July. The core CPI, more relevant from the monetary policy perspective, is expected to have remained unchanged, 0.3% on the month and 3.1% YoY.

On Wednesday, the cooling US Producer Price Index figures added to the case for an easier monetary policy. The monthly PPI contracted unexpectedly at a 0.1% pace, while yearly inflation eased to 2.6% from 3.1% in the previous month, against expectations of an increase to 3.3%. Likewise, the core PPI fell 0.1% in August and rose at a 2.8% pace from August last year after 0.7% and 3.4% respective readings in July.

Futures markets are fully pricing a Fed rate hike after the September 16-17 Federal Open Market Committee (FOMC) meeting, with an 8% chance of a 50-basis-points cut, according to data from the CME Group FedWatch tool.

Technical Analysis: EUR/USD is correcting lower within a broader bullish trend

EUR/USD remains on its back foot after rejection from the 1.1780 area earlier this week. Technical indicators have turned lower. The 4-hour Relative Strength Index (RSI) has dropped below the 50 level, and the Moving Average Convergence Divergence (MACD) line crossed below the signal line, suggesting that sellers are in control.

The pair has breached the 1.1700 round level, and bears might be tempted to test the bottom of the near-term ascending channel, now at the 1.1670 area. Further down, the September 4 low, near 1.1630, would come into focus. To the upside, Wednesday's high at 1.1730 is likely to challenge bulls, ahead of the July 24 high near 1.1790, the last resistance area before the July 1 high at 1.1830.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.