Will Palantir Stock Crash in 2026?

Key Points

Palantir's revenue growth was phenomenal in 2025.

The company is going to face a tough challenge to keep up this revenue growth in 2026.

Shares of the stock trade at an extreme level relative to trailing revenue.

- 10 stocks we like better than Palantir Technologies ›

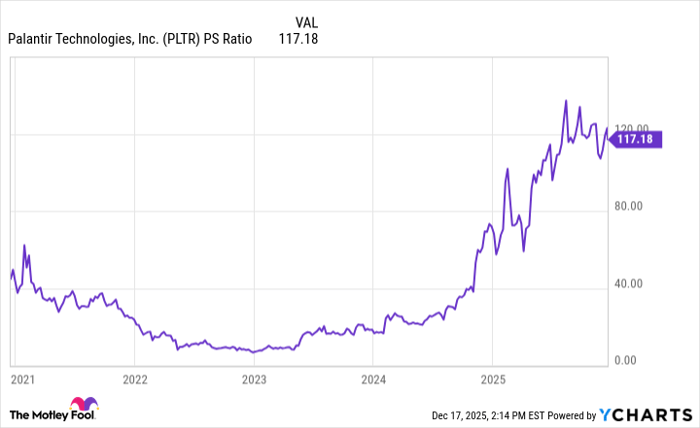

Palantir Technologies (NASDAQ: PLTR) stock has defied gravity. The stock now trades at a market cap of over 100x its trailing revenue, and is valued as the 22nd largest company in the world. Up well over 1,000% since 2023, the software and analytics provider for large enterprises is riding high on the artificial intelligence (AI) wave.

It is now potentially one of the most expensive stocks around. After multiple years of AI-enthused growth, will Palantir stock crash back to earth in 2026? Let's take a closer look and find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Strong government and commercial penetration

When looking at Palantir's growth rate, you begin to understand why investors love the stock.

Last quarter, Palantir's U.S. revenue grew 77% year over year to $883 million, driven by a high 121% growth for U.S. commercial revenue. Future growth looks solid, with $2.76 billion in future contract value closed in the quarter, up 151% year over year.

Profits? Strong as well. Palantir's GAAP (generally accepted accounting principles) operating margin was 33% in the quarter and has been expanding steadily for years. That gives the business $1.79 billion in trailing free cash flow on $3.9 billion in trailing revenue. That's an impressive feat for a company that's growing so quickly.

Difficult comparisons in 2026

Palantir has quickly blossomed into one of the largest software analytics providers globally. It is working with the U.S. government and virtually every large enterprise in the United States. At least, that's what it feels like with how many contracts it is currently signing. Last quarter alone, it closed 204 deals worth at least $1 million.

This will make growth comparisons difficult in 2026. Palantir is not going after a giant addressable market. Spending on analytics software is estimated to be at over $100 billion a year globally, but that overstates Palantir's addressable market, because it can only operate in regions that are allies of the United States. What's more, there are a lot of competitors in the software space vying for all this revenue. Palantir is not going to win the entire market, and definitely not next year.

Starting in 2025, Palantir's revenue growth began to accelerate due to the AI boom. In 2026, it is going to have difficult comparisons to match this level of revenue growth. Consolidated revenue growth -- which was 63% last quarter -- could fall back close to the lower double digits sometime in 2026.

Data by YCharts.

Will Palantir stock crash?

If Palantir's revenue growth begins to decelerate, I think it's likely that the stock will crash in 2026. Even if it doesn't, shares look wildly overvalued for today's buyers.

It has a market cap of $426 billion, and that's before considering upcoming shareholder dilution. That gives it a price-to-sales ratio (P/S) of over 100. This implies massive levels of future revenue growth and profit margin expansion. Even if Palantir can quadruple its revenue to $16 billion and bring profit margins to 40%, that will lead to bottom-line earnings of $6.4 billion and a price-to-earnings ratio (P/E) of 66.5.

Palantir stock may continue to tread water if the AI spending boom continues through 2026, but over the long term, this is a stock that is bound to disappoint investors. The math simply doesn't add up when you compare its financial potential to the company's current market cap.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,039!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,506!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 21, 2025.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.