Intel Slashes Workforce in Desperation Move — Can Radical Restructuring Signal a Fresh Start?

TradingKey - U.S. chip giant Intel (INTC.US) is planning a sweeping round of layoffs that could affect up to 20% of its global workforce. The first wave has already begun in Oregon, targeting research and development centers in Aloha and Hillsboro, where a total of 529 permanent positions will be eliminated starting July 15.

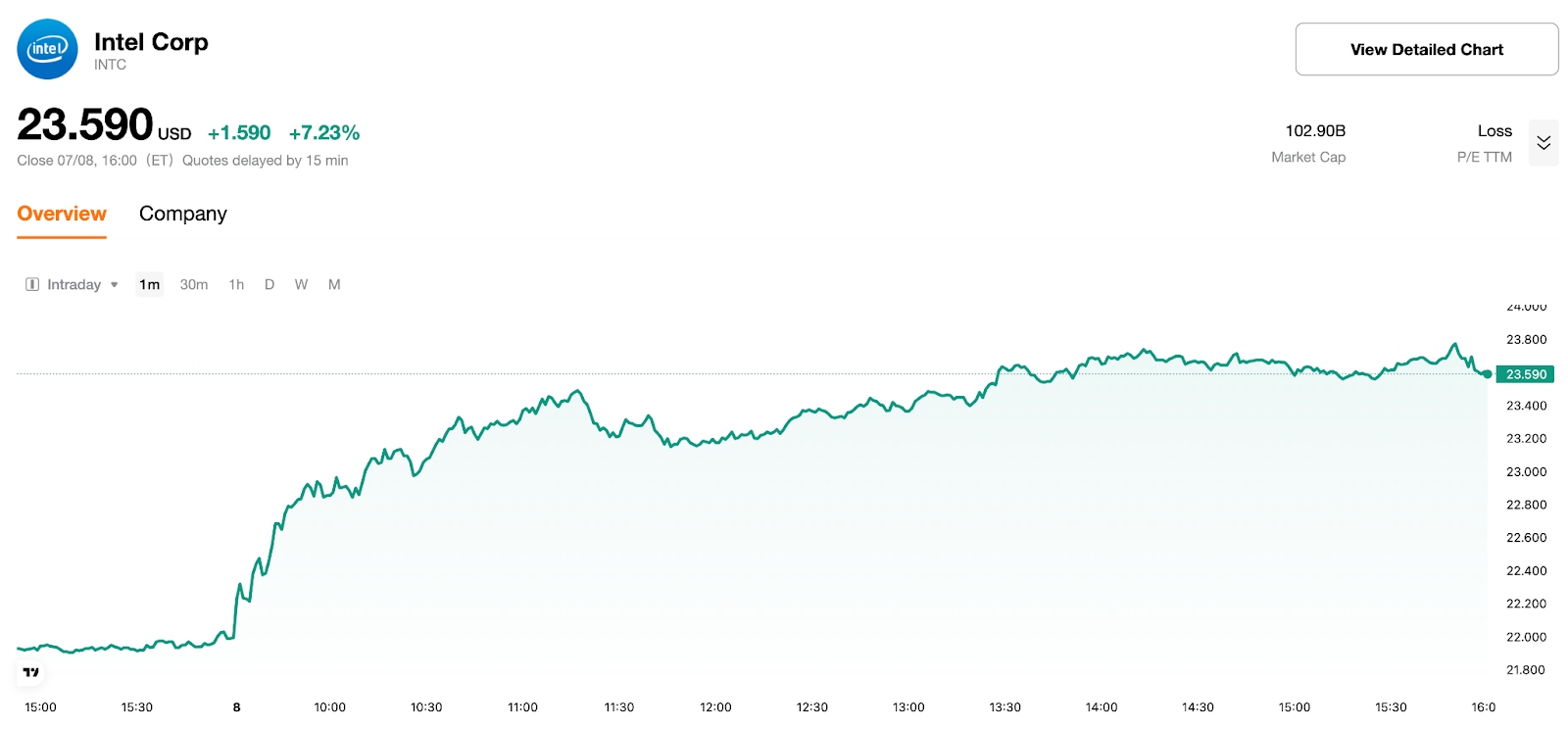

[Intraday trend chart of Intel stock, source: TradingKey]

Since taking office in April, newly appointed CEO Lip-Bu Tan has launched a comprehensive organizational streamlining strategy aimed at building a “leaner, more efficient” operating model. Intel stated the move is intended to better align with customer demands, enhance execution speed, and address ongoing profitability pressures and technological competition.

Over the past few years, Intel has steadily lost market share due to its delayed response to the AI transformation. Competitor NVIDIA rapidly rose to dominance in the AI chip space, while companies like TSMC and AMD have continued to encroach on Intel’s stronghold in high-performance computing.

Market analysts suggest that while job cuts may help control costs in the short term, without core technological breakthroughs and meaningful product innovation, restructuring alone may not be enough to reverse Intel’s downward trajectory. The company’s upcoming earnings reports and progress on AI chip development will serve as key indicators of whether it can regain competitive ground.

Intel is currently accelerating its shift toward AI infrastructure, including the launch of its next-generation Gaudi AI chips and strategic partnerships with tech giants such as Microsoft and Google. However, whether these efforts will successfully return the company to relevance remains uncertain.

For insight into how top investors are positioning themselves in this environment, tracking their holdings in Intel may offer valuable clues: Click to view holdings