Rocket Lab Stock Analysis: Why Is Rocket Lab Stock Price Soaring? Is Now a Good Time To Buy?

TradingKey - Even though Rocket Lab's stock price has seen substantial gains from its previous levels, we believe that Rocket Lab still offers speculative value. Although Rocket Lab is currently unprofitable, its forward price-to-earnings (P/E) ratio does not indicate severe overvaluation. Rocket Lab stock is not severely overvalued. Considering that the upcoming IPO of SpaceX's forward P/E is projected to be 250 times, Rocket Lab, as a strong competitor in the commercial space sector, still presents a significant valuation discount.

For long-term investors, this remains a core space sector stock with a high beta and growth characteristics, but close attention must be paid to operational milestones and changes in macroeconomic liquidity.

What is Rocket Lab? What are Rocket Lab's operations?

Rocket Lab is a commercial space company headquartered in the United States with operations in New Zealand. Its primary business involves rocket launch services and space systems manufacturing, effectively operating as a "private space contractor." The company initially gained recognition for its small launch vehicle, Electron, which primarily provides rapid, flexible launch services for small satellites.

The company designs and manufactures small and medium-sized rockets, spacecraft, and their components, along with related software and services, to support the development of the space economy. It also offers reliable launch services, satellite manufacturing, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and on-orbit management solutions, making space exploration more accessible.

