Is Netflix a Must-Own Stock for 2026?

Key Points

Netflix brought 2025 to a close with a stock split and a blockbuster deal to acquire Warner Bros.

The acquisition carries pros and cons for the streaming leader, including the burden of billions of dollars in debt to fund the purchase.

Netflix has hurdles to overcome before the deal can close, such as addressing concerns that the combined entity will hold too much pricing power in the entertainment industry.

- 10 stocks we like better than Netflix ›

Entertainment giant Netflix (NASDAQ: NFLX) made headlines this month with its bid to acquire most of the assets of Warner Bros. Discovery (NASDAQ: WBD). That proposed acquisition still faces several hurdles.

However, after the deal's announcement on Dec. 5, Netflix's share price fell, apparently due to investors' concerns about the financial impacts of such a costly purchase. The streaming giant's stock is now down markedly from the 52-week high of $134.12 it touched in June.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With that share price drop, a potentially game-changing acquisition in the works, and the 10-for-1 stock split it just completed in November that made shares more accessible to retail investors, Netflix just might be a stock to own for the new year despite Wall Street's concerns.

Image Source: Netflix.

The challenges facing Netflix

Warner Bros. Discovery was already planning to split up next year, putting the streaming and studio businesses, including its massive content library, HBO Max and HBO, and the video game business under the name Warner Bros. Meanwhile, CNN, TNT Sports, Discovery, and its other channels would become Discovery Global.

Netflix is only interested in buying the future Warner Bros., and it has apparently emerged victorious in its bidding war for it, but it's not out of the woods yet. The streaming giant first must cope with a hostile takeover attempt of Warner Bros. Discovery in its entirety by Paramount Skydance.

Beyond that, Netflix must gain government approval for the acquisition. That could be difficult, considering the deal would combine two of the largest streaming services in America by subscribers.

Netflix management believes it will prevail, stating, "Our $5.8 billion reverse termination fee, which is the largest cash regulatory termination fee in a public M&A transaction, shows our confidence in our ability to obtain required regulatory approvals."

Even so, one reason for Wall Street's reaction is the substantial debt the streaming leader will take on to close the deal. The transaction involves a mix of cash and Netflix stock paid to Warner Bros. Discovery shareholders that assigns WBD a total enterprise value of $82.7 billion.

To help pay for this, Netflix secured a massive $59 billion bridge loan, although it refinanced $25 billion of this sum recently. It exited the third quarter with $14.5 billion in long-term debt and $9.3 billion in cash and equivalents.

Factors that make Netflix appealing

Despite the potential 2pitfalls, the acquisition offers many benefits. First, as mentioned, Netflix is obtaining only the parts of Warner Bros. Discovery related to the Warner Bros. business, which includes the film and TV studio division, HBO, and the video games segment. WBD's Discovery, CNN, and other TV outlets won't be part of the deal. Netflix is getting arguably the most valuable components of WBD.

Netflix says it intends to continue the studio's tradition of theatrical movie releases, which could provide it with a significant new revenue stream. This content part of WBD's business generated $3.1 billion in Q3 revenue. For Netflix, which is still building its nascent advertising business, only subscription fees provide a material source of sales today.

Greg Peters, co-CEO of Netflix, underscored the importance of the Warner Bros. addition when he stated, "This acquisition will improve our offering and accelerate our business for decades to come."

The acquisition arrives at a time when Netflix is doing well on several fronts. Revenue increased 17% year over year to $11.5 billion in the third quarter. In Q4, the company expects another quarter of 17% year-over-year sales growth to $12 billion.

The third quarter was also Netflix's best quarter of advertising sales ever, and free cash flow rose to $2.7 billion from $2.2 billion in the prior-year period.

This, in part, helps explain why some in the entertainment community are concerned about the acquisition.

"Does that [deal] ultimately give Netflix pricing leverage over the consumer?" asked Walt Disney CEO Bob Iger.

Iger raises a good point, one that federal regulators are likely to consider carefully as they weigh the proposed acquisition. That's part of what makes the situation precarious for Netflix, especially considering the $5.8 billion breakup fee it will have to pay if the deal fails to gain government approval.

Weighing whether to buy Netflix stock

If Netflix succeeds in buying Warner Bros., it would be a greater entertainment powerhouse than it already is. Another factor to weigh in considering an investment is its stock valuation.

The share price decline after the acquisition announcement brought Netflix's price-to-earnings (P/E) ratio down sharply.

Data by YCharts.

Data by YCharts.

Consequently, the company's earnings multiple is at a low point in 2025, even lower than it was after President Donald Trump's announcement of his massive tariff plan caused the stock market to crash. This suggests Netflix shares are at a compelling valuation.

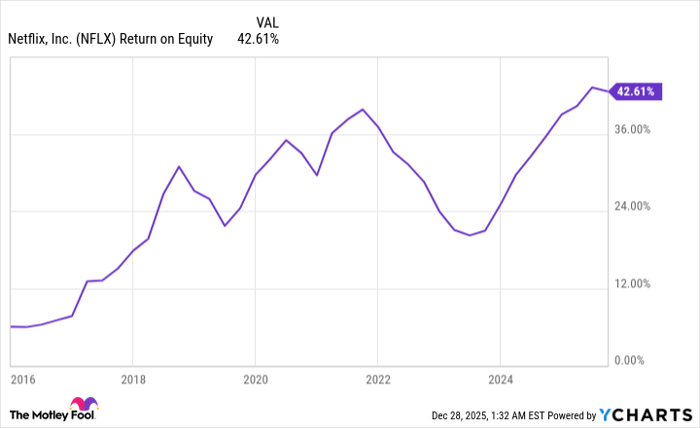

Moreover, while the streaming giant has experienced its share of ups and downs, it has delivered for shareholders over the long term, as demonstrated by its return on equity.

Data by YCharts.

As the chart illustrates, over the past decade, Netflix's return on equity has risen. Yes, it has experienced dips, but it has bounced back each time.

That track record, its low P/E ratio relative to the rest of 2025, and a potentially game-changing acquisition make Netflix an attractive stock to own for 2026 and beyond.

Should you buy stock in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2025.

Robert Izquierdo has positions in Netflix, Paramount Skydance, Walt Disney, and Warner Bros. Discovery. The Motley Fool has positions in and recommends Netflix, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.