Musk Further Expands Space Blueprint, SpaceX Fully Acquires xAI to Build Space AI Strategic Core

TradingKey - On February 2, 2026, local time, Elon Musk's space exploration company SpaceX officially announced the acquisition of xAI, the artificial intelligence company he founded. The deal is regarded as one of the most historic mergers in the technology industry, further integrating Musk's space exploration and artificial intelligence initiatives.

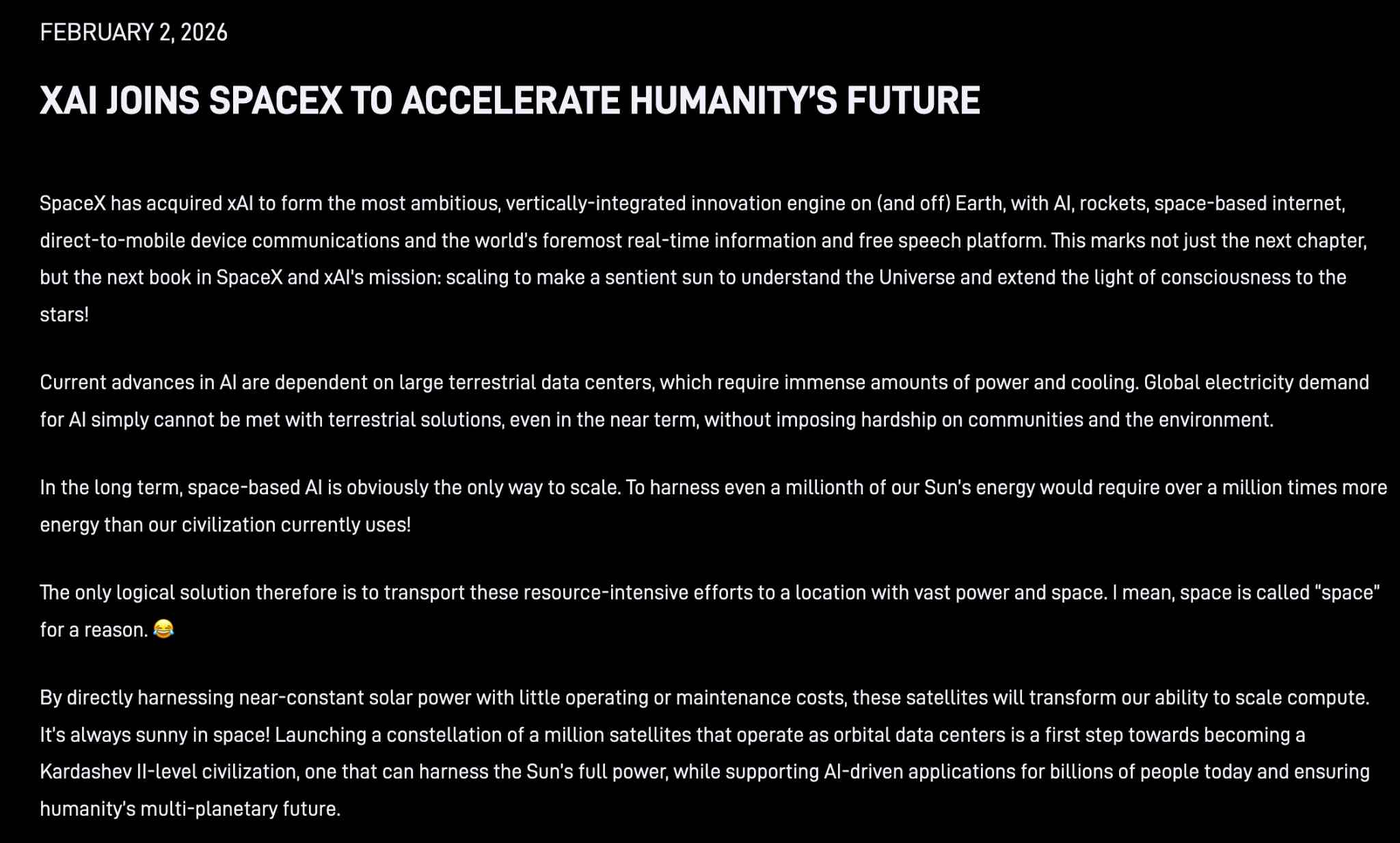

[SpaceX acquires xAI, Source: SpaceX Official Website ]

The merger between SpaceX and xAI aims to link Musk's ventures in artificial intelligence and space infrastructure.

According to Reuters, the transaction is being conducted via a stock swap, where xAI shareholders will exchange their holdings for SpaceX shares at a specific ratio. The new company is expected to reach a total valuation of approximately $1.25 trillion, which would make the entity one of the world's most valuable private technology companies while laying a larger foundation for SpaceX's anticipated IPO in 2026.

Strategic Intent Behind SpaceX's Acquisition of xAI

Musk publicly stated that this merger allows SpaceX to leverage its satellite network (Starlink) and future orbital data centers to provide powerful computing support for xAI. This is expected to address the growing energy and cooling cost pressures faced by terrestrial AI data centers.

Furthermore, SpaceX's long-term vision includes establishing large-scale AI computing infrastructure in space to realize a more energy-efficient and scalable platform for AI training and inference. This strategy could become a significant watershed in the global AI competition.

Since its founding, xAI has focused on large language models and AI technology. Its flagship product, Grok, and its early integration with the social platform X demonstrate its positioning in the AI model and data ecosystem. Following the merger with SpaceX, these technologies have the opportunity to enhance their scale and influence through SpaceX's infrastructure.

Investors should note that because SpaceX holds a significant number of federal government contracts and possesses strategic assets in multiple fields, this merger may trigger regulatory scrutiny. Risks related to national security, technological monopolies, and corporate governance need to be carefully assessed. Ultimately, whether the merger succeeds and if the process becomes protracted could impact the final SpaceX IPO.