Is the Vanguard Dividend Appreciation ETF a Buy Now?

Key Points

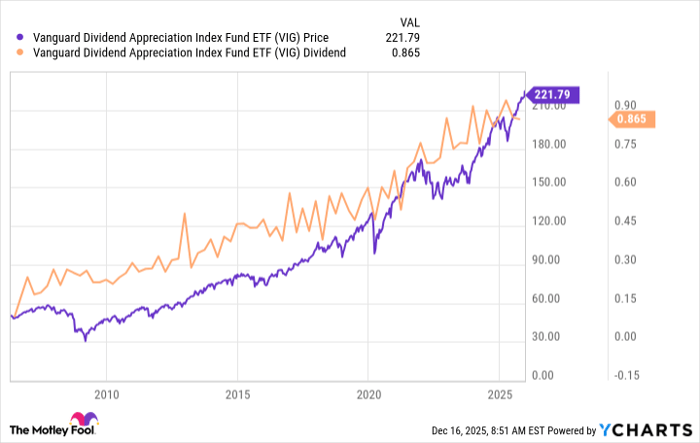

Vanguard Dividend Appreciation ETF has provided investors with a generally rising share price and dividend over time.

The exchange-traded fund's yield is a rather modest 1.6%.

Vanguard Dividend Appreciation ETF selects stocks based on dividends, but it isn't a yield-focused investment.

- 10 stocks we like better than Vanguard Dividend Appreciation ETF ›

Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) is a large and popular exchange-traded fund (ETF), with over $120 billion in assets. There are good reasons to like the ETF, but there are also some investors who will likely be disappointed if they step aboard. Here's why Vanguard Dividend Appreciation ETF is a buy now and why it might not be, too.

What does Vanguard Dividend Appreciation ETF do?

Vanguard Dividend Appreciation ETF is an index-tracking exchange-traded fund, so it doesn't really "do" anything but copy the index it tracks. However, the index, which is the S&P U.S. Dividend Growers Index, and the ETF are effectively doing the same thing and, thus, they're basically interchangeable when you discuss the ETF.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Despite the use of the word "dividend," the goal of the index and the ETF is total return. Dividends are used as a tool to identify investment candidates that have attractive businesses. That's accomplished by only including companies that have at least 10 consecutive annual dividend increases in their portfolio.

That said, there's a wrinkle here. The index doesn't buy all of the stocks with 10 years of annual dividend increases; it discriminates based on dividend yield. The 25% of stocks with the highest yield are eliminated. That move solidifies the notion that Vanguard Dividend Appreciation ETF is not a yield investment. It also helps explain why the dividend yield is a pretty modest 1.6%.

While the yield on offer from Vanguard Dividend Appreciation ETF is higher than the 1.1% of the S&P 500 index (SNPINDEX: ^GSPC), it isn't even remotely difficult to find higher-yielding ETFs. If you were trying to live off the income your portfolio generates, 1.6% wouldn't likely be enough. All in, if you're looking for a high-yield ETF, you'll likely not want to buy Vanguard Dividend Appreciation ETF right now or ever.

Who should buy Vanguard Dividend Appreciation ETF?

Who exactly is this ETF made for? The truth is, there are a couple of interesting ways to use it. If you're a dividend investor with a sufficiently large portfolio, Vanguard Dividend Appreciation ETF could be used to supplement other, higher-yielding investments. The purpose of this would be to add dividend growth to a mix that might be overly focused on yield, resulting in relatively low dividend growth. That would open you up to the ravages of inflation. Vanguard Dividend Appreciation could help protect the buying power of your dividend income.

VIG data by YCharts.

It could also help grow your capital. As the chart above illustrates, Vanguard Dividend Appreciation's share price and dividends have generally trended higher over time. Often, high-yield investments don't generate significant capital appreciation because a substantial portion of the return is tied up in the dividend. Assuming you can generate enough income from the rest of your portfolio, Vanguard Dividend Appreciation could still be useful for a dividend lover. You just have to use it in the right way.

That said, the ETF could be a suitable choice for a more growth-oriented investor who values dividends. In essence, Vanguard Dividend Appreciation ETF utilizes dividends as a signaling tool to identify high-quality companies. If that sounds like a good idea to you, you could easily use this ETF in place of an S&P 500 index fund. That's largely thanks to its more than 330 holdings and fairly well-diversified portfolio. The cost is low, too, given the 0.05% expense ratio.

Vanguard Dividend Appreciation ETF is an acquired taste

When considering all the positives and negatives, some investors will love Vanguard Dividend Appreciation ETF, while others will dislike it. The key is to understand clearly what it's doing and how that fits into your portfolio's goals. If all you care about is generating income, don't buy this ETF. If you're looking for growth or the growth of your income stream, however, you might find it is the perfect fit for your portfolio.

Should you buy stock in Vanguard Dividend Appreciation ETF right now?

Before you buy stock in Vanguard Dividend Appreciation ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Dividend Appreciation ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $506,935!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,514!*

Now, it’s worth noting Stock Advisor’s total average return is 958% — a market-crushing outperformance compared to 192% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 19, 2025.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Dividend Appreciation ETF. The Motley Fool has a disclosure policy.