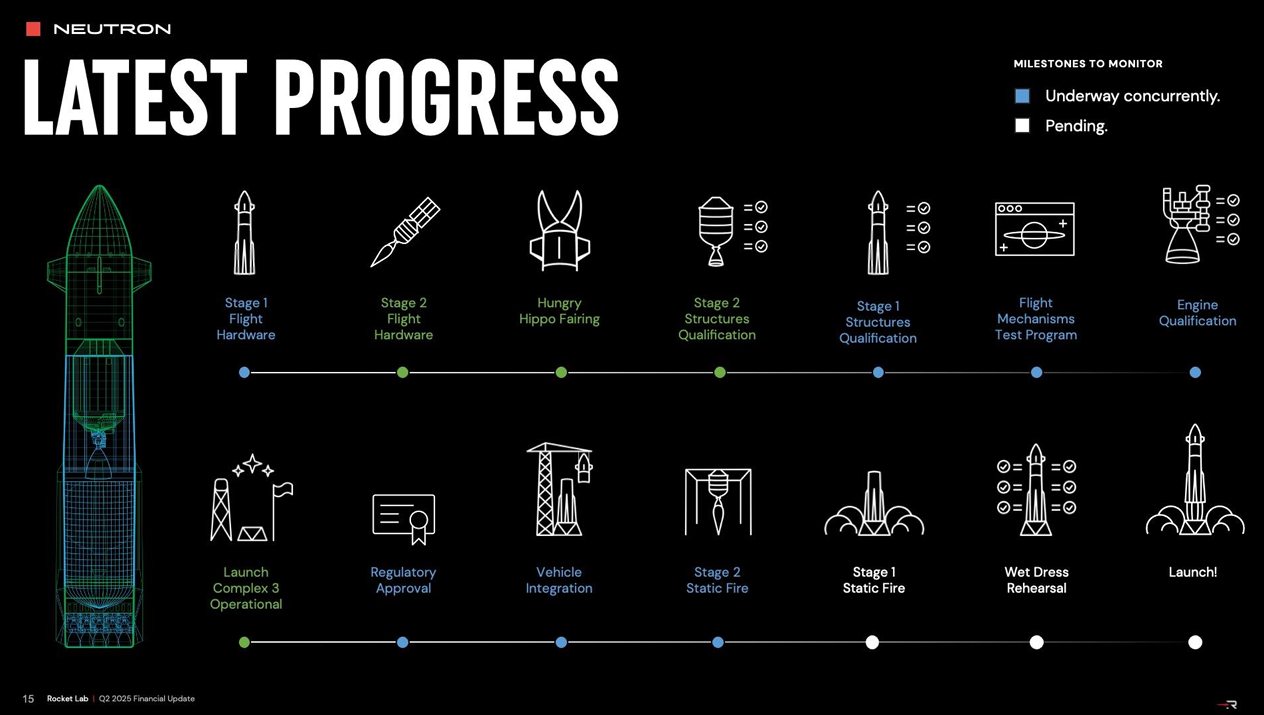

Neutron is Rocket Lab's most critical strategic project. Unlike Electron, Neutron targets higher-value commercial and military markets, aiming to deliver heavier satellites and directly compete with SpaceX's Falcon 9.

The gradual development of Neutron also signifies that Rocket Lab is transitioning from a "small rocket company" to a space platform company with scaled launch capabilities. Its future growth will no longer solely depend on a single rocket but rather on Neutron's successful maiden flight and subsequent commercialization.

How has Rocket Lab performed historically?

Since Rocket Lab's merger with the Special Purpose Acquisition Company (SPAC) Vector Acquisition and subsequent IPO, its stock price fluctuated between 2020 and 2023, failing to show significant growth.

Year | Performance |

2025 | 122.32% |

2024 | 379.66% |

2023 | 42.89% |

2022 | -69.10% |

2021 | 19.22% |

2020 | 3.76% |

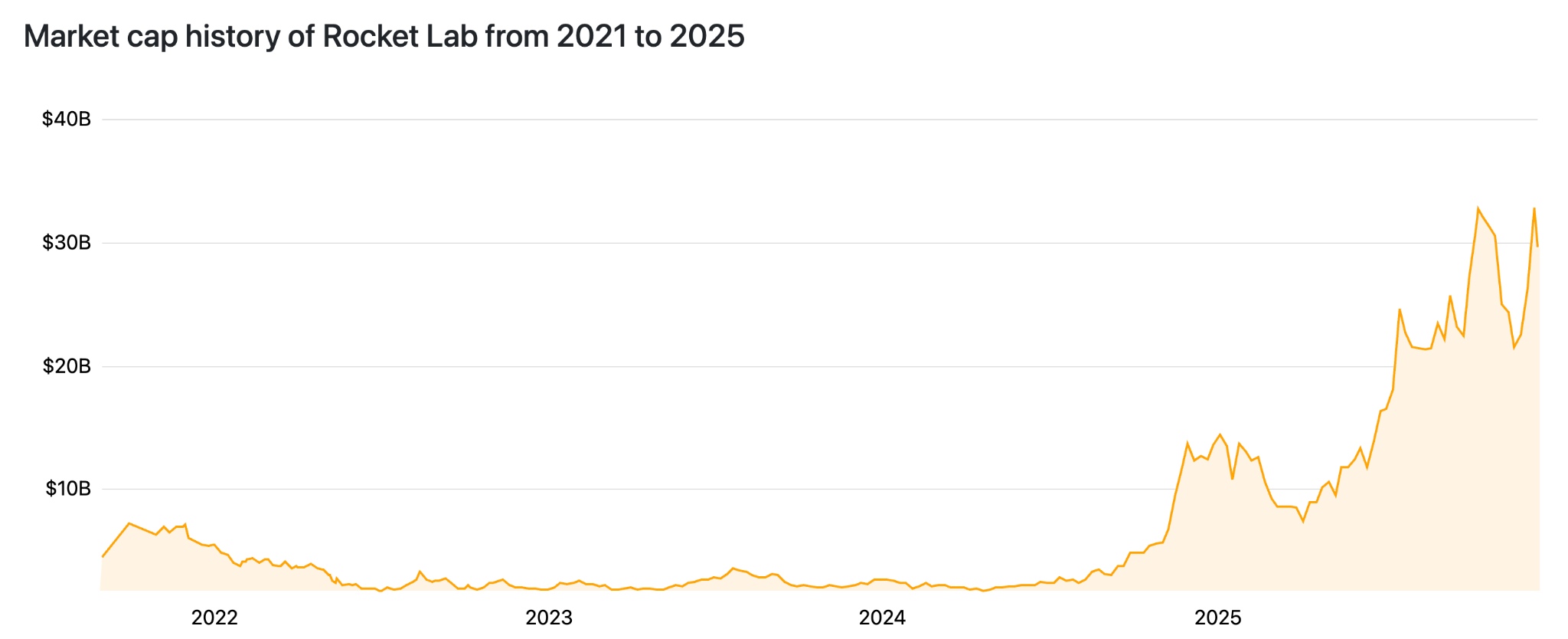

However, since the beginning of 2024, Rocket Lab's stock price has soared, reaching a high of $73.97 and briefly pushing its market capitalization above $30 billion.

[ Rocket Lab Market Capitalization Trend Post-IPO, Source: companiesmarketcap.com ]

This performance significantly outperformed the broader market, reflecting optimistic market expectations for the company's expansion from a small satellite launch service provider to the medium-sized reusable rocket sector.

Why has Rocket Lab's stock price surged?

Rocket Lab's significant stock gains in recent years stem from a confluence of fundamental improvements, operational execution, and structural opportunities within the space industry. Despite its valuation entering elevated territory, order visibility and growth potential continue to bolster investor confidence.

[Rocket Lab Stock Price Historical Trend, Source: TradingView]

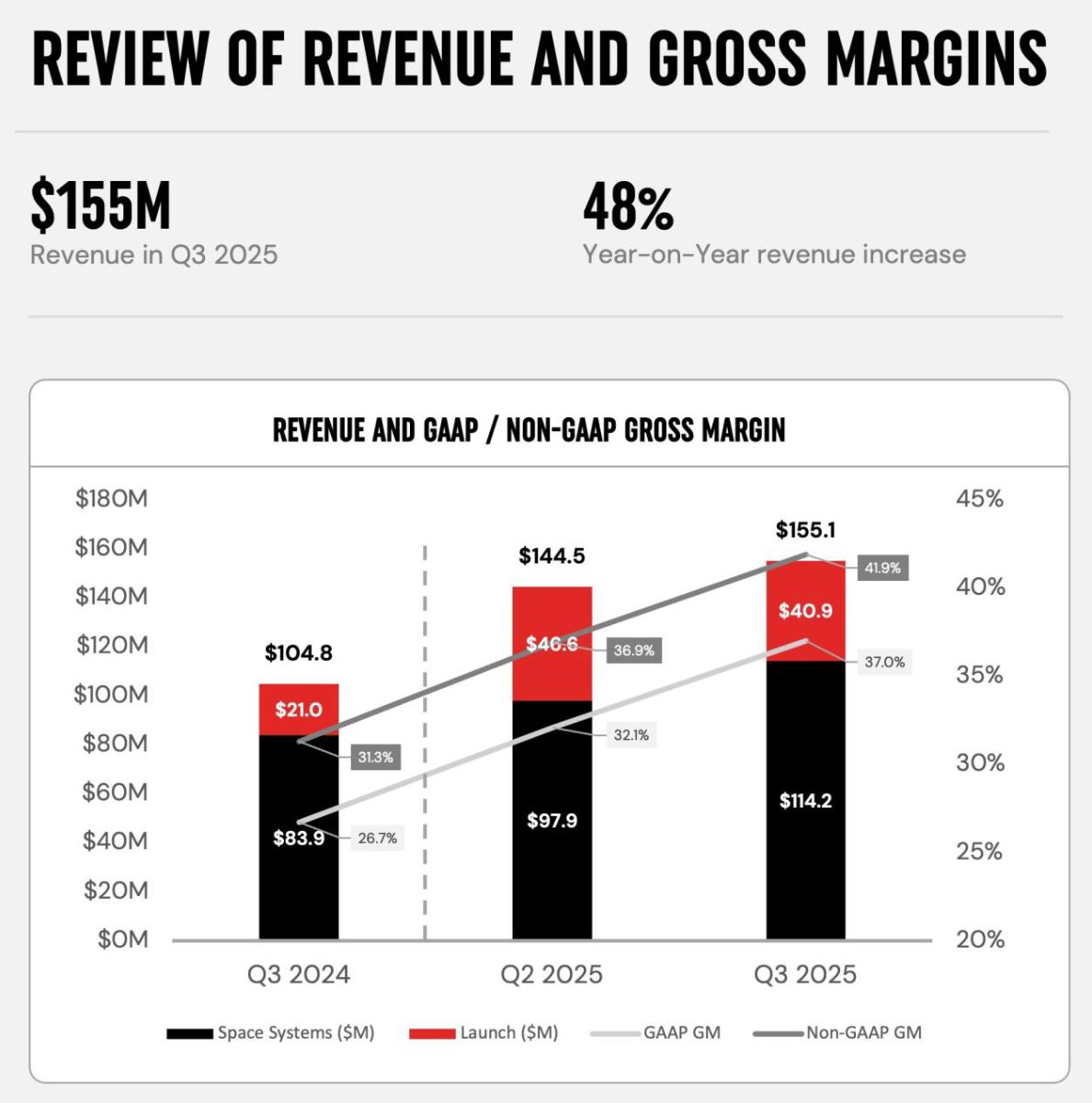

Accelerated financial performance is the foundation for Rocket Lab's stock price increase. Full-year revenue in 2024 reached $436.2 million, a 78% year-over-year increase, primarily driven by the scaling of its space systems business and robust contributions from launch services.

[ Rocket Lab's Q3 2025 Revenue, Source: investors.rocketlabcorp.com]

Entering 2025, this momentum has further strengthened: Third-quarter revenue reached $155 million, a 48% year-over-year increase, with gross margins improving to 37%. The order backlog remains around $1.1 billion, with over half expected to convert within the next 12 months. This order book not only provides high revenue visibility but also reflects the company's enhanced pricing power—the average selling price for a single Electron launch has risen to approximately $8.4 million, a significant increase from earlier periods.

Operationally, the frequent and reliable launches of the Electron rocket have been a key catalyst. In 2024, the company completed 16 launches, setting an annual record; in 2025, this number climbed further to 20, maintaining an extremely high success rate, second only to SpaceX in terms of launch frequency in the United States.

This high-tempo operation has not only solidified Rocket Lab's leading position in the dedicated small satellite launch market but also directly driven rapid revenue growth in its launch services. Against a backdrop of strong demand for small satellite constellation deployment (with the global space economy projected to continue expanding), Electron's responsiveness and dedicated service model have become core competencies for both commercial and government clients.

More strategically, the steady progress in the development of the Neutron medium-lift rocket is significant. This project aims to fill the supply gap in the medium-payload launch market, directly challenging existing dominant players. Although the maiden flight has been rescheduled to 2026, the achievement of several key milestones in 2025 has significantly boosted market sentiment.

Once Neutron enters commercial operation, it will significantly expand Rocket Lab's commercial market and potentially drive an inflection point towards profitability.

The macroeconomic environment has also provided favorable support. Benefiting from satellite constellation deployment, defense demand, and the booming commercial space industry, the space sector as a whole has seen a revaluation, creating sector-wide opportunities. SpaceX's soaring valuation (market estimates project its 2026 IPO valuation at $1.5 trillion, with current market valuation around $800 billion) has driven up the entire space sector, and Rocket Lab, as an "investable SpaceX alternative," has clearly benefited.

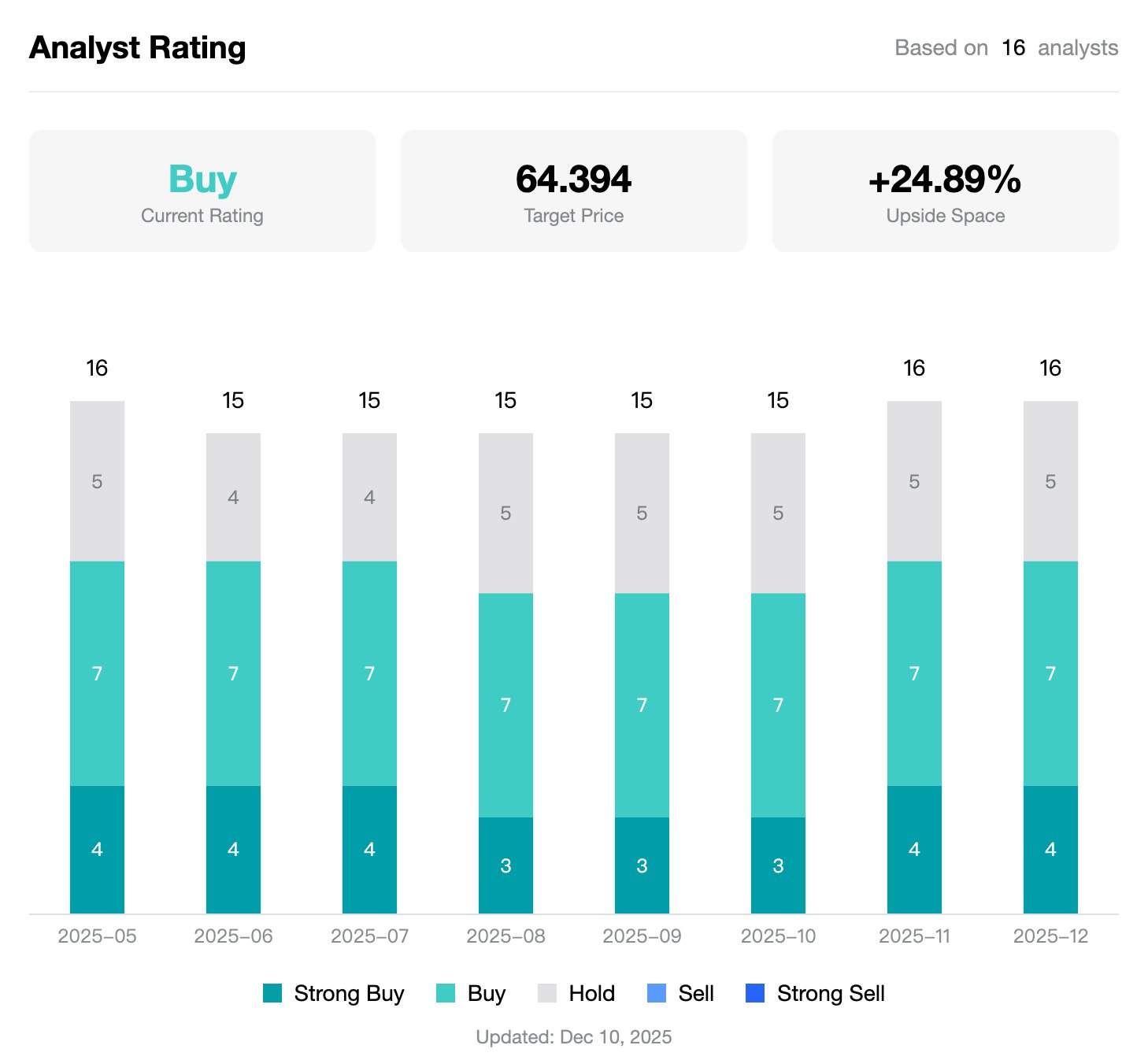

[Most Analysts Maintain Buy Rating on Rocket Lab Stock, Source: TradingKey]

As one of the few pure-play space growth stocks in the public market, Rocket Lab has attracted significant capital inflows. Wall Street analysts maintain a consensus "Buy" rating.

Is Rocket Lab stock still worth buying?

First, we state our view: despite Rocket Lab's stock price having surged over 400% from its early 2024 lows, with market capitalization nearing $30 billion, we believe the stock still holds strong speculative value.

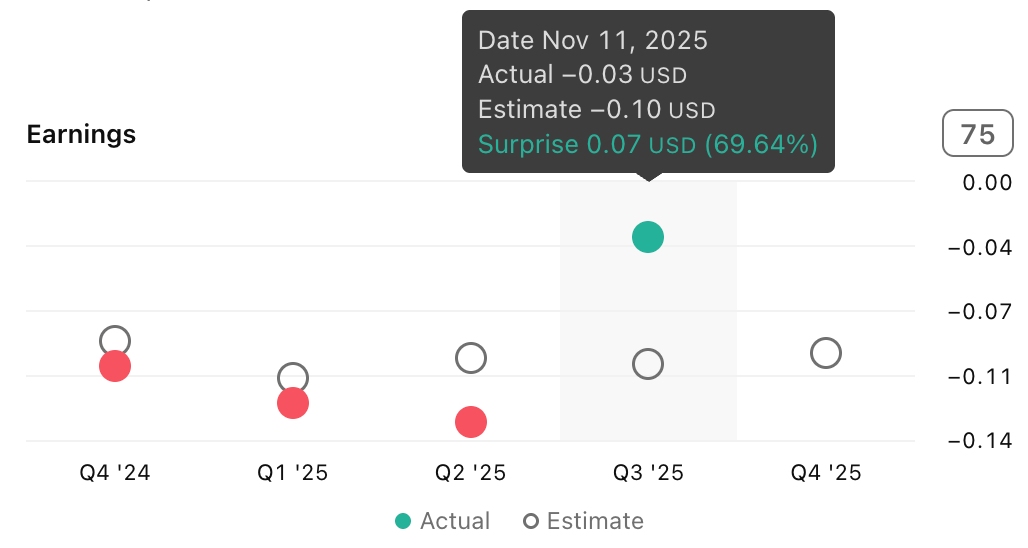

[Rocket Lab Earnings Surprises, Source: TradingView]

Rocket Lab's earnings fundamentals exceeding market expectations, coupled with the immense potential of Neutron, continue to provide it with an outsized premium.

Under current ongoing policy guidance, we believe this premium will persist in the short term. However, whether this premium can be sustained will depend on regional policy directives and whether future earnings data can once again impress investors.

Rocket Lab is currently unprofitable (with an estimated full-year net loss of approximately $190 million in 2025), rendering traditional P/E ratios inapplicable. The valuation logic for high-growth commercial space companies relies more on future earnings potential than current profitability.

Based on current projected EPS, its forward P/E ratio is estimated to be in the 150-160x range. While this valuation level appears high, when compared to privately held peer SpaceX (based on a rumored $800 billion valuation and estimated 2025 revenue of $15 billion, implying a P/S ratio close to 60x and a forward P/E exceeding 250x), Rocket Lab, as one of the few pure-play public companies capable of directly competing with SpaceX in the small to medium launch sector, still presents a significant valuation discount. As the Neutron medium-lift rocket gradually commercializes, this P/E differential is expected to narrow further, and the market may assign a higher growth premium.

Overall, Rocket Lab's stock performance is rooted in accelerating revenue, increased launch cadence, and the Neutron strategy's overall progress. Although the current price-to-sales (P/S) ratio is elevated, and the delay of Neutron's maiden flight introduces uncertainty, the order backlog and high-growth trajectory provide support for its valuation.

Future focus will be on the execution of Neutron's maiden flight in 2026 and the securing of more large contracts. If these progress smoothly, the company is poised to further solidify its competitive position in the medium-lift launch sector.

For long-term investors, this remains a core space sector stock with a high beta and growth characteristics, but close attention must be paid to operational milestones and changes in macroeconomic liquidity